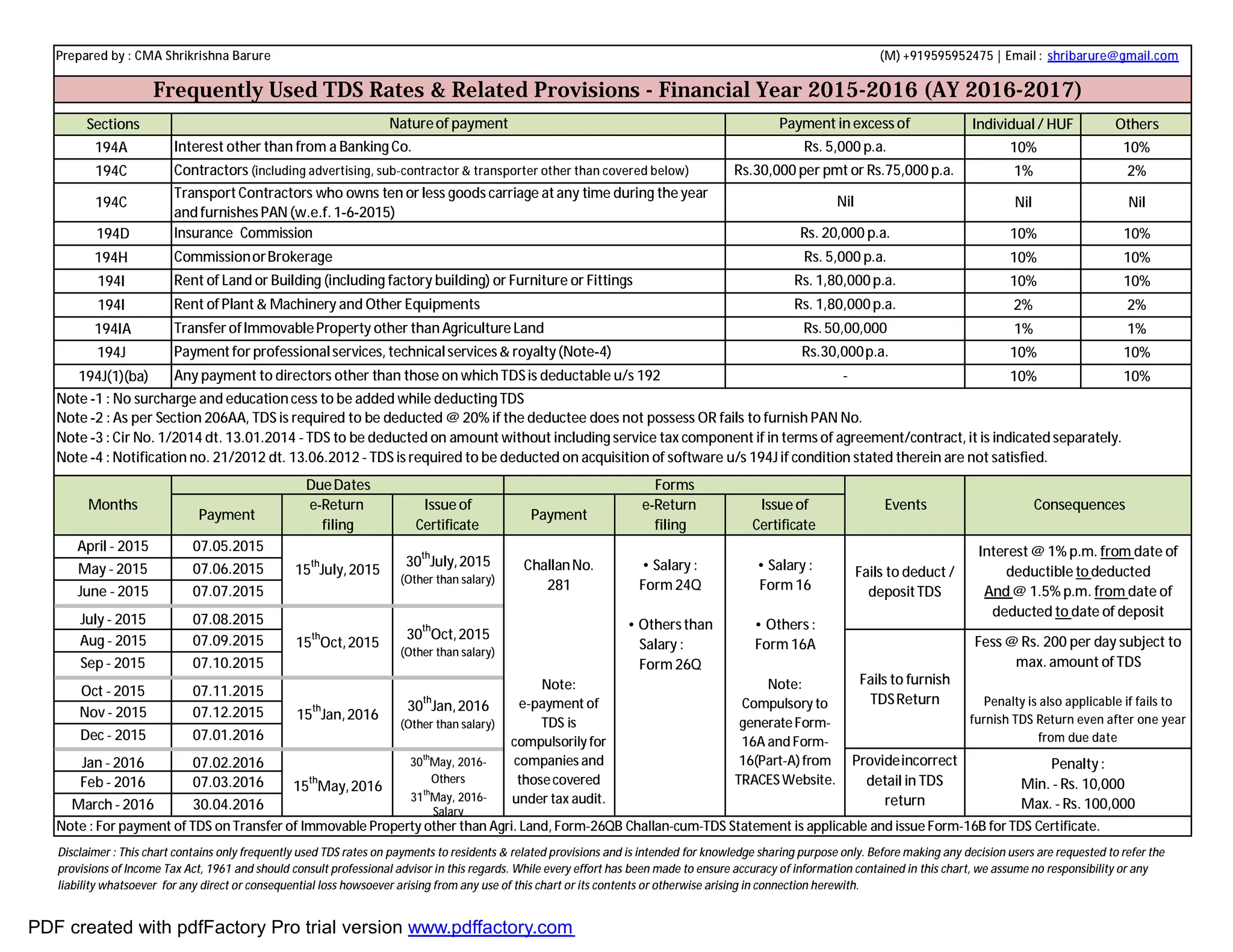

This document provides an overview of Tax Deducted at Source (TDS) rates and related provisions for the financial year 2015-2016 in India. It lists the TDS rates for various types of payments like interest, rent, professional fees, and contract payments. It also outlines the due dates for depositing TDS, filing returns, and issuing TDS certificates. Payers are required to deduct TDS at the specified rates on applicable payments exceeding the thresholds and comply with the due dates, else they may face interest penalties and fees for non-compliance.