The document discusses Value Added Tax (VAT) including:

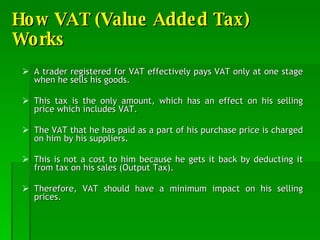

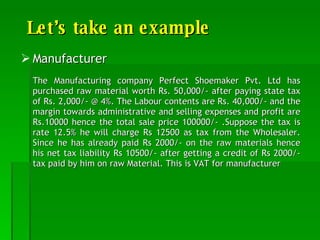

- VAT is a multi-point sales tax levied on the value added at each stage of production and distribution. It aims to tax value addition rather than turnover.

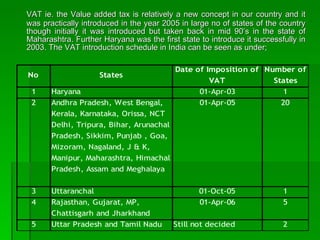

- VAT was first introduced in France in 1954 and has since been adopted by many countries including India where it was introduced in 2005.

- Under VAT, tax is collected in installments at each stage of production/distribution rather than just at the final retail point like under sales tax. This avoids cascading of taxes.