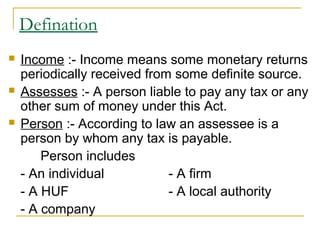

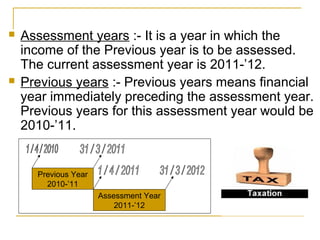

This document provides an overview of taxation in India. It discusses the history of income tax, which was first introduced in India in 1860. It outlines the various tax authorities in India, including central and state governments and municipalities. It defines key terms related to taxation like income, assessment year, and previous year. It also provides examples of statements showing taxable income from sources like salary, house property, business/profession, and a summary statement of total taxable income. Finally, it briefly discusses value-added tax.

![Thank you

Name :- Daxesh Kanani

Roll No. :- 09

Subject :- Communication Skills for IT Mgmt.

Class :- BBA [ITM] – IV

College :- C. P. Patel & F. H. Shah

Commerce College](https://image.slidesharecdn.com/taxppt-130202121230-phpapp01/85/Tax-ppt-12-320.jpg)