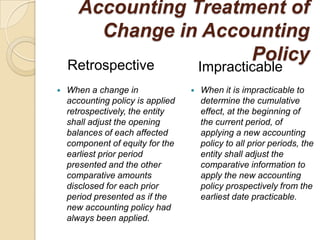

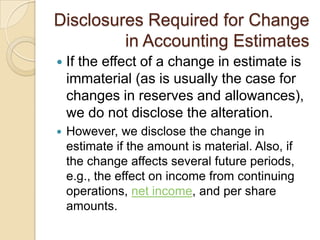

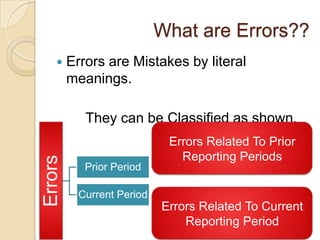

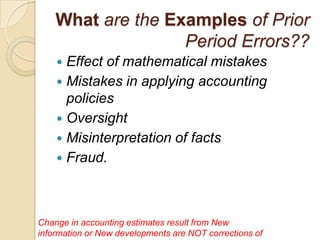

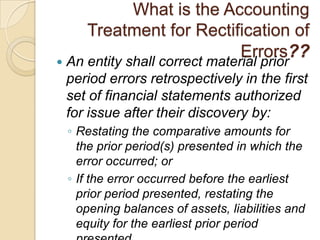

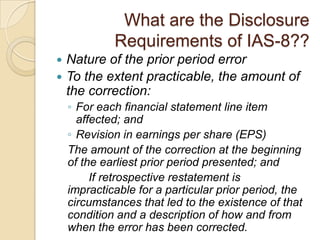

International Accounting Standard 8 establishes requirements for selecting accounting policies, accounting for changes to accounting policies, changes in accounting estimates, and correcting errors in previously issued financial statements. The standard aims to enhance the relevance and reliability of financial statements and their comparability over time and across entities. It requires retrospective application for changes in accounting policies, retrospective restatement to correct errors in prior periods, and prospective application for changes in accounting estimates. Extensive disclosures are also required.