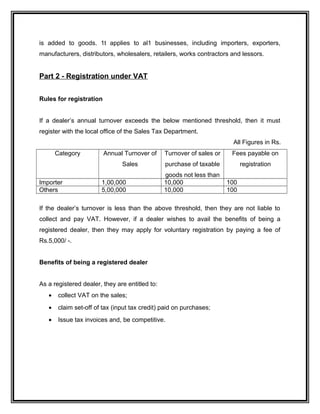

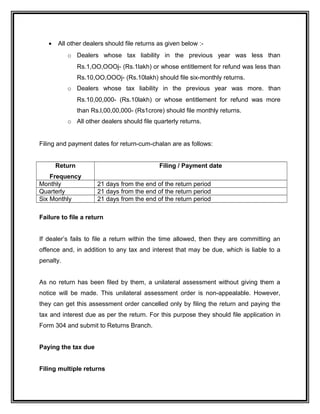

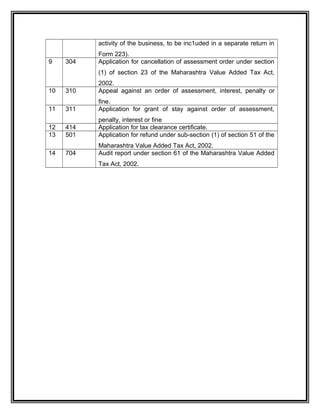

This document is a project report submitted by Miss Vanita Laxman Kajale to the N.E.S Ratnam College of Arts, Science & Commerce in partial fulfillment of the requirements for a Master's degree in Commerce. The report discusses Value Added Tax (VAT) implementation in the state of Maharashtra, India. It includes an introduction to VAT, details on VAT registration, calculation of tax liability, filing returns and payment procedures, record keeping requirements, and appeals processes in Maharashtra. The project was guided and reviewed by the lecturer Prof. Rajiv Mishra.