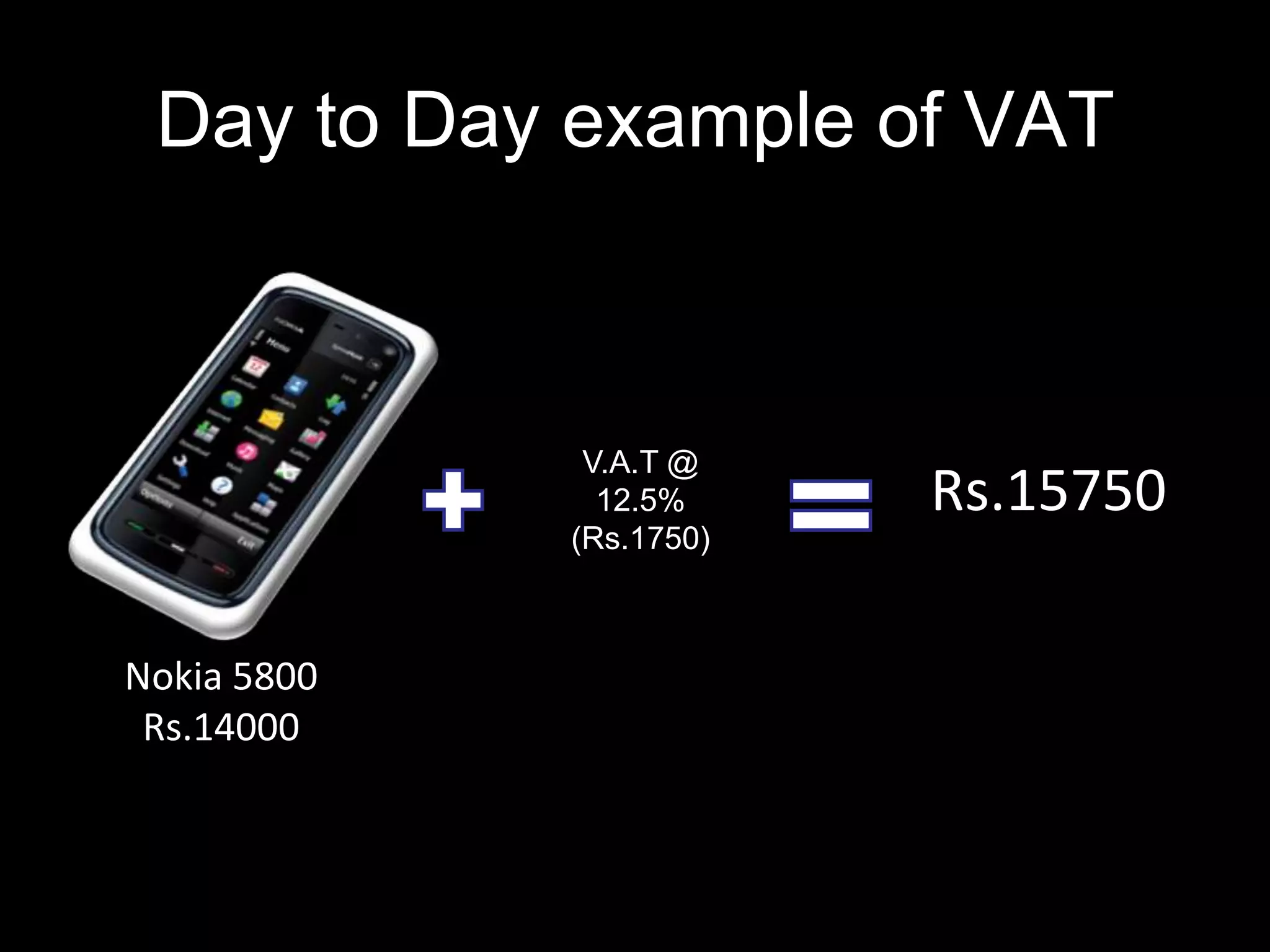

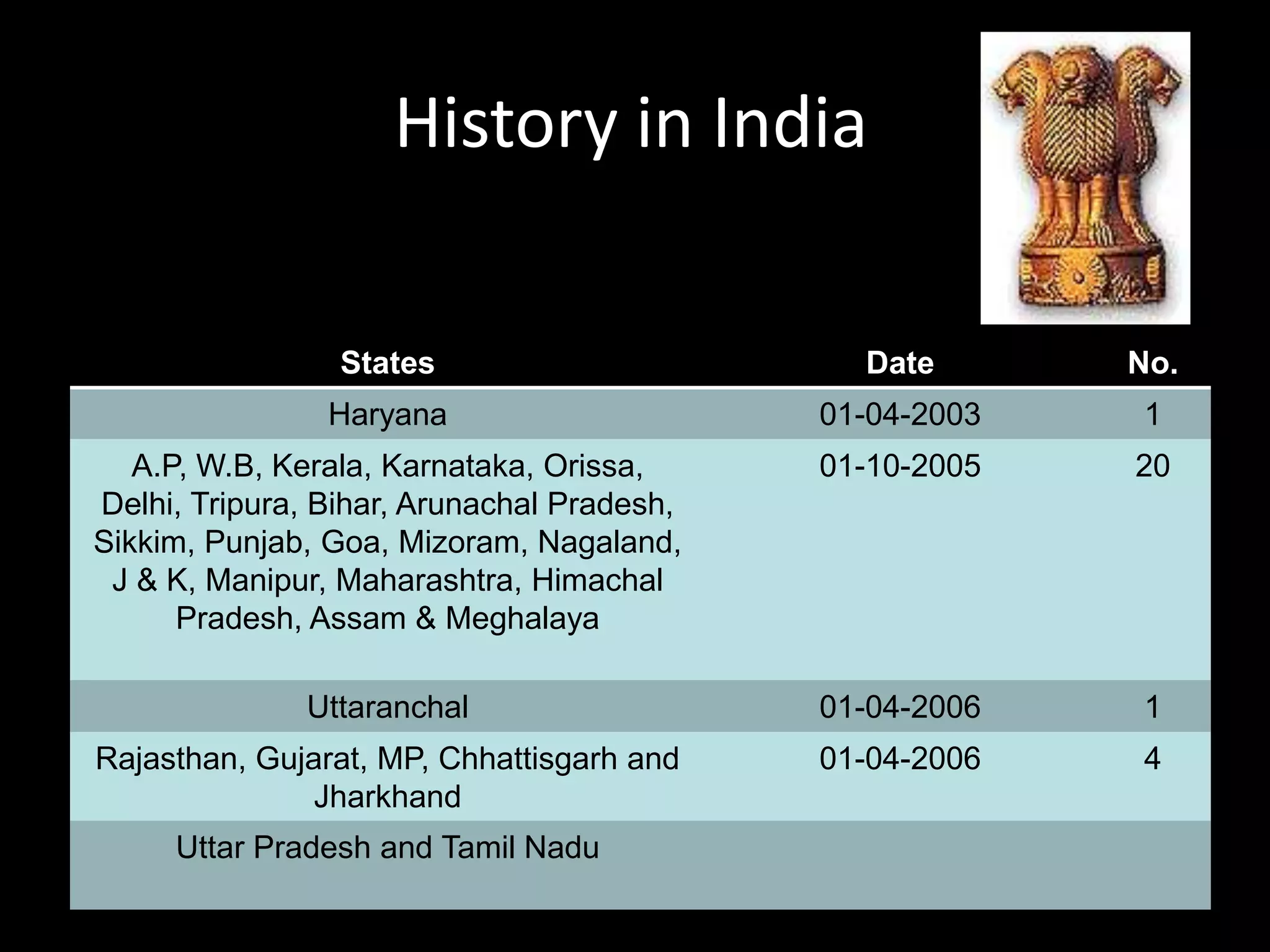

This presentation summarizes the key aspects of value-added tax (VAT) in India. It introduces VAT and explains how it differs from other sales tax systems by being levied at multiple points of a product's production and distribution chain. The presentation outlines the history of taxation systems in India, the reasons for changing to VAT, how VAT affects the Indian economy, and compares the advantages and disadvantages of VAT to other systems. Real-world examples of calculating VAT are provided.