This document provides an overview of value added tax (VAT) including:

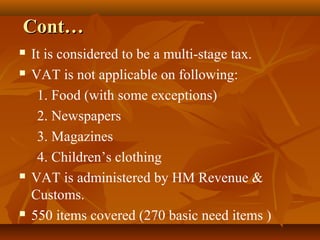

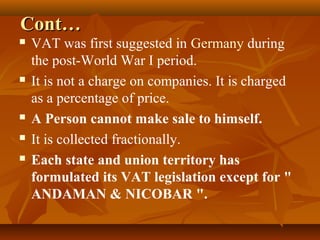

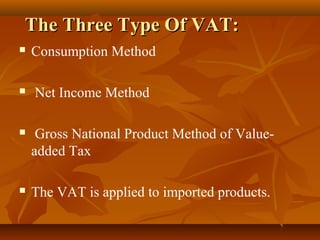

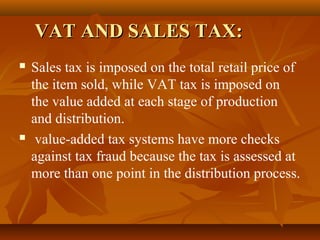

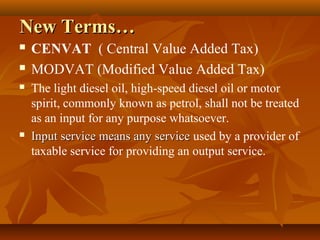

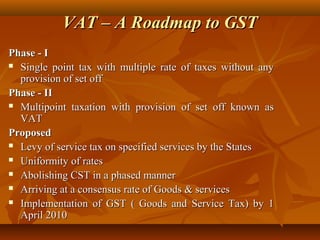

1. VAT is an indirect tax assessed on the value added to goods and services at each stage of production and distribution. Over 130 countries have introduced VAT.

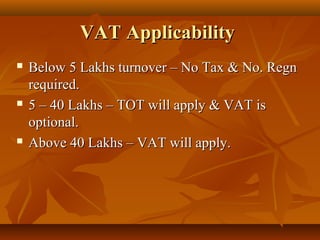

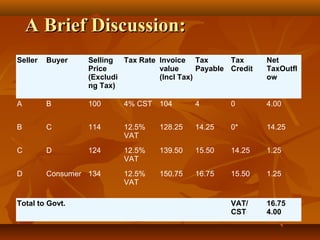

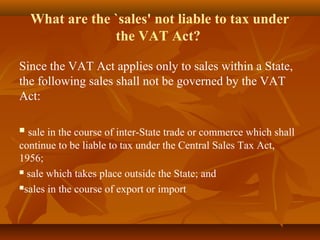

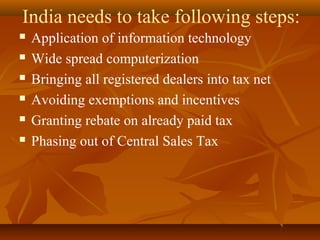

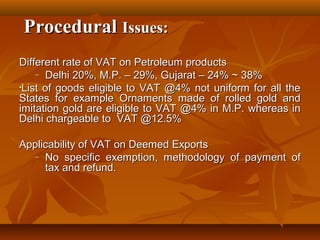

2. VAT was introduced in India in 2005 and is administered by the government revenue authority. It is a multi-stage tax collected fractionally at each stage of production/distribution.

3. Advantages of VAT include increased tax base and revenue, transparency, avoidance of double taxation, coordination with income tax, and simplification compared to other tax systems.