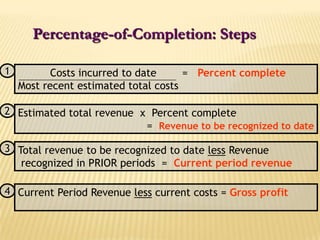

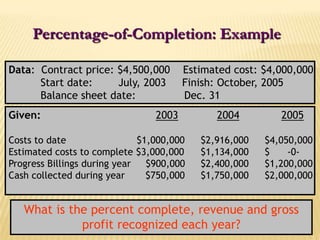

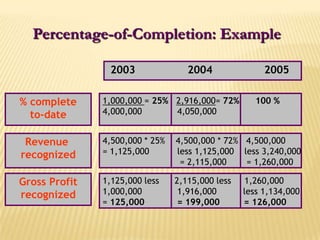

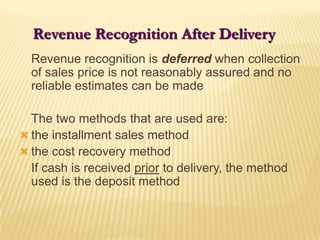

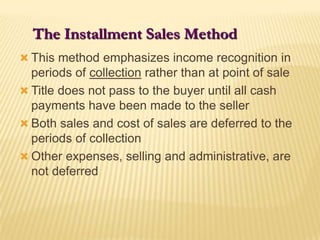

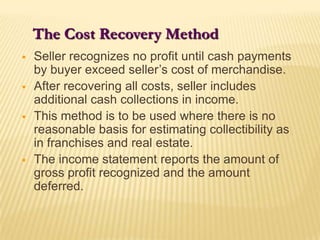

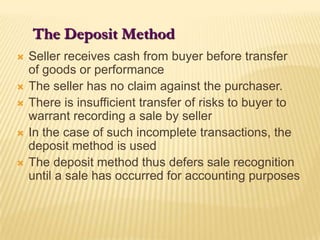

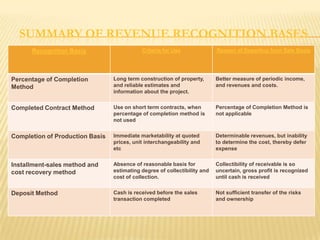

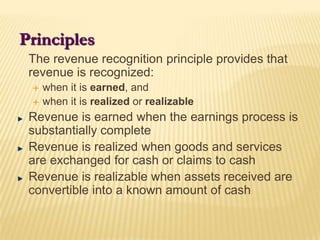

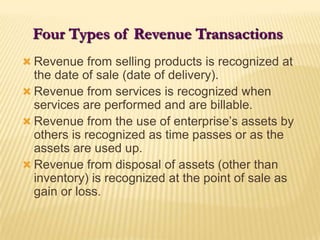

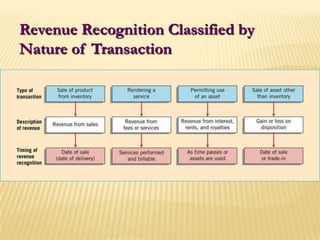

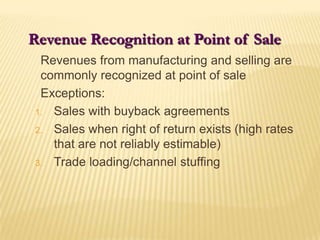

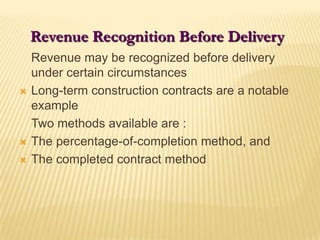

The document discusses accounting standards for revenue recognition. It defines revenue and the principles of revenue recognition, which are that revenue is recognized when it is earned and realized or realizable. There are four types of revenue transactions and revenue can be recognized at the point of sale or before delivery using different methods like percentage-of-completion for long-term contracts. Revenue recognition may also occur after delivery using installment sales or cost recovery methods depending on whether collection is reasonably assured.

![Percentage-of-CompletionMethodCompleted ContractMethod1) Terms of contract must be certain, enforceable2) Certainty of performance by both parties3) Estimates of completion can be made reliably1) To be used only when the percentage method is inapplicable [uncertain]2) For short-term contractsRevenue Recognition Before DeliveryLong-Term ConstructionAccounting Methods](https://image.slidesharecdn.com/as9revenuerecognition-100315041132-phpapp02/85/As-9-Revenue-Recognition-9-320.jpg)