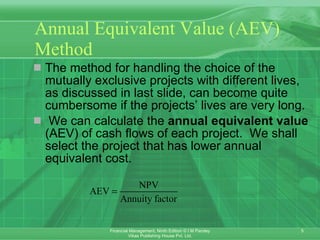

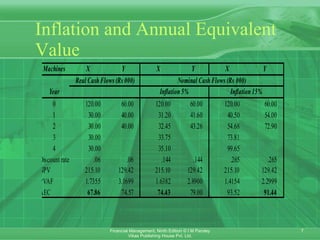

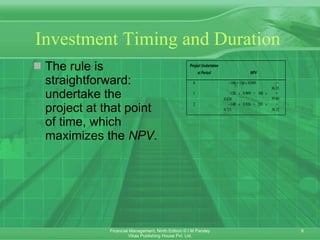

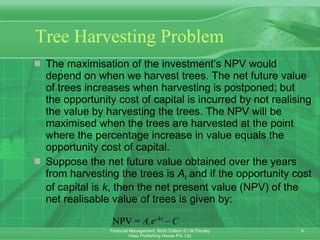

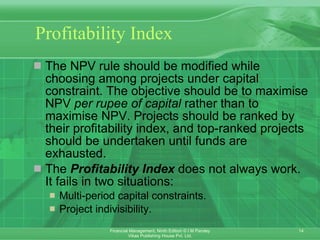

This document discusses complex investment decisions involving projects with different lives, replacement decisions, and capital rationing. It provides methods for evaluating mutually exclusive projects over equal periods using annual equivalent value (AEV). Under capital rationing, where funds are limited, the profitability index method ranks projects by NPV per rupee invested, but other techniques like linear programming may be needed for multi-period constraints or indivisible projects. Replacement decisions are made by comparing the AEV of old and new assets.