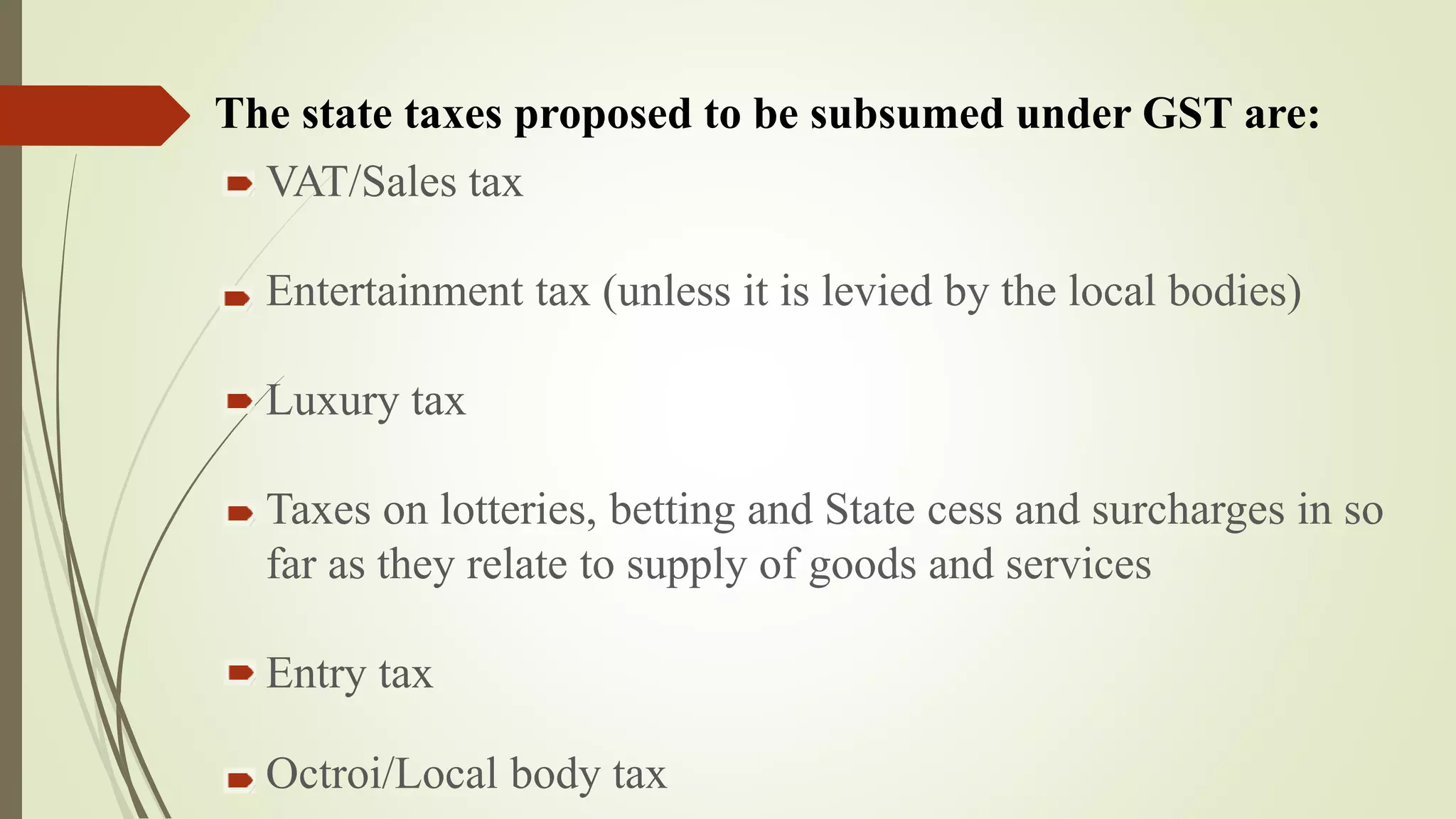

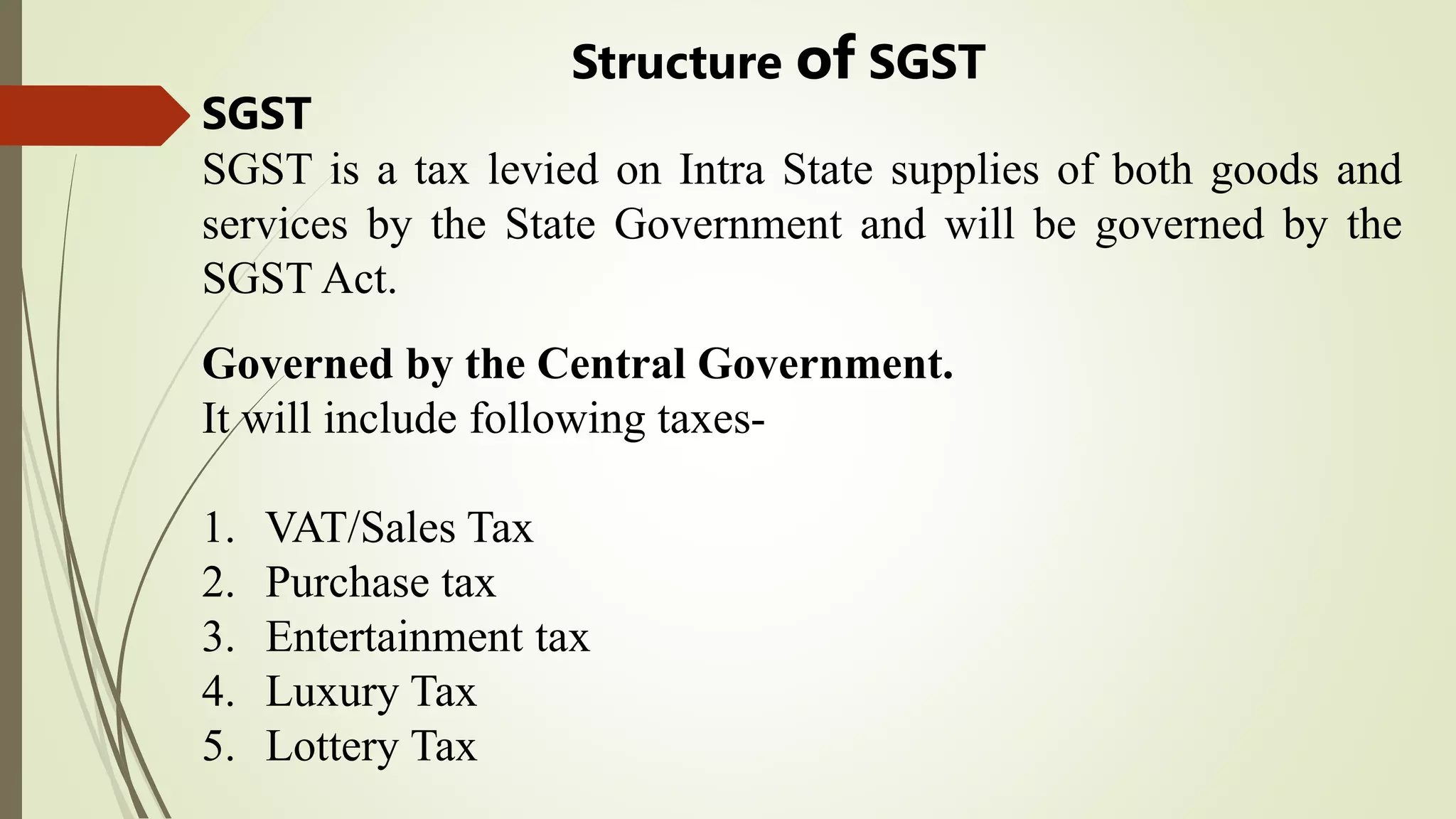

The Goods and Services Tax (GST) is a unified indirect tax system implemented in India to streamline taxation on goods and services from production to consumption. It introduces various tax slabs and encompasses multiple previous taxes under Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST). Additionally, the document discusses the composition scheme for small taxpayers, detailing eligibility, conditions, benefits, and process of opting in while noting the limitations of such a scheme.