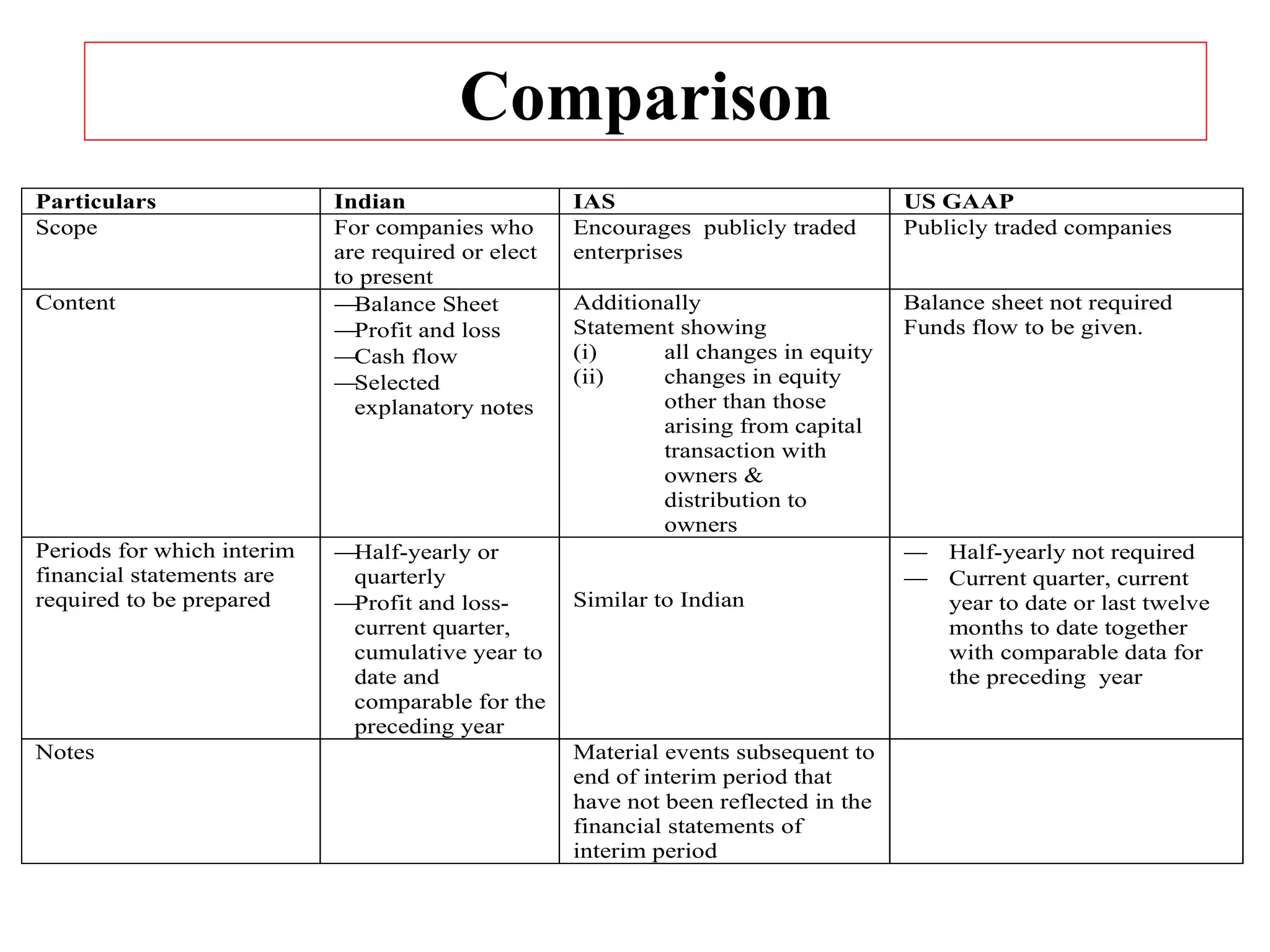

Accounting Standard 25 outlines the requirements for interim financial reporting, including:

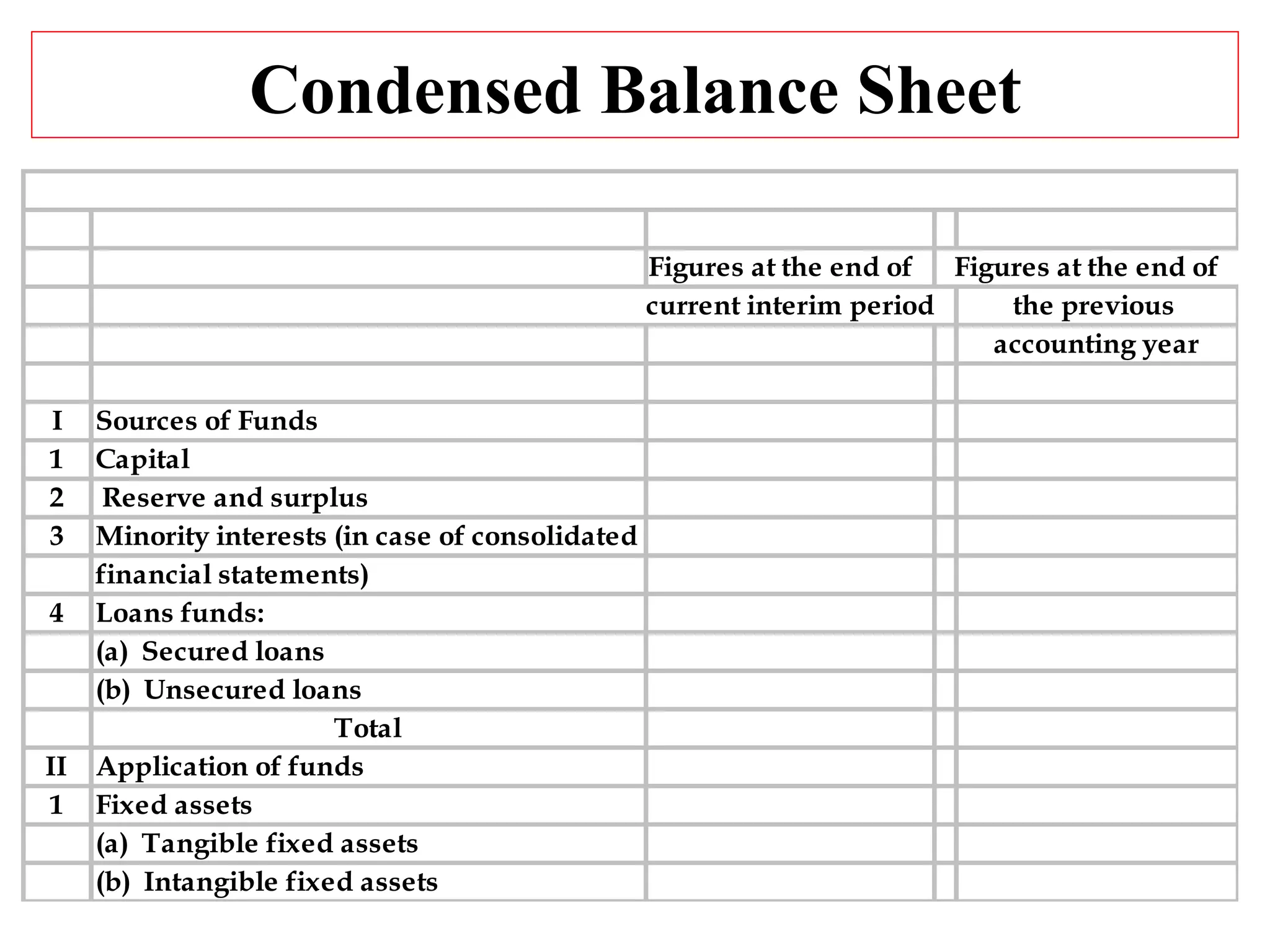

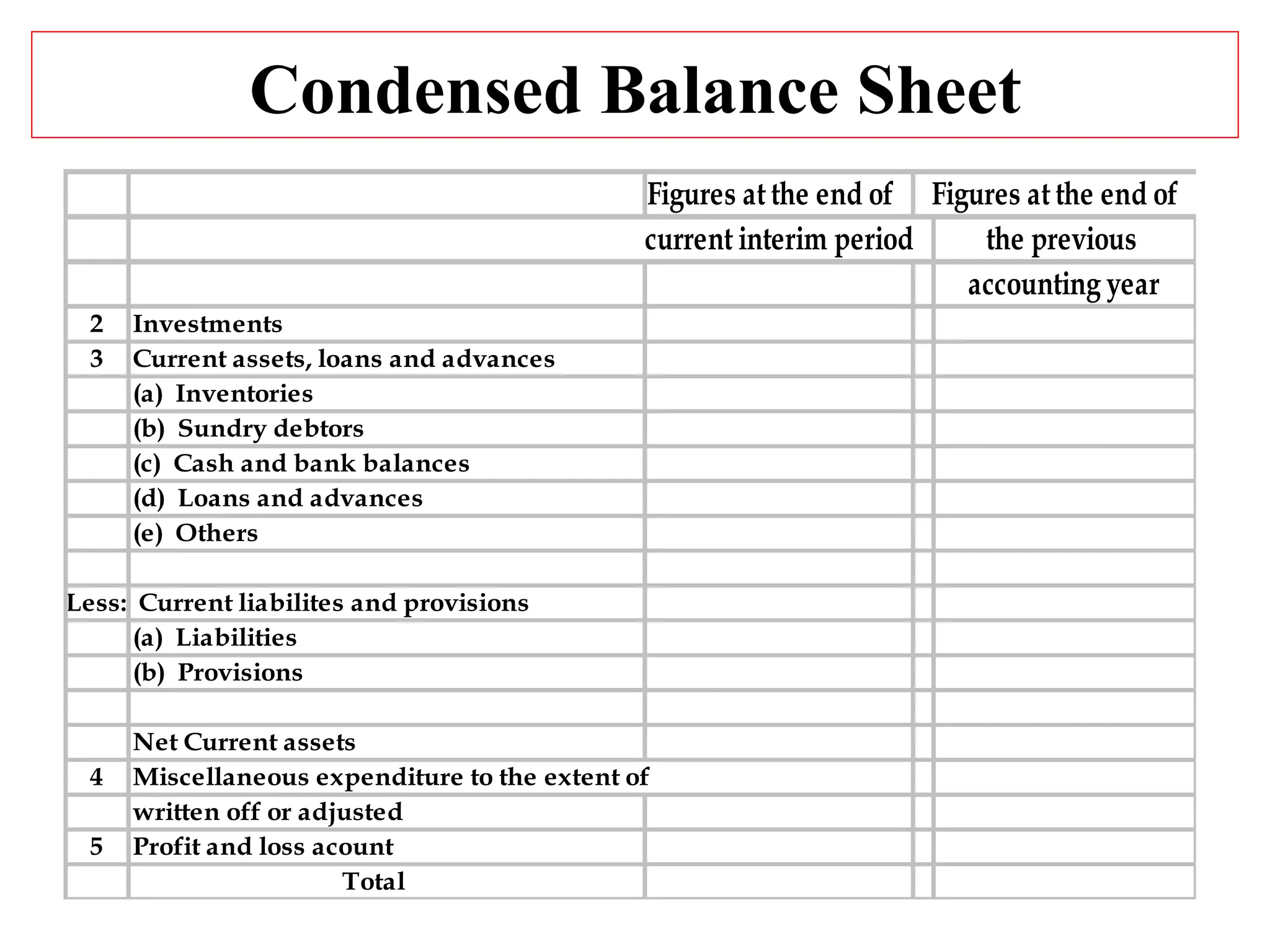

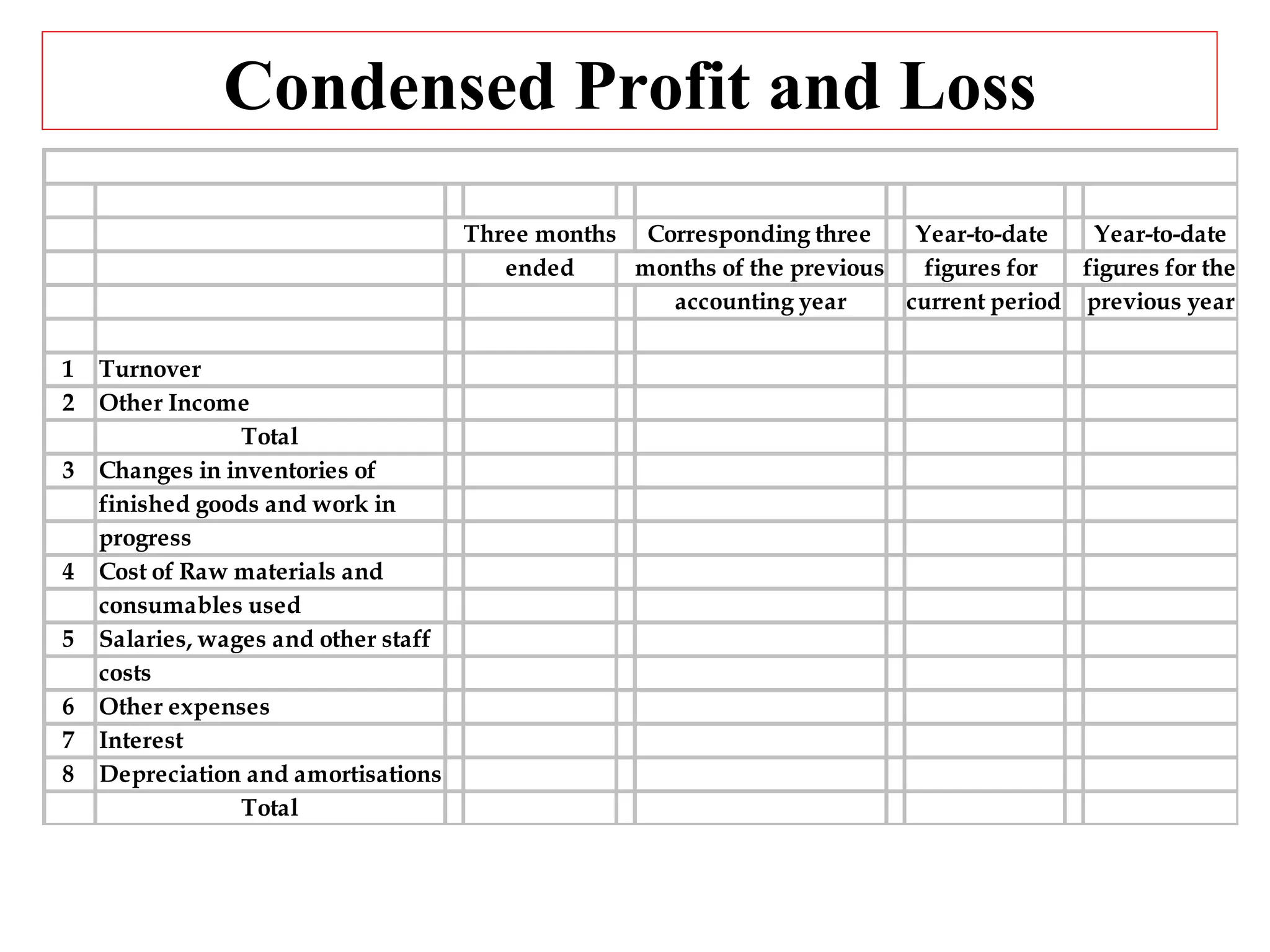

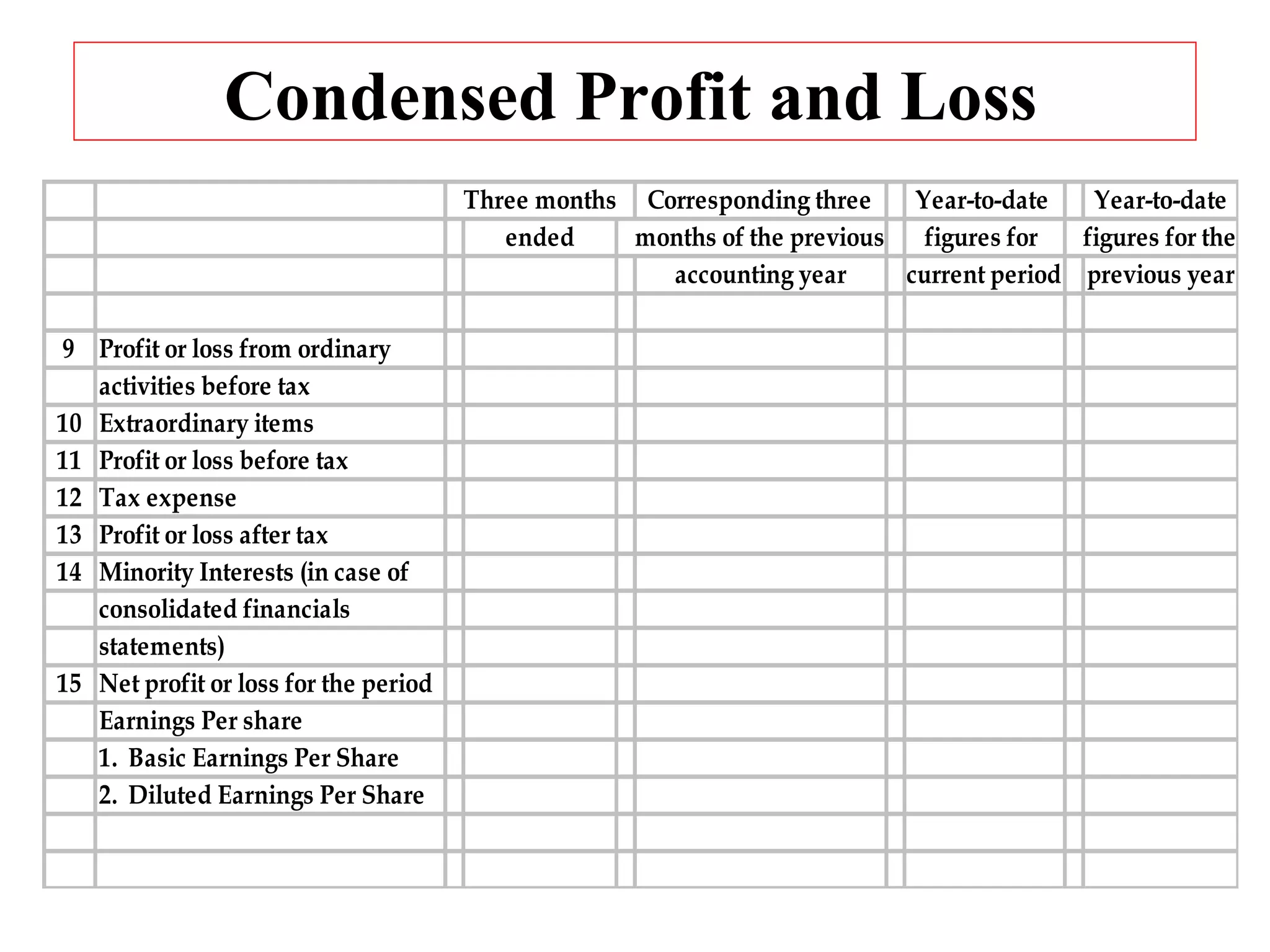

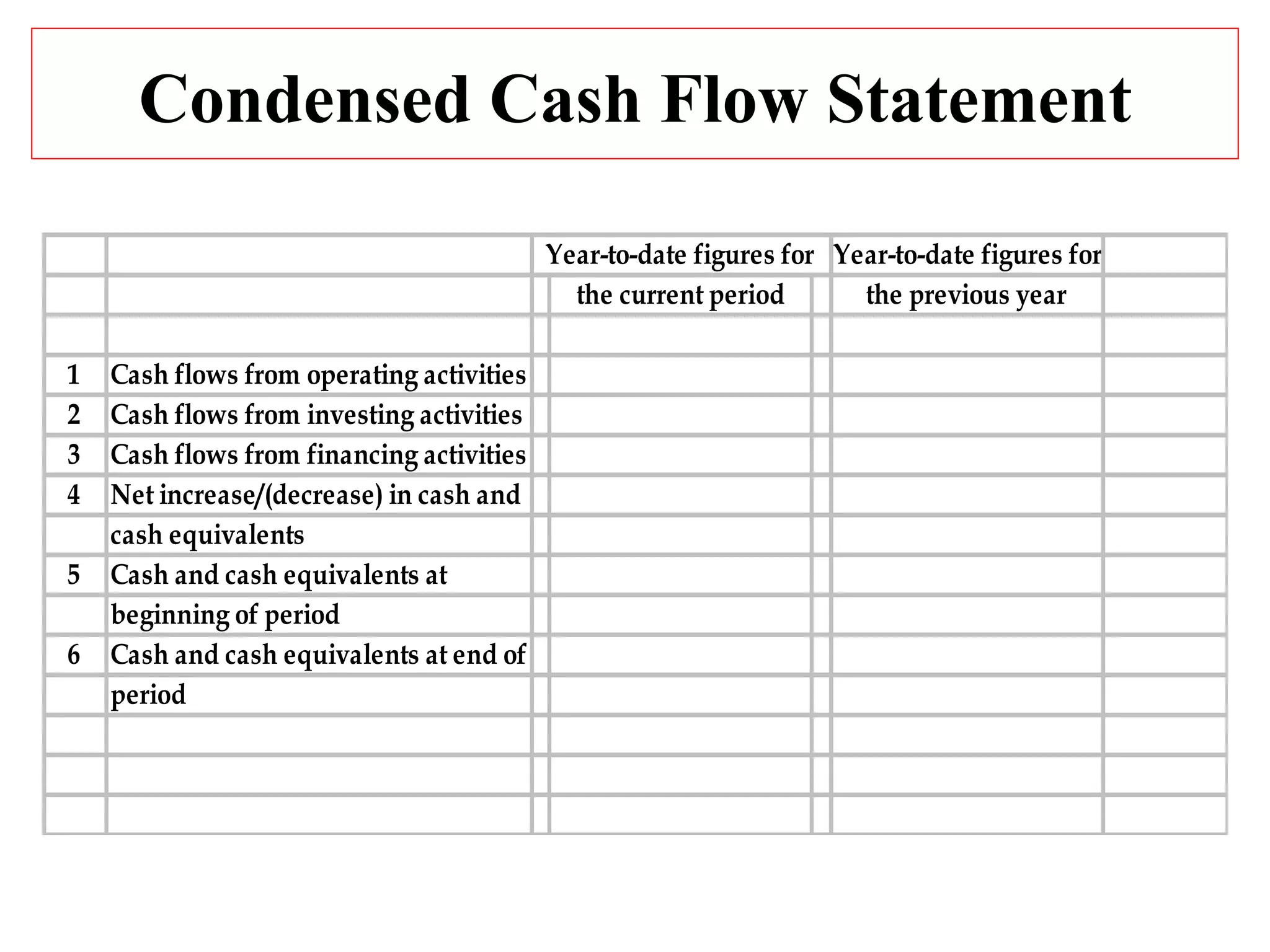

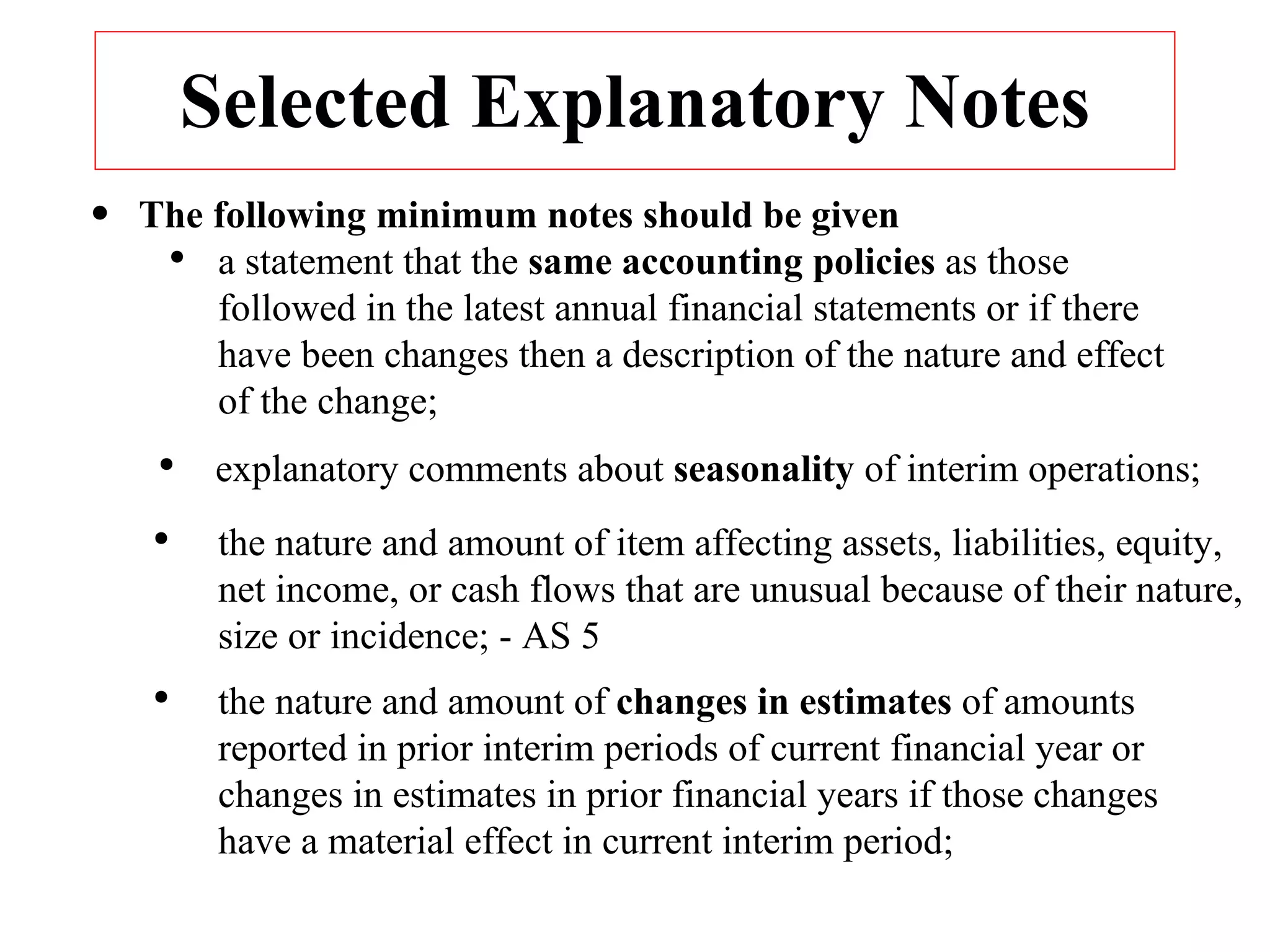

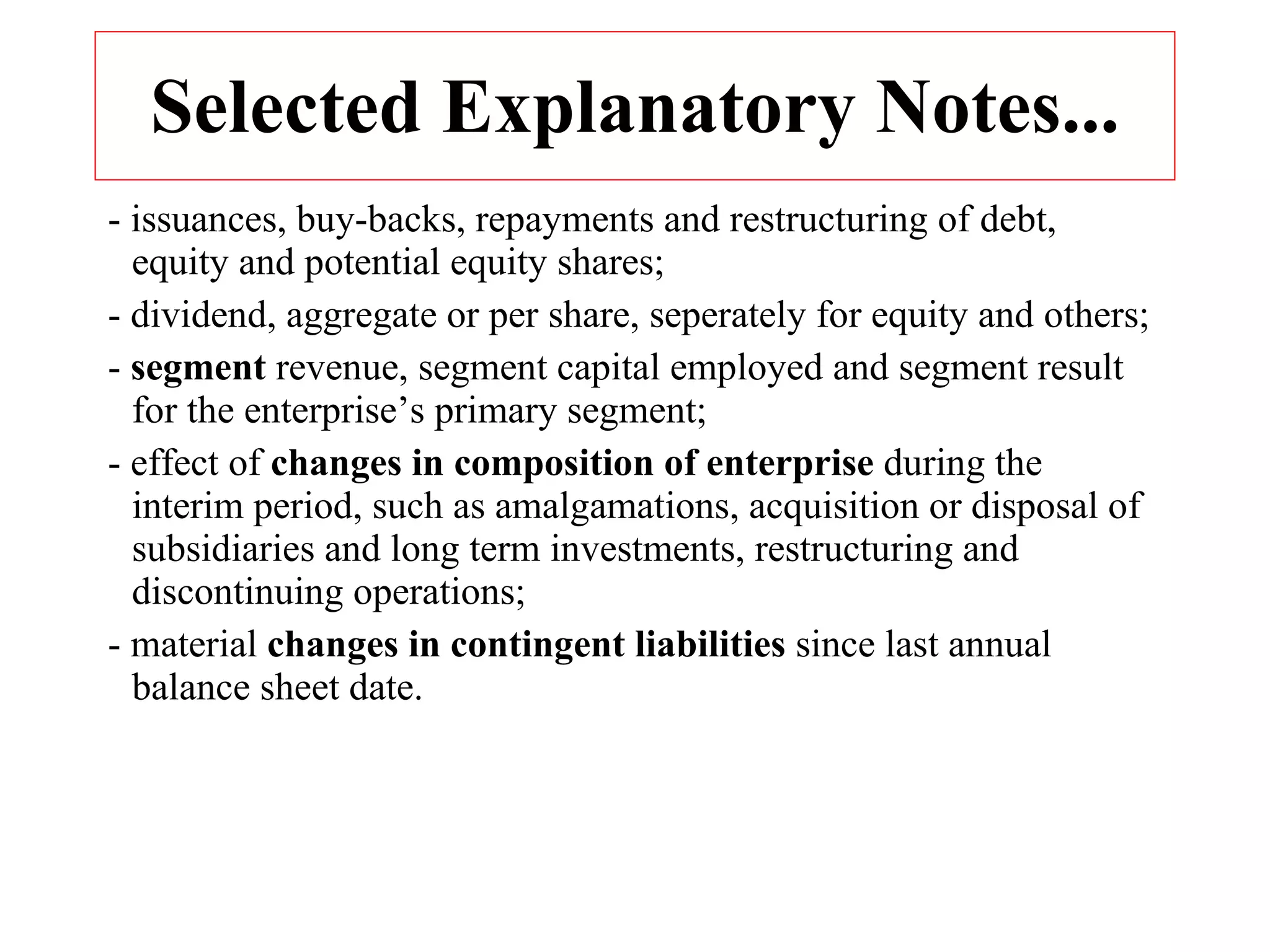

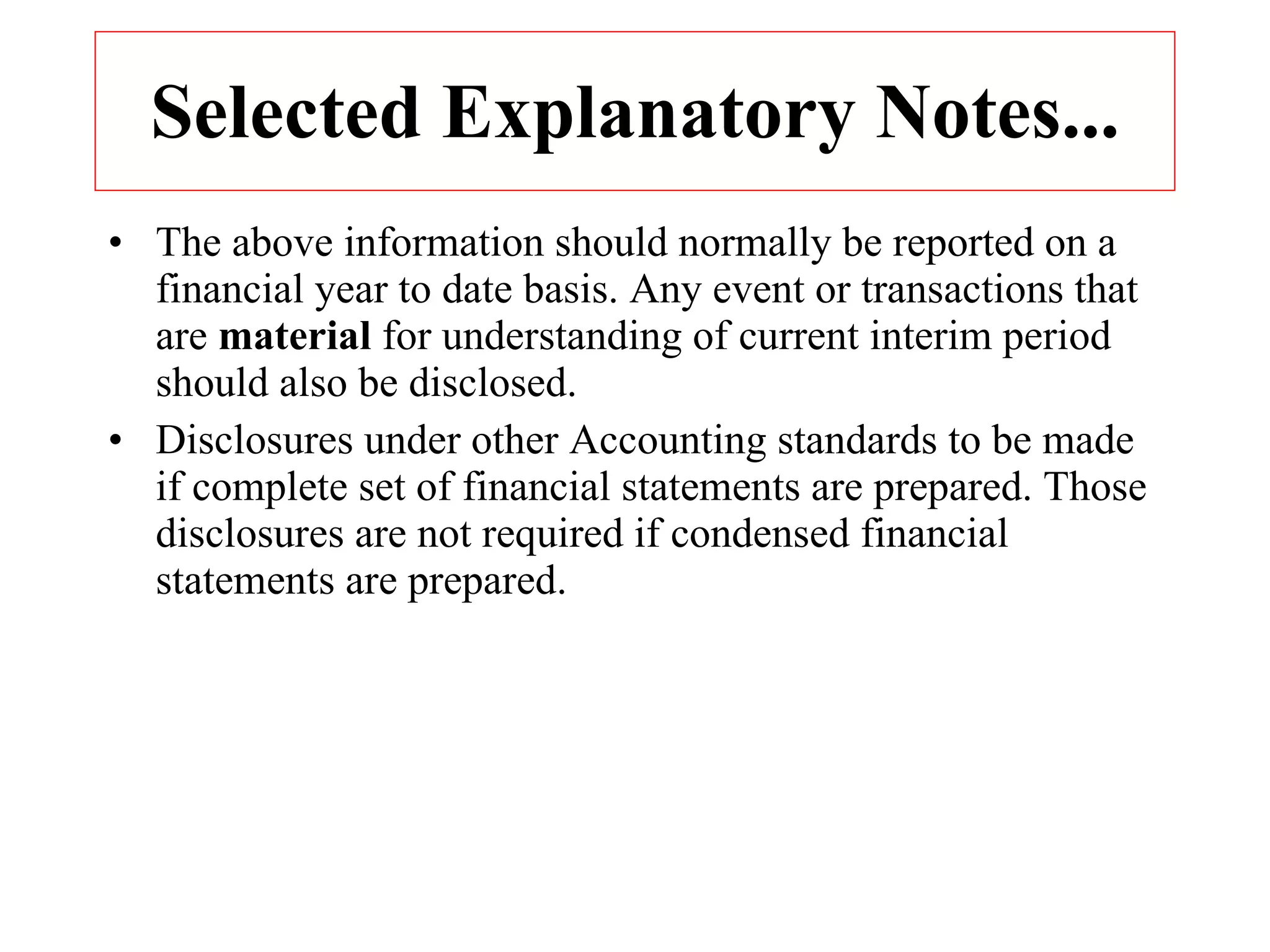

- Minimum content of interim reports which includes condensed financial statements and selected explanatory notes

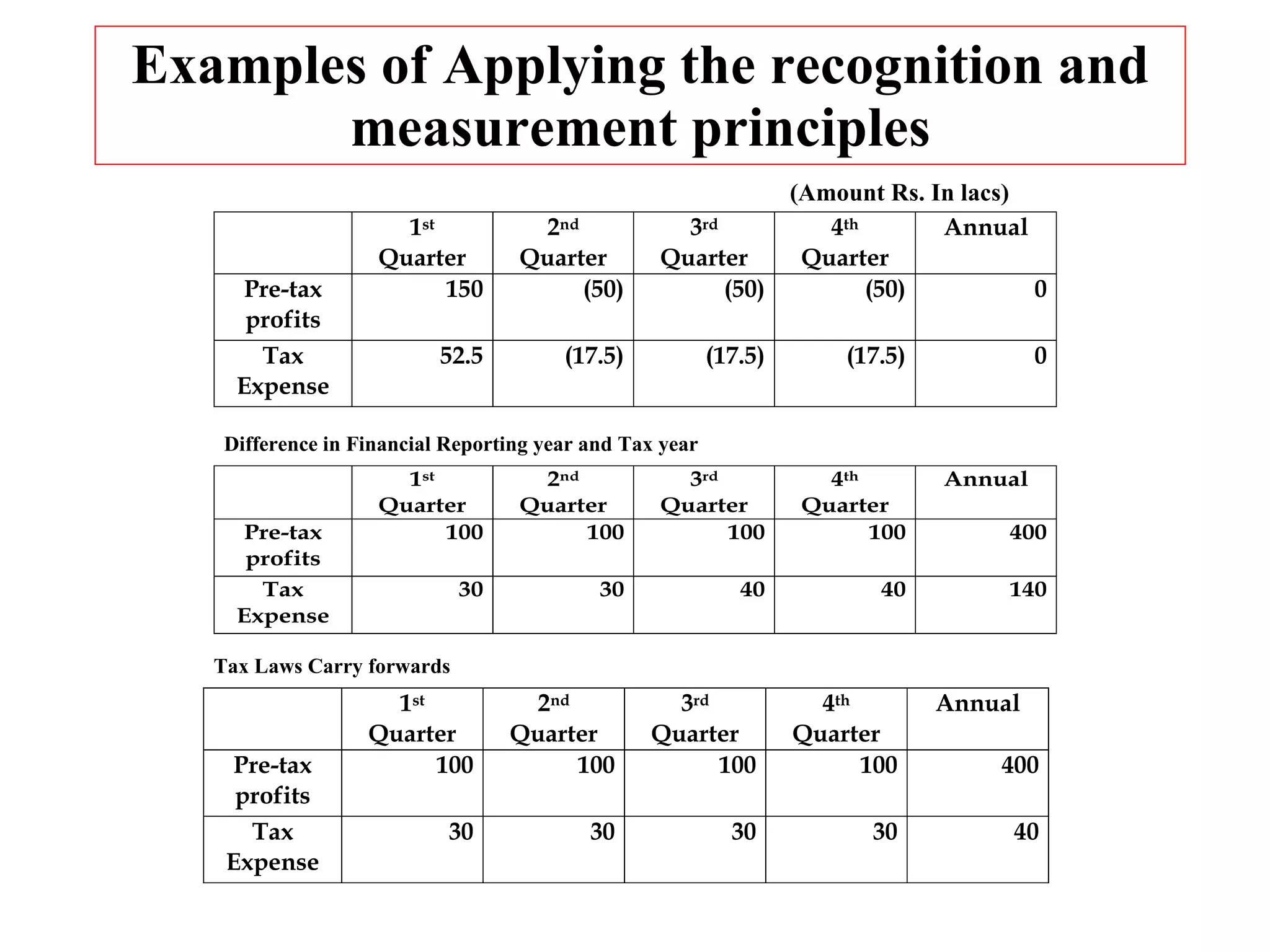

- Principles for recognizing and measuring items in interim reports, which should be consistent with annual financial statements

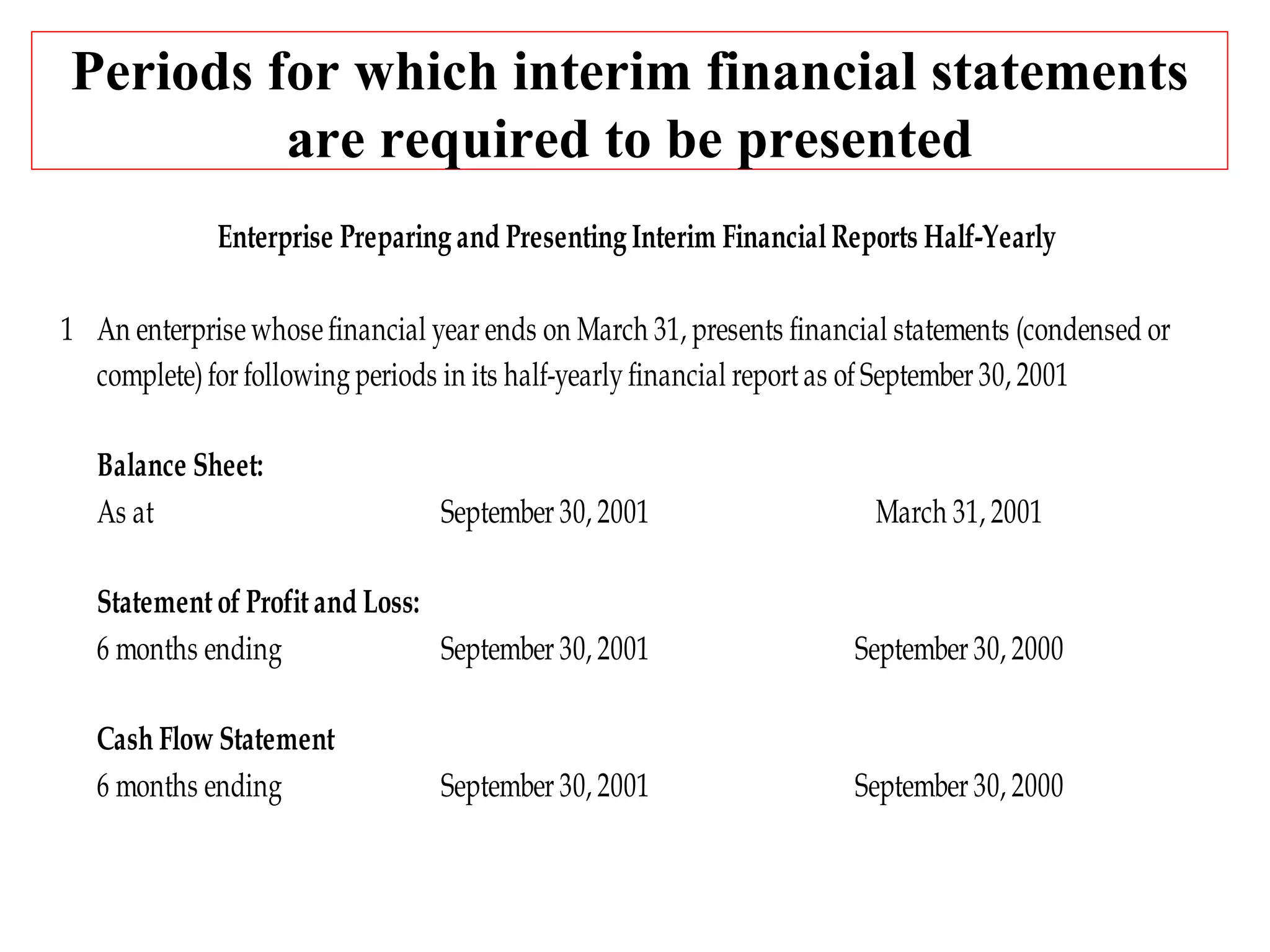

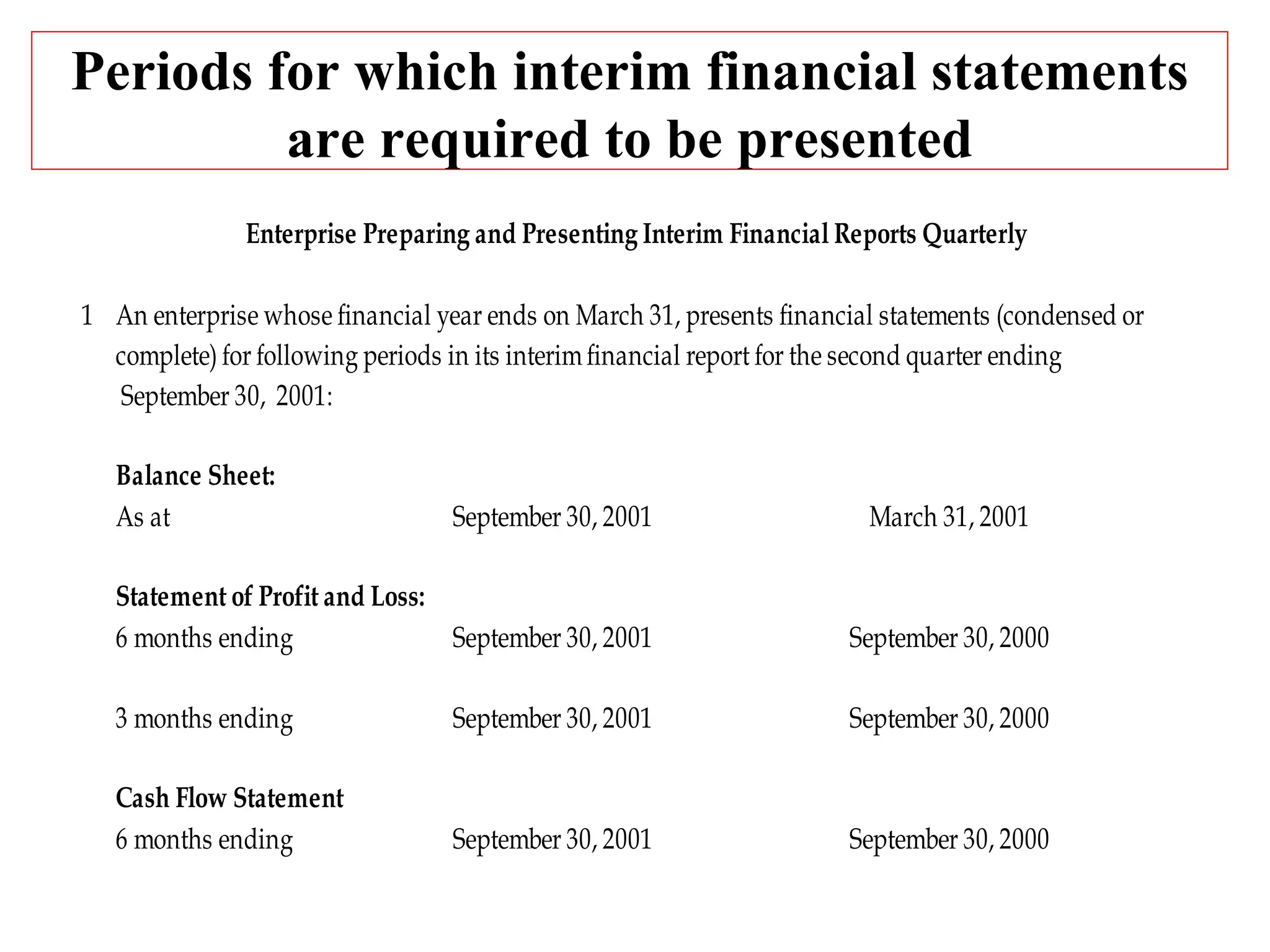

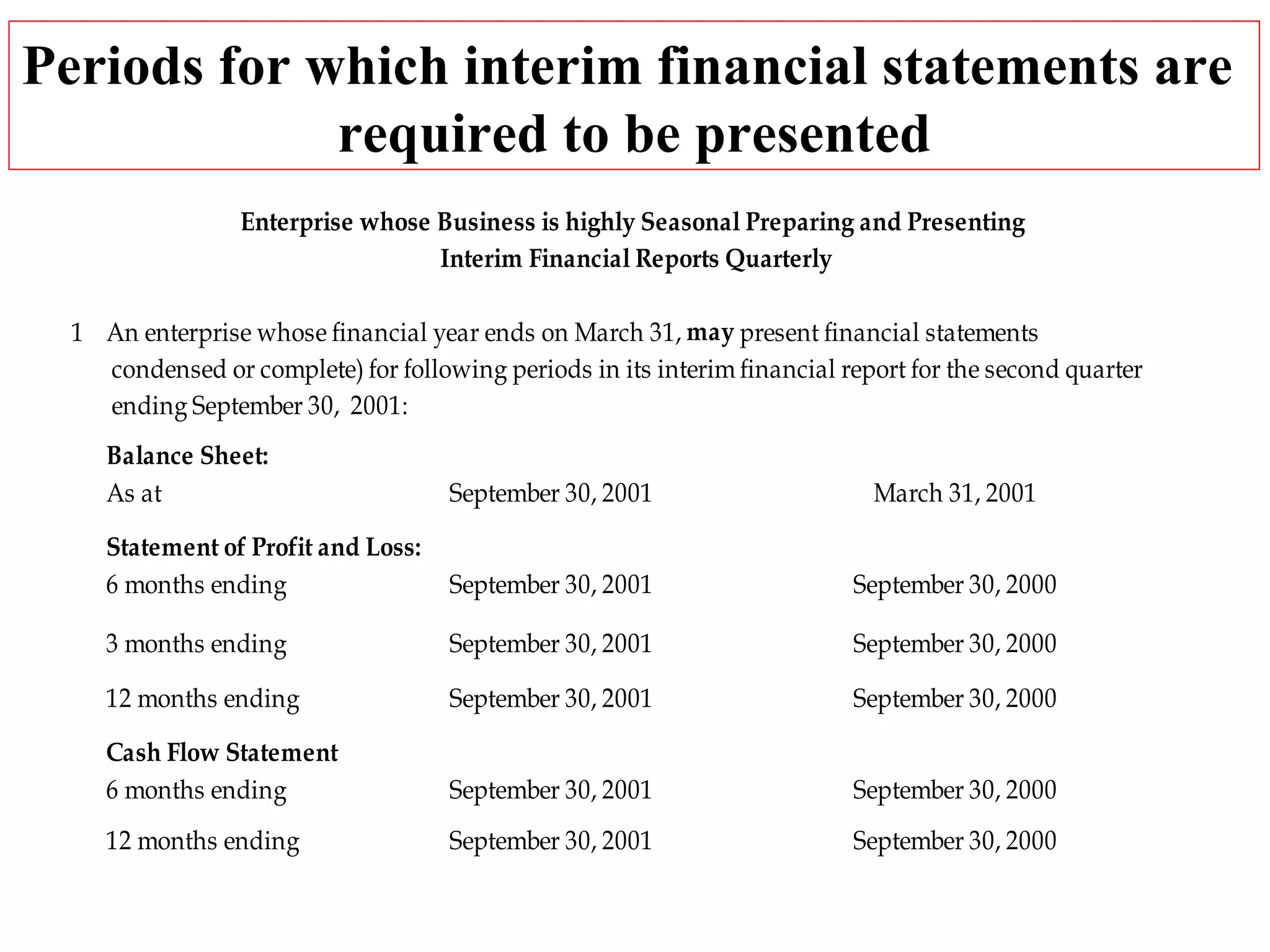

- Periods for which interim reports must be presented, which is normally on a year-to-date basis

- Disclosures in annual financial statements if a separate interim report is not issued for the final interim period