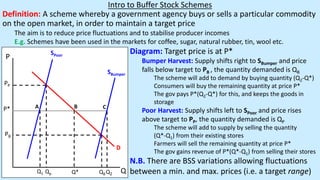

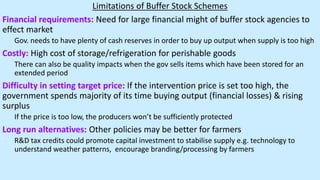

Buffer stock schemes aim to reduce price fluctuations and stabilize producer incomes by having a government agency buy or sell a commodity to maintain a target price. When supply is high and prices fall below the target, the agency adds to demand by purchasing the excess quantity. When supply is low and prices rise above the target, the agency adds to supply by selling from its stockpile. However, buffer stock schemes require large financial resources to implement and store commodities, have high costs, and setting the correct target price that benefits both consumers and producers can be difficult. Alternative long-run policies for farmers include research and development tax credits.