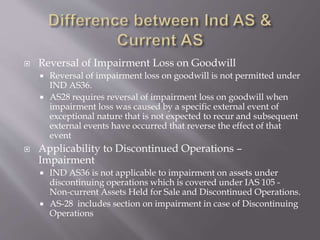

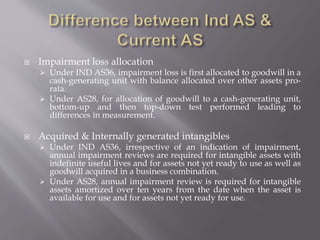

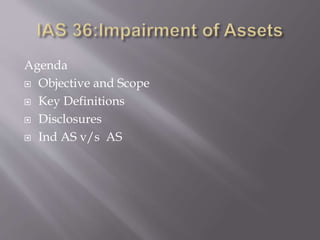

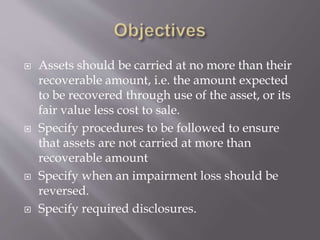

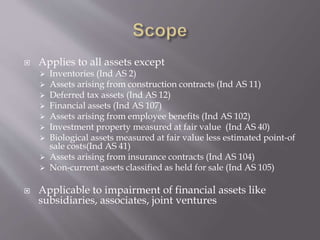

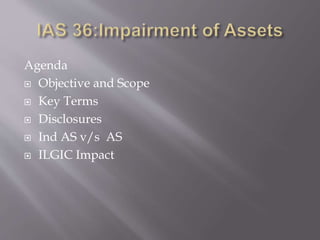

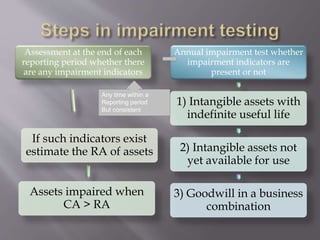

This document provides an overview of Ind AS 36 - Impairment of Assets. It begins with an agenda outlining the key topics to be covered, including objective and scope, definitions, recognition and measurement requirements, required disclosures, differences between Ind AS 36 and the corresponding Indian accounting standard AS 28, and the potential impact on ILGIC. Some of the main points covered include: assets within the scope of Ind AS 36, the definition of impairment and key terms, procedures for identifying and measuring impairment losses, impairment loss allocation methods, and additional annual testing required under Ind AS 36 for certain assets.

![Recoverable

amt = greater

of following

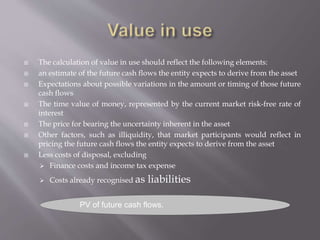

Value in use [VIU] = PV of

estimated future cash flows to

be derived from an asset/ CGU

continuing use & ultimate

disposal

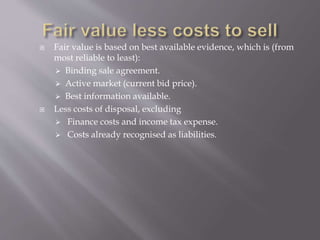

Fair value less cost of sell =

(FVLCS) = Amt obtainable from

the sale of asset/ CGU in an

arm’s length transaction less of

costs of disposals](https://image.slidesharecdn.com/indas36-160313144708/85/Ind-as-36-10-320.jpg)

![Cash generating Unit

[CGU]

Smallest identifiable

group of assets.

That generates cash inflows

Largely

independent

from other

[groups of

assets]](https://image.slidesharecdn.com/indas36-160313144708/85/Ind-as-36-13-320.jpg)