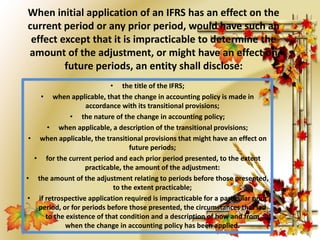

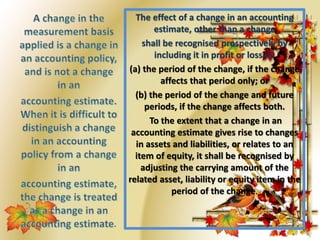

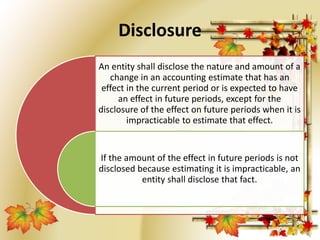

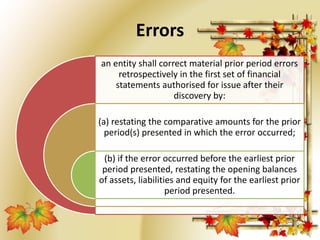

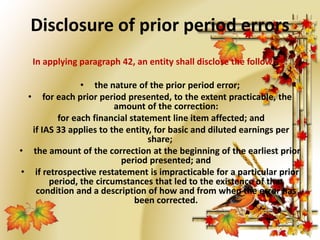

This document summarizes International Accounting Standard 8 which provides guidance on selecting and changing accounting policies, accounting for changes in estimates, and correcting errors. The standard aims to enhance the relevance and reliability of financial statements over time and in comparison to other entities. It addresses topics such as retrospectively applying new policies, accounting for policy changes, and disclosing the nature and amount of errors or changes in estimates. The goal is to provide consistency and comparability in financial reporting.