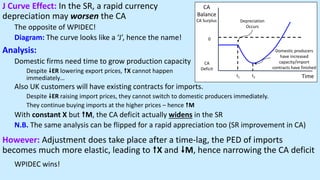

The document discusses the factors influencing the current account balance of payments, which records all transactions between a country and the rest of the world, focusing on aspects such as exchange rates, price competitiveness, and the impacts of current account deficits on macroeconomic objectives like unemployment and growth. It outlines various economic theories, such as the Marshall-Lerner condition and the J-curve effect, explaining how domestic and international market dynamics affect trade balances. Additionally, it highlights the implications of funding current account deficits and situations where deficits might not indicate economic trouble, such as foreign direct investment or a rapidly growing economy.