This document outlines the requirements for operating/reporting segments under IFRS 8. Key points include:

1) Operating segments are components of a business for which separate financial information is available and regularly reviewed by chief decision makers.

2) Segments are typically defined based on products, services, regions, or major customers.

3) Similar segments can be combined if they have similar economic characteristics, products/services, customers, distribution, or regulatory environments.

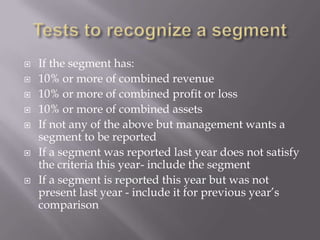

4) A segment must constitute over 10% of certain financial statement items or be reviewed by management to qualify for separate reporting.