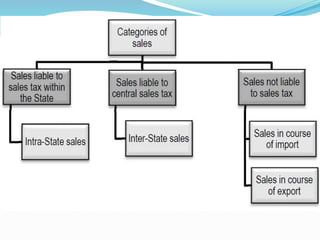

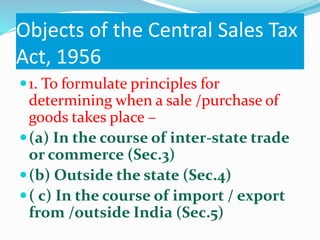

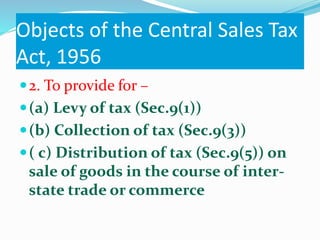

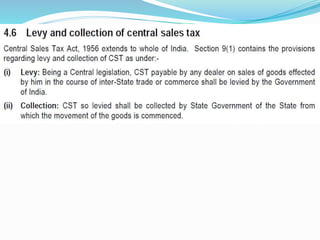

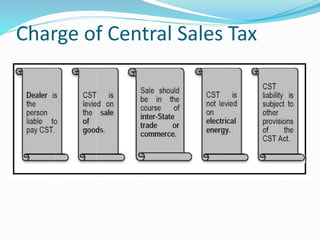

The Central Sales Tax Act, 1956 provides the legal framework for levying and collecting tax on the sale of goods in the course of inter-state trade or commerce in India. Some key aspects include:

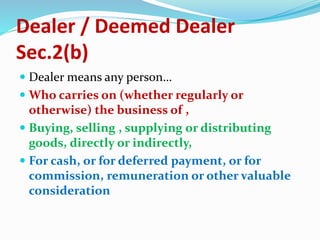

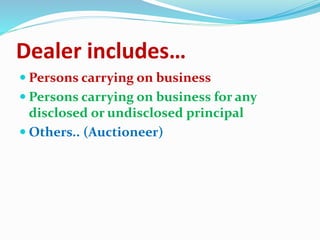

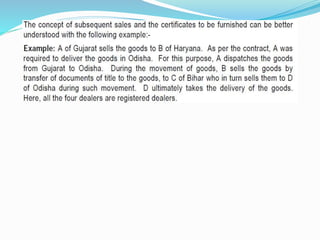

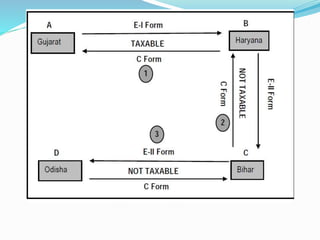

1. It defines terms like "sale", "declared goods", "place of business", and categorizes dealers as registered or unregistered.

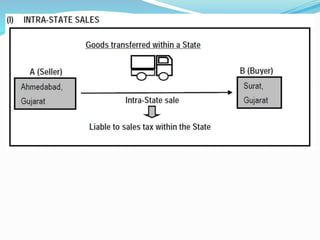

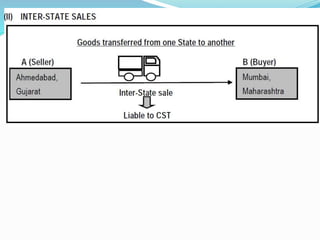

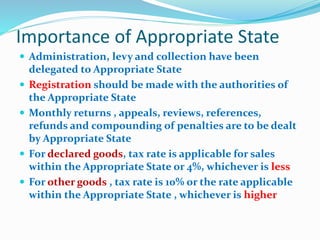

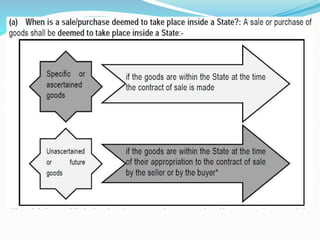

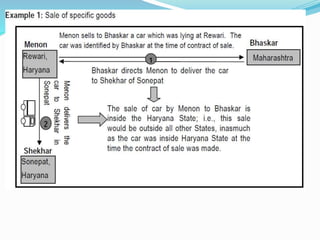

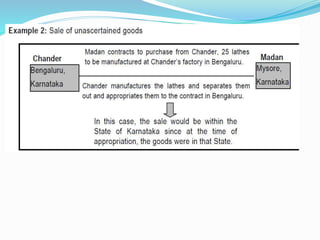

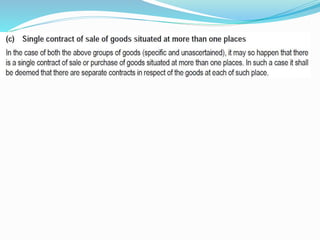

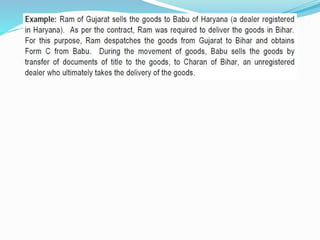

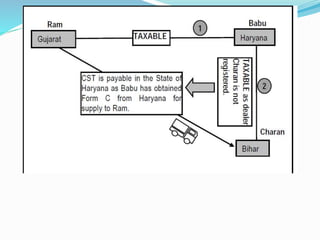

2. The Act determines when a sale occurs within a state or inter-state and assigns an "Appropriate State" to administer the tax.

3. It empowers the central government to levy tax according to the tax rates of the Appropriate State and provides for the distribution of tax revenues among states.

![Objects of the Central Sales Tax

Act, 1956

3. To declare certain goods to be of special

importance in the course of inter – state

trade or commerce [Sec.14]

4. Taxation of Declared Goods : To specify

the restrictions and conditions in the matter

of imposing taxes on the sale or purchase of

goods declared by the central Government

to be of special importance in the course of

inter-state trade or commerce [Sec.15]](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-14-320.jpg)

![Objects of the Central Sales Tax

Act, 1956

5. To provide for collection of tax from

companies in the event of liquidation

[Sec.15]](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-15-320.jpg)

![Appropriate State [Sec.2(a) ]

Number of places of

business

Appropriate State is

Only one place of business State in which place of

business is situated

Many places of business

(a) All in one State State in which place of

business is situated

(b) In different States EACH state in which a place

of business is situated](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-19-320.jpg)

![Business [Sec.2(aa) ]

Business includes :

1. any trade, commerce or manufacture, or

2. any adventure or concern in the nature of

trade , commerce or manufacture-

(a) with a motive to make profit or not,

(b) whether such profit actually accrues or not,

3.any activity which is incidental or ancillary

to such trade, commerce , manufacture ,

adventure or concern](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-21-320.jpg)

![Crossing the Customs Frontiers of

India [Sec.2(ab) ]

Crossing the Customs Frontiers of India means :

(a) crossing the limits of the area of a customs

station;

(b) in which imported goods or exported

goods are ordinarily kept before clearance by

Customs Authorities](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-23-320.jpg)

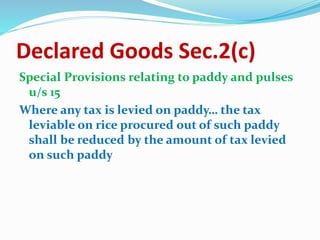

![Declared Goods Sec.2(c)

1 .Declared Goods declared u/s 14 to be of

special importance in inter-state trade or

commerce

2. Restrictions / Conditions w.r.t Declared

Goods [Sec.15]

(a) Maximum Tax Rate – 4%

(b) Reimbursement of Local Sales Tax …. To

the seller making Inter state sale](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-32-320.jpg)

![Place of Business [Sec.2(dd)]

Includes…

Place of business of an agent, in case where a

dealer carries on business through an agent

Place where stores his goods like warehouse /

godown

Place where dealer keeps his books of account](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-39-320.jpg)

![Works Contract [Sec.2(ja)]

Means a contract for carrying out any work

which includes…

Altering

Assembling

Building

Construction

Erection

Fabrication](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-49-320.jpg)

![Works Contract [Sec.2(ja)]

Means a contract for carrying out any work

which includes…

Fitting out

Improvement

Installation

Manufacturing

Processing

Repair or commissioning of any movable or

immovable property](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-50-320.jpg)

![Sale Price [Sec.2(h)]

Meaning …

Amount payable to a dealer as consideration

for sale of any goods](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-51-320.jpg)

![(i) Returnable Containers In case of returnable goods, the

ownership vests with the Dealer and does

not pass on to the Purchaser. The

containers are required to be returned to

the Dealers. No consideration is

chargeable in respect of such returnable

containers. The definition of sale price

u/s 2(h) does not include amounts not

charged by the Dealer. Hence, cost of

returnable containers cannot constitute

sale price. [Dyer Meakin Breweries].](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-59-320.jpg)

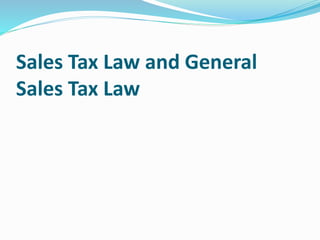

![Sales Tax Law [Sec.2(i)] General Sales Tax Law

(GST)

Means any law, for the time

being in fore, in any State or

part thereof which provides for

levy of Taxes on sale /

purchase of goods generally or

on any specified goods

expressly mentioned in that

behalf and includes value

Added Tax Law.

Means any law, for the time

being in force, in any State of

Part thereof which provides

for levy of taxes on sale /

purchase of goods generally

and includes Value Added

Tax Law.](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-61-320.jpg)

![Turnover [Sec.2(j)]

Means …

The aggregate of sale price received and receivable

by a Dealer.

In respect of sale of any goods,

In the course of inter-state trade or commerce,

Made during the prescribed period, and

Determined in the prescribed manner, (as per

Rules under the Act)](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-62-320.jpg)

![Year [Sec.2(k)]

Where GST Law of

appropriate State is

Year is

Applicable Year as applicable under the

General Sales Tax law

Not Applicable Financial year – 1st April to 31st

March.](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-63-320.jpg)

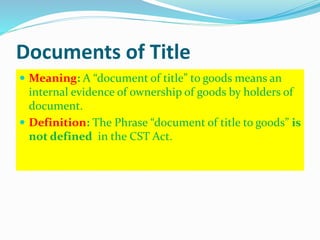

![Inter-State Trade[Sec.3]- Meaning

Meaning: A sale or purchase of goods shall be deemed

to take place in the course of inter-state trade or

commerce effected either by –

(a) Transfer of goods.

(b) Transfer of document of title to goods.](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-65-320.jpg)

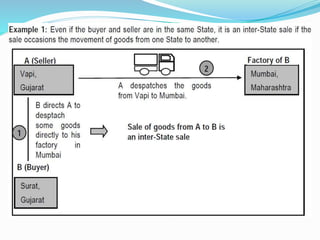

![Sale/Purchase by transfer of goods

[Sec.3(a)]

When a sale or purchase occasions the movement

of goods from one State to another.

Such movement is in pursuance of contract of sale or

purchase.](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-66-320.jpg)

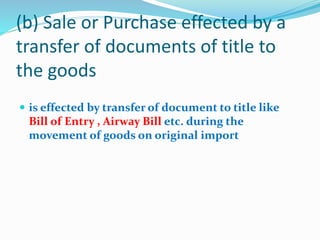

![By transfer of documents of title

to goods [Sec.3(b)]

When a sale or purchase is effected by transfer of

documents of title to goods during their movement

from one state to another.

Duration of movement: Duration of movement

commences when the goods are delivered to a carrier

or other bailee for transmission and ends at the time

such delivery is taken from such carrier/ bailee.

It shall be effected during the original movement of

goods u/s 3(a).](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-67-320.jpg)

![Sale/Purchase inside a State

(intra-State) [Sec.4]](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-83-320.jpg)

![Sale or Purchase in the course

of Export [Sec.5]](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-89-320.jpg)

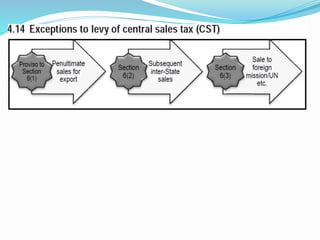

![Levy of Tax on Inter-State Sale

[Sec.6]

A dealer is liable to pay tax on all sales effected by

him

In the course of inter-state trade or commerce

Liable …even if no tax is payable by him under

GST law or State tax law](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-105-320.jpg)

![Levy of Tax on Inter-State Sale

[Sec.6]

Exceptions….

Penultimate sale which occasions for export

Inter-State sale of Electrical energy

Purchase of ATF by international flights](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-106-320.jpg)

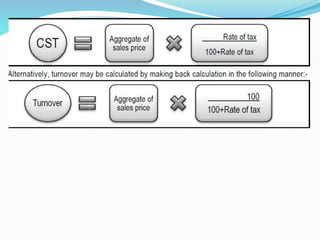

![Determination of Turnover

[Sec.8A]

Situation 1 …

When the Turnover or Sale is given

exclusive of CST, no adjustment shall be

made to the Turnover](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-122-320.jpg)

![Determination of Turnover

[Sec.8A]

Situation 2 …

If the Turnover / Sale is given inclusive of

CST, then the Taxable Turnover shall be

determined as …](https://image.slidesharecdn.com/cst-150924180009-lva1-app6892/85/Central-Sales-Tax-123-320.jpg)