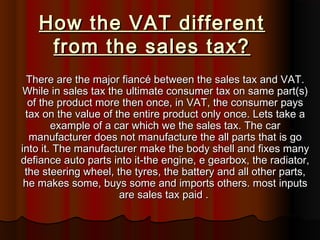

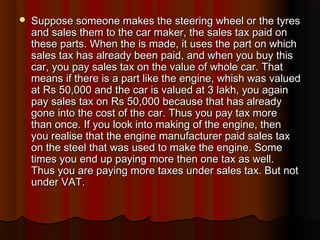

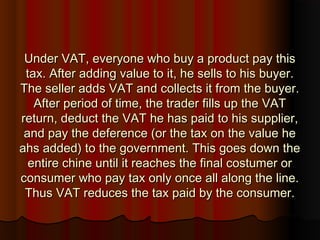

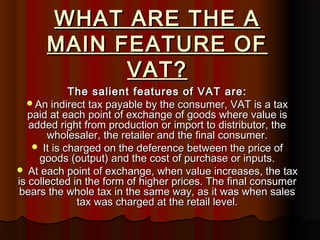

VAT (value added tax) is a simple, transparent tax collected on the sale of goods throughout the chain of production and distribution. It is intended to replace sales tax in India. VAT is calculated on the value added at each stage, allowing businesses to claim credits for VAT paid on inputs. This avoids taxing the same goods multiple times under sales tax. The key features of VAT include being paid by the consumer at each point of exchange where value is added, charging tax on the difference between output and input prices, and allowing self-assessment of tax through VAT returns.