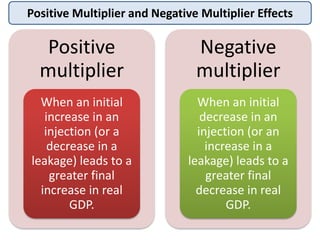

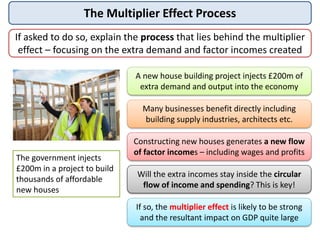

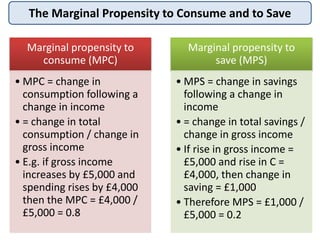

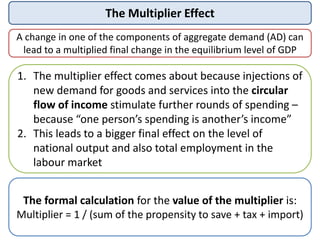

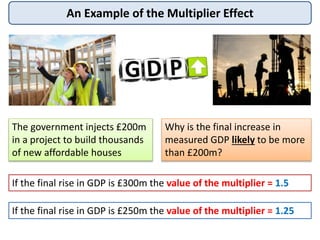

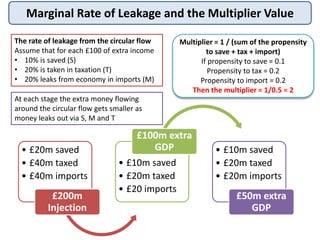

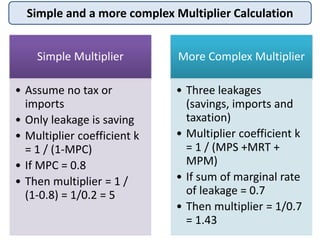

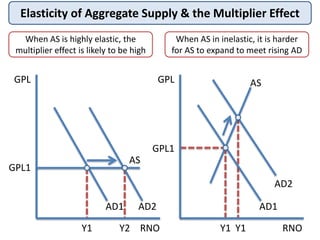

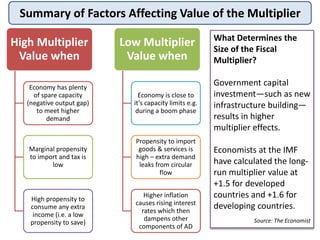

The multiplier effect occurs when an initial injection of spending, such as government spending on a new infrastructure project, leads to a greater total increase in real GDP through multiple rounds of spending. The size of the multiplier effect depends on factors like the marginal propensity to consume, marginal propensity to save, marginal propensity to import, and how elastic the aggregate supply is. A higher propensity to consume and a lower propensity to save and import leads to a larger multiplier. The multiplier is calculated as 1 divided by the sum of the marginal propensities.