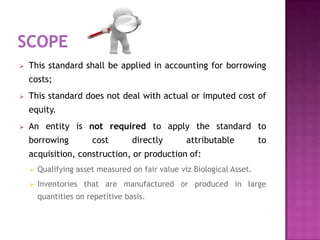

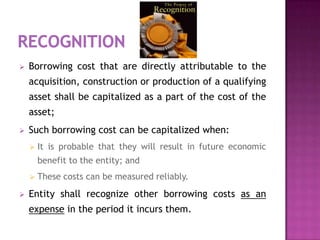

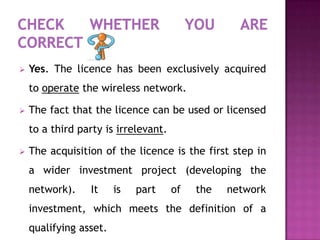

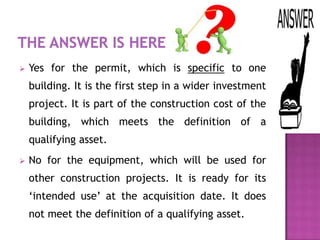

The document discusses the key aspects of accounting for borrowing costs as per Ind AS 23. It defines borrowing costs and qualifying assets. It covers the recognition, capitalization, suspension and cessation of capitalizing borrowing costs to qualifying assets. It also provides examples to illustrate the treatment of exchange differences and disclosures required.

![With regard to exchange difference required to be

treated as borrowing costs, the manner of arriving

at the adjustments stated therein shall be as follows

[Paragraph 6(e)]:

An amount which is equivalent to the extent to

which the exchange loss does not exceed the

difference between the cost of borrowing in

functional currency when compared to the cost of

borrowing in a foreign currency.](https://image.slidesharecdn.com/indas23-borrowingcost-130130092057-phpapp01/85/Ind-AS-23-borrowing-cost-14-320.jpg)