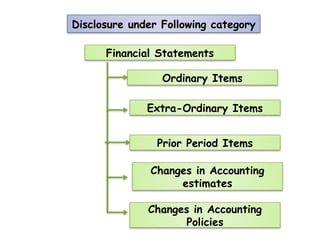

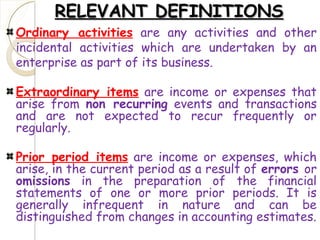

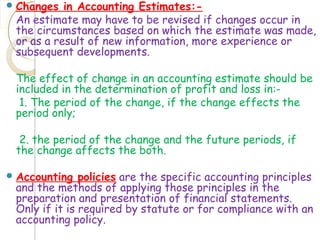

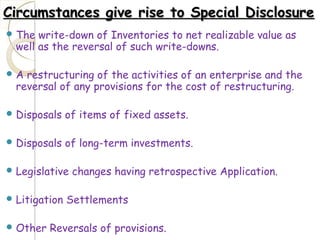

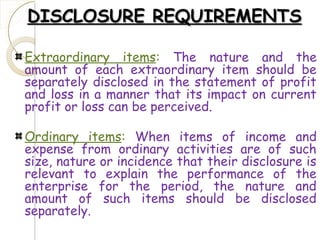

This accounting standard provides guidelines for classifying and disclosing items in the statement of profit and loss to increase comparability between financial statements of different companies. It requires separate disclosure of ordinary activities, extraordinary items, prior period items, changes in accounting estimates, and changes in accounting policies. The standard defines these terms and specifies disclosure requirements for each category. Companies must disclose the nature and amount of any material items, changes, or policy changes along with their financial impact. The aim is to present financial statements on a uniform basis.