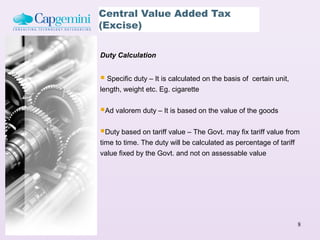

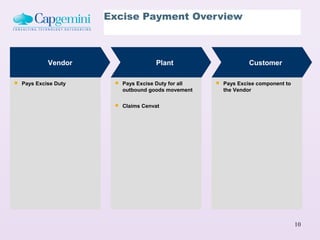

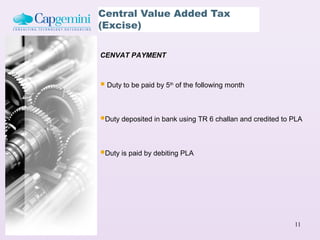

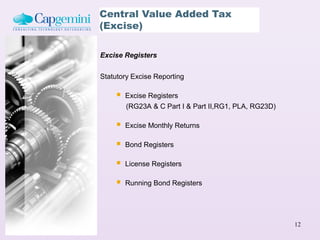

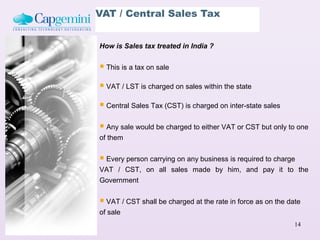

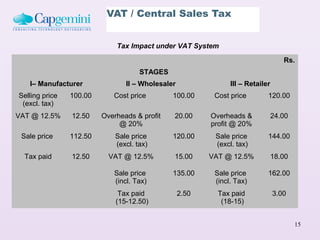

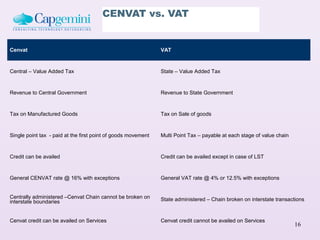

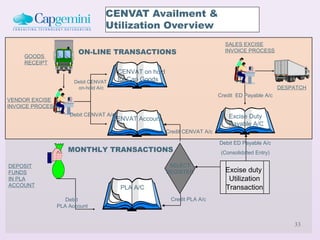

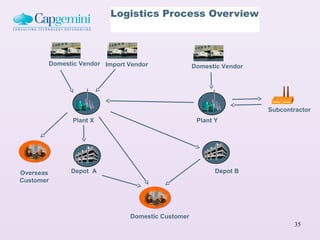

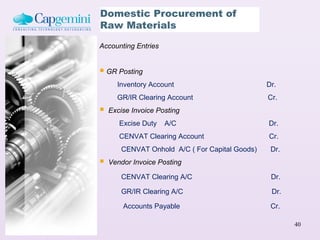

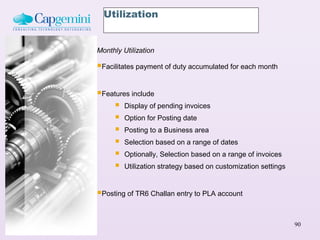

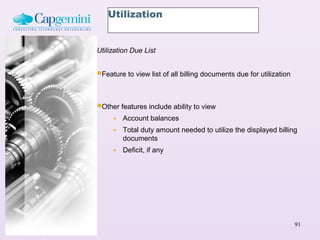

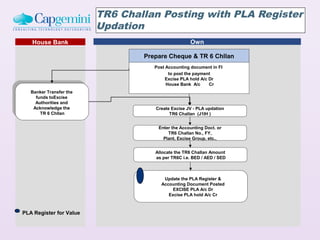

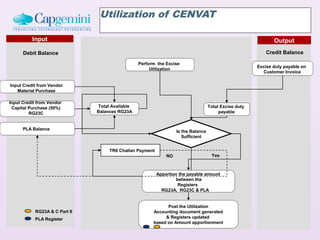

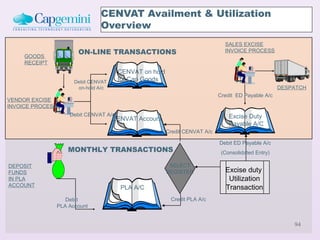

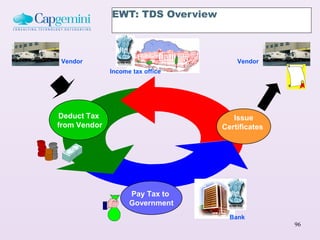

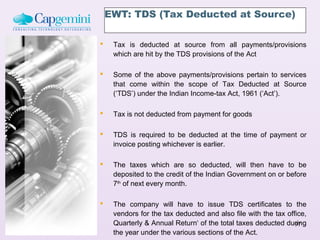

This document provides an overview of India's legal requirements for localization, including excise (CENVAT), VAT/LST/CST, service tax, and CENVAT credit. It discusses key aspects of each tax type such as applicable rates, payment due dates, eligibility criteria, and credit mechanisms. The document also compares CENVAT and VAT systems and outlines considerations for various tax compliance areas like duty calculation, export/import of services, and CENVAT credit on input services.