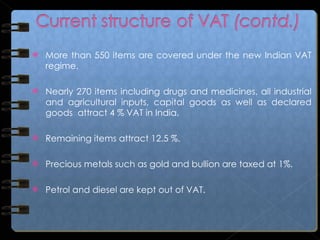

The document discusses Value Added Tax (VAT) in India. It is levied at each stage of production and distribution, with businesses able to claim credit for taxes paid on purchases. VAT aims to tax value addition at each stage, replacing sales tax. It is seen as more equitable and transparent than previous tax systems. Certain goods are exempted or taxed at special rates under VAT in India.