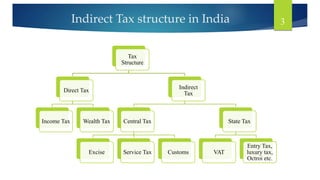

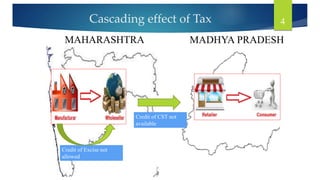

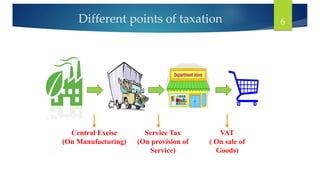

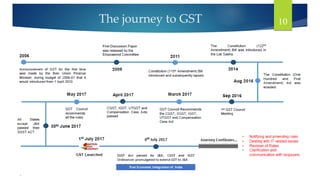

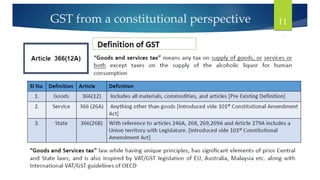

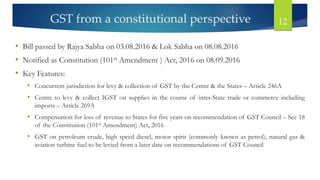

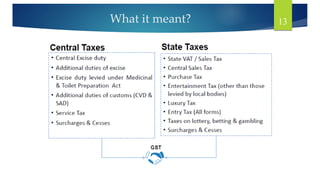

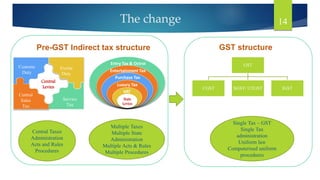

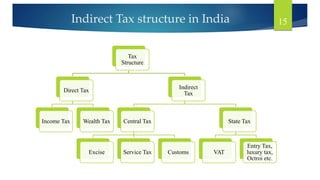

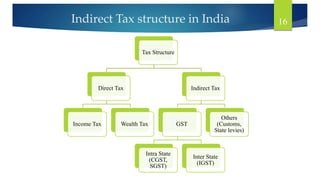

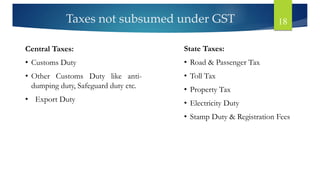

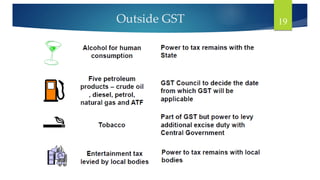

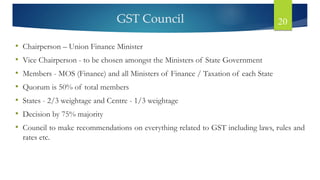

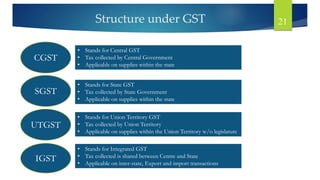

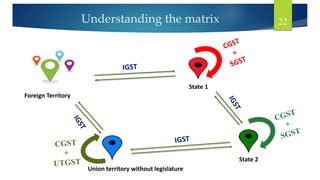

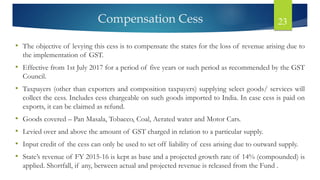

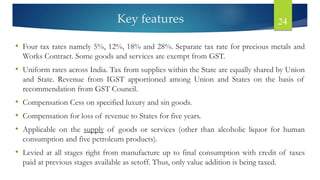

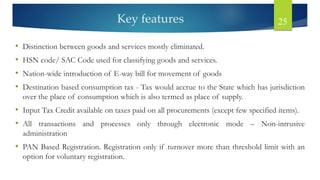

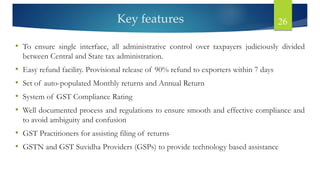

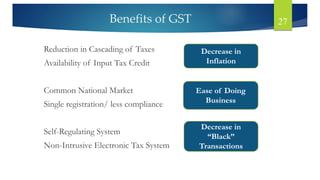

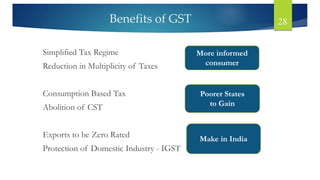

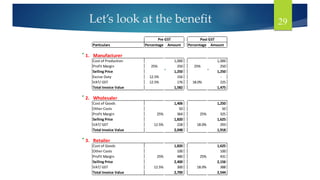

The document provides an overview of the Goods and Services Tax (GST) in India, highlighting its need for indirect tax reform and the transition from a complex multi-tax structure to a single GST regime. Key features include the introduction of a unified tax rate, the establishment of the GST Council for governance, and provisions for revenue compensation to states. It also outlines benefits such as simplified tax processes, reduction in tax cascading, and enhanced compliance through technology.