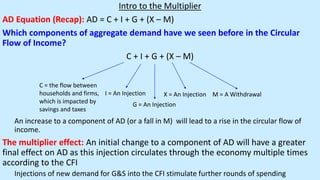

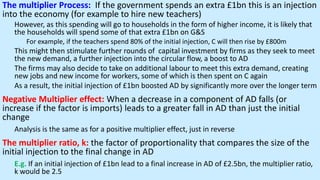

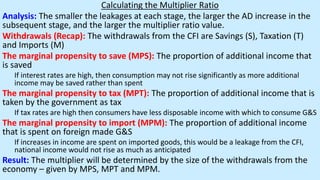

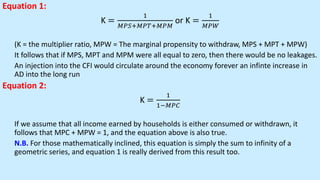

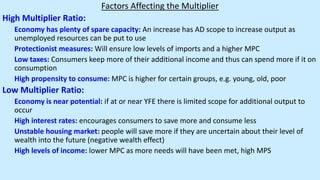

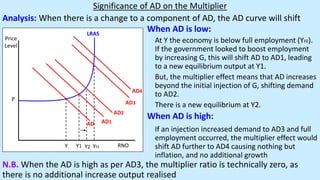

The document provides an overview of the multiplier effect in the context of national income and aggregate demand, highlighting how initial changes in spending can lead to greater overall economic impacts through multiple rounds of circulation. It explains key concepts such as marginal propensity to save, tax, and import, which influence the size of the multiplier ratio. Additionally, the document discusses factors that can affect the multiplier's efficacy, including economic capacity, taxes, and consumer behavior.