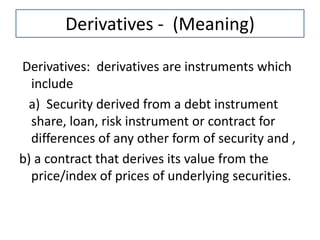

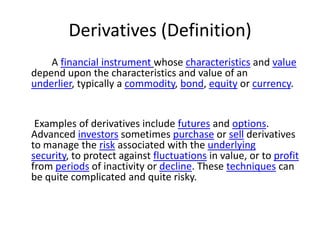

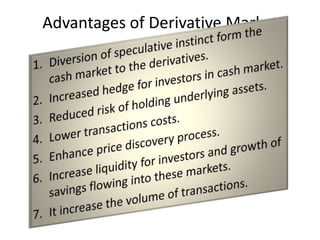

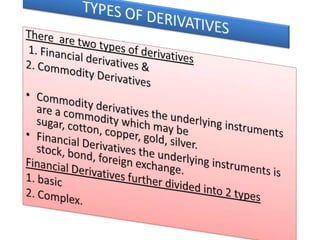

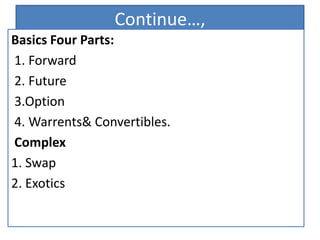

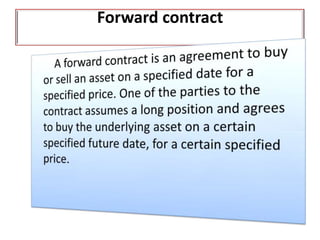

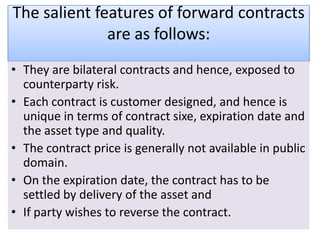

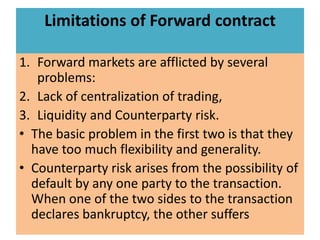

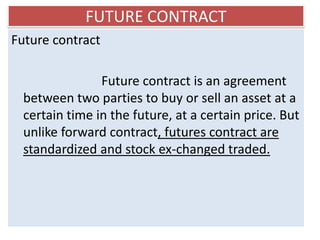

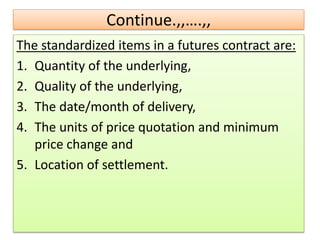

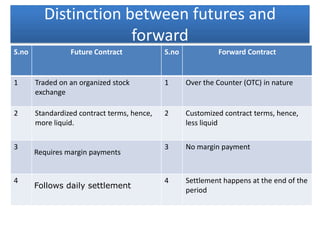

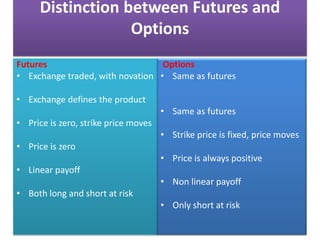

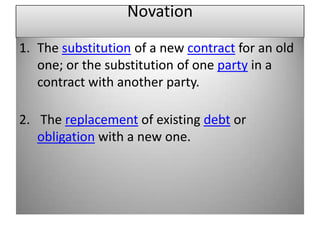

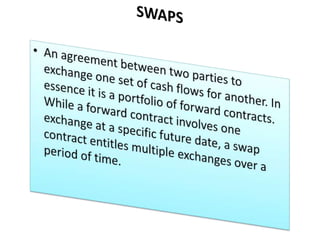

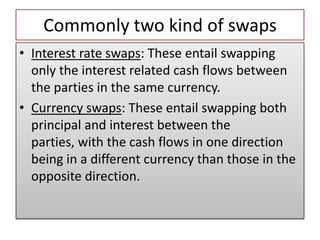

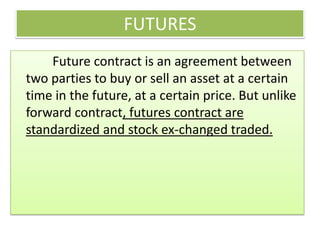

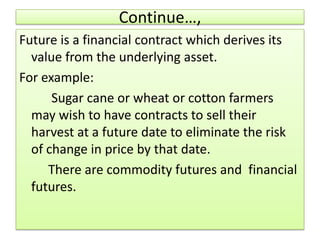

The document discusses various types of financial derivatives including futures, forwards, options, and swaps. It explains that derivatives derive their value from underlying assets and are used to hedge risk or profit from price changes. Futures contracts are exchange-traded standardized agreements to buy or sell assets at a future date, while other derivatives like forwards and swaps are customized over-the-counter transactions.