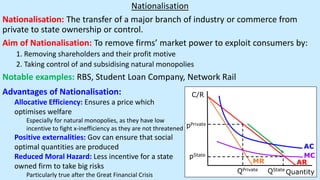

Nationalisation is the transfer of key industries from private to state control aimed at reducing market power and ensuring consumer welfare by eliminating profit motives. While it can lead to allocative efficiency and reduced moral hazard, it also risks x-inefficiency, limited innovation, and high government costs. The success of nationalisation depends on public support, acquisition costs, and the efficiency of the existing business.