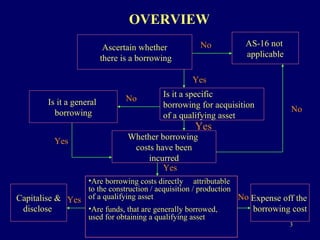

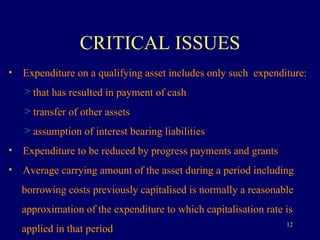

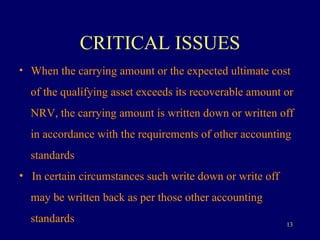

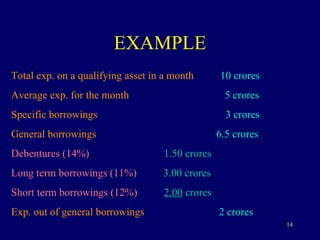

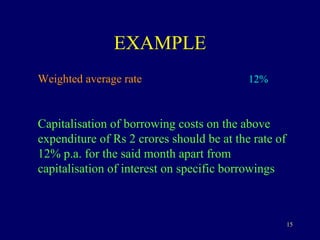

Accounting Standard 16 outlines the accounting treatment for borrowing costs related to qualifying assets. It requires that borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset be capitalized as part of the cost of that asset. Other borrowing costs should be recognized as an expense. Capitalization of borrowing costs should commence when funds are borrowed and activities to prepare the asset are underway, and cease when the asset is ready for its intended use or sale. Certain disclosures regarding capitalized borrowing costs are also required.