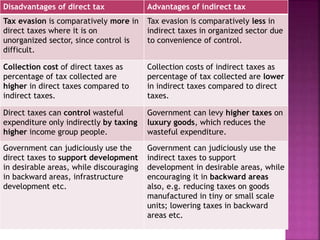

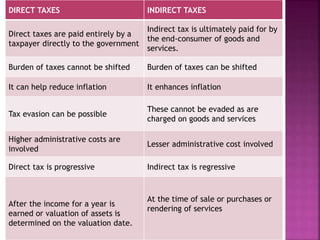

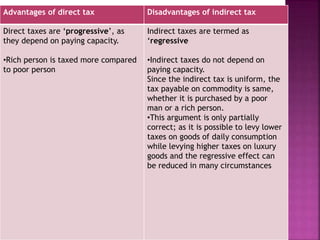

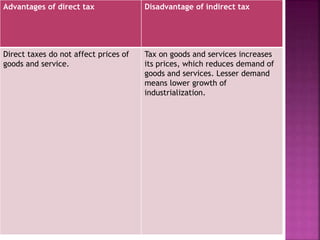

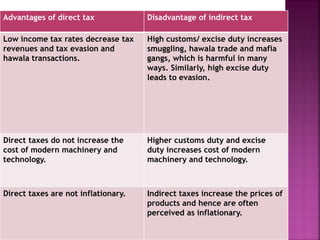

Direct taxes are paid directly to the government by taxpayers based on their income or assets. Indirect taxes are ultimately paid by consumers through higher prices of goods and services. Direct taxes are generally progressive, where higher incomes face higher tax rates, while indirect taxes are often regressive with the same tax rates regardless of income. Both direct and indirect taxes have advantages and disadvantages related to issues like tax evasion, prices, revenues, and economic impacts.

![Disadvantages of direct tax Advantages of indirect tax

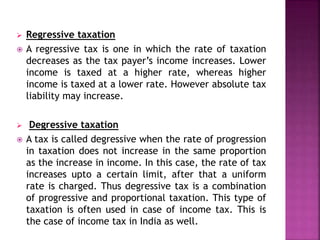

It is psychologically very difficult for a

person to pay some amount after it is

received in his hands. Hence, there is

psychological resistance .

•[This is the reason why even Income Tax

Act is widening the scope of “Tax

Deduction at Source’’ (TDS) and TCS.

Thus, a direct tax is converted to an

indirect tax].

Since the price of commodity or service is

already inclusive of indirect taxes, the

customer i.e. the ultimate tax payer does

not feel a direct pinch while paying

indirect taxes and hence, resistance to

indirect taxes is much less compared to

resistance to direct taxes.

•Manufacturer’s/ Dealer’s Psychology

favours indirect taxes- The

manufacturer/ trader

who collects the taxes in his Invoice and

pays it to Government, has a

psychological feeling that he is only

collecting the taxes and is not paying out

of his own pocket](https://image.slidesharecdn.com/dtvsit-190727075336/85/Direct-Tax-vs-Indirect-Tax-8-320.jpg)