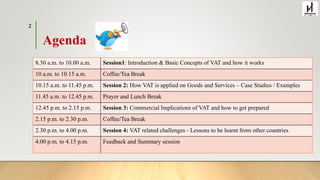

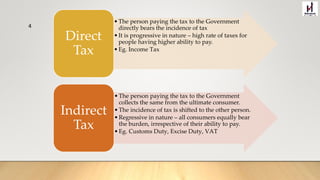

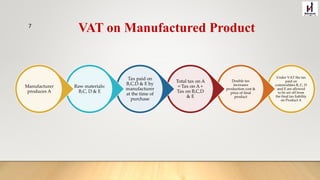

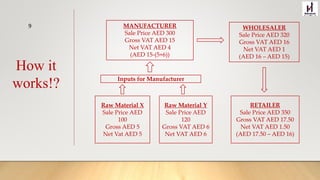

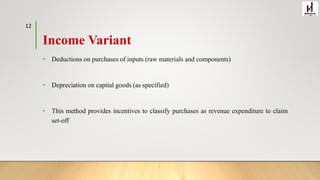

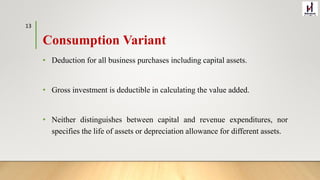

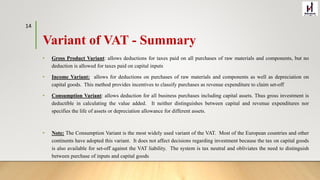

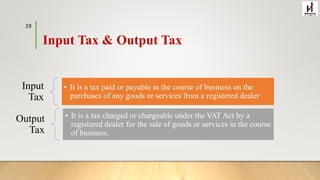

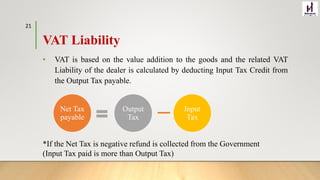

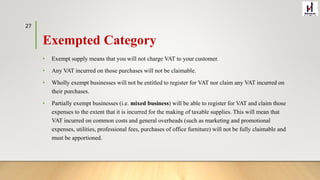

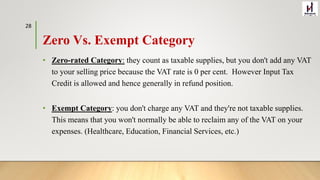

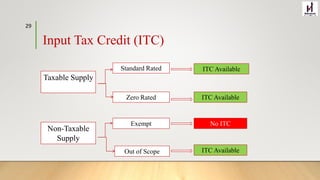

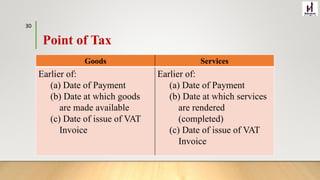

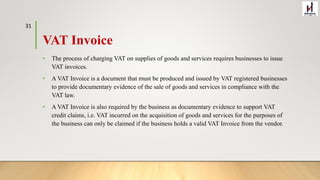

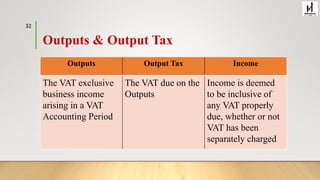

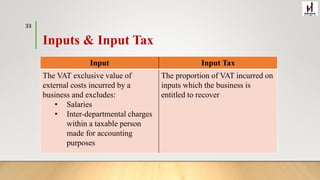

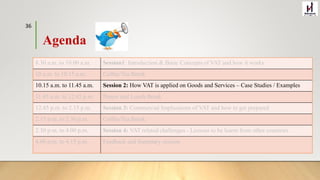

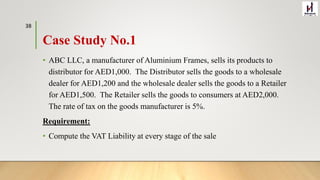

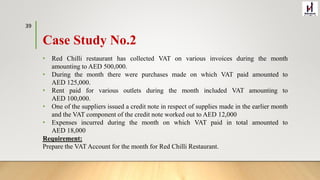

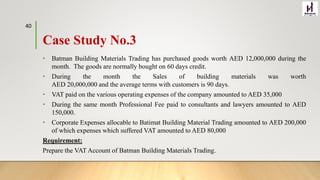

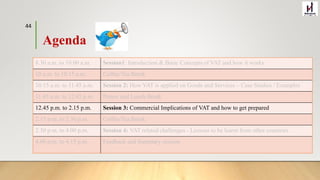

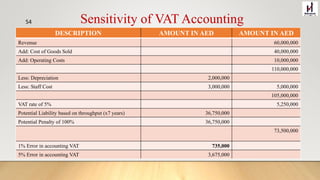

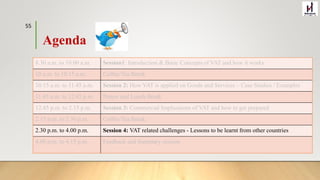

The document outlines the agenda for a VAT workshop taking place in Dubai in March 2017, including sessions on the basics of VAT, its application on goods and services, and challenges faced in different countries. It elaborates on the mechanisms of VAT, such as input and output tax, methods of computing VAT, and the various categories of goods and services under VAT regulations. Additionally, it includes case studies illustrating VAT computations in business scenarios.