The document discusses Accounting Standards in India. It provides details on:

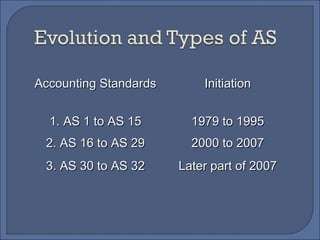

1. Accounting Standards were first issued in India by ICAI in 1977 to standardize accounting policies and make financial statements more reliable and comparable.

2. There are currently 32 Accounting Standards in India based on International Accounting Standards. Other countries have adopted 41 International Financial Reporting Standards.

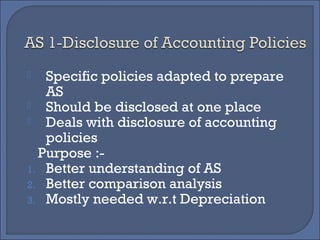

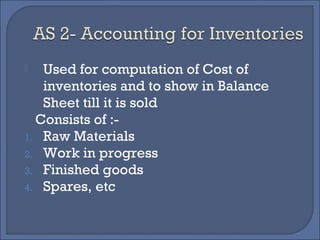

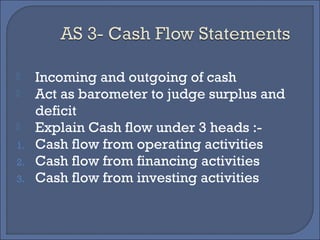

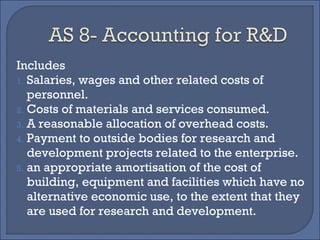

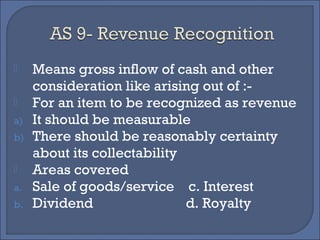

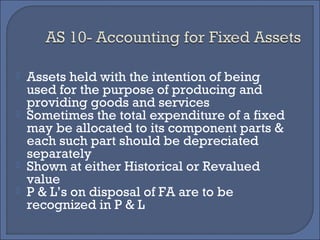

3. Key Accounting Standards cover topics like disclosure of accounting policies, valuation of inventories, cash flow statements, events after balance sheet date, components of profit and loss, depreciation methods, construction contracts, research and development costs, revenue recognition, and fixed assets.