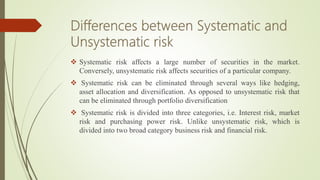

Systematic risk, also known as market risk, is uncertainty inherent to the entire market and consists of day-to-day stock price fluctuations. It includes interest, market, and inflation risks and is uncontrollable, arising from macroeconomic factors that affect many securities. Unsystematic risk is uncertainty from a specific company or industry and includes business and financial risks, which can be reduced through diversification. It is controllable and arises from micro-economic factors affecting individual securities.