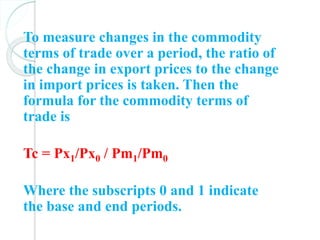

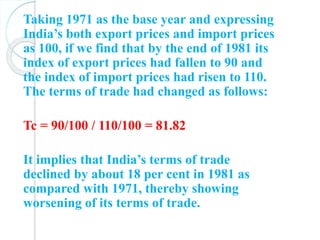

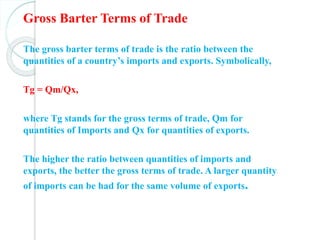

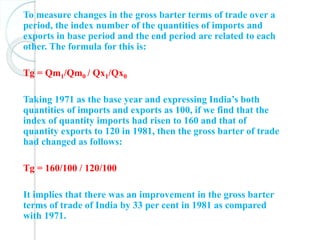

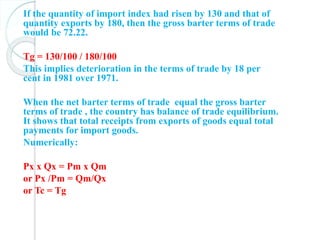

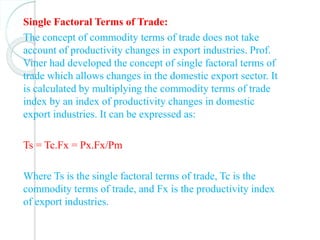

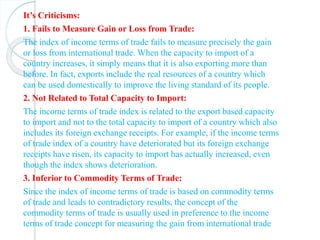

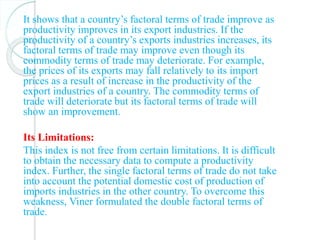

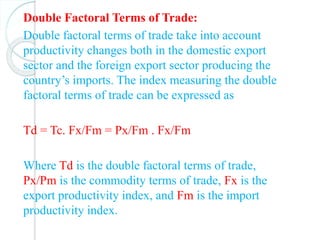

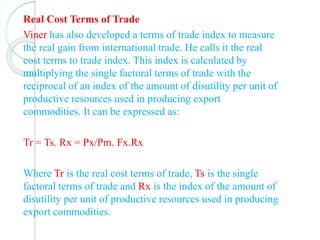

This document defines and compares different types of terms of trade, including commodity terms of trade, gross barter terms of trade, income terms of trade, single factoral terms of trade, and double factoral terms of trade. It provides formulas for calculating each type and examples to demonstrate how they are used. It also discusses the limitations and criticisms of each approach.