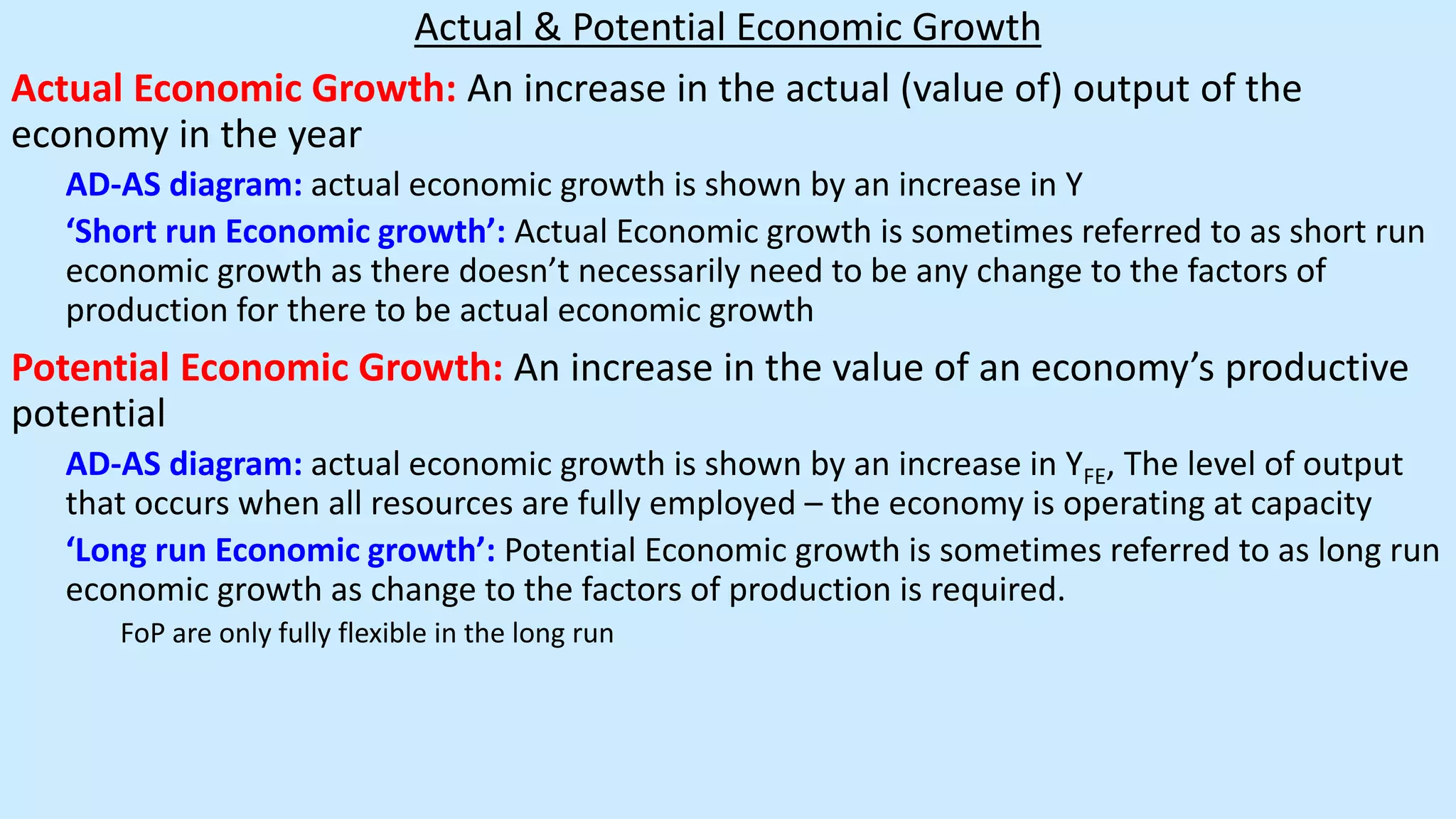

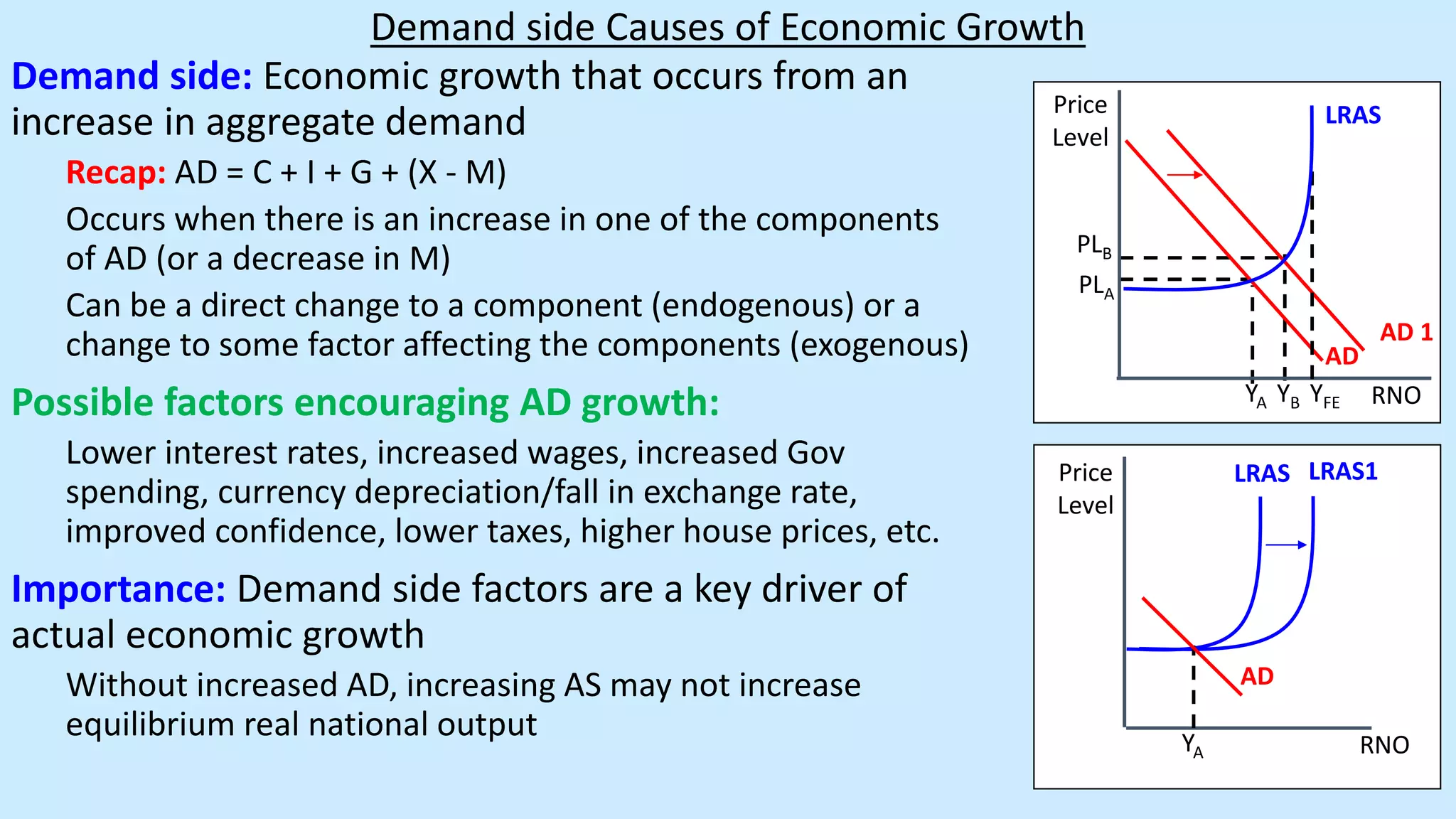

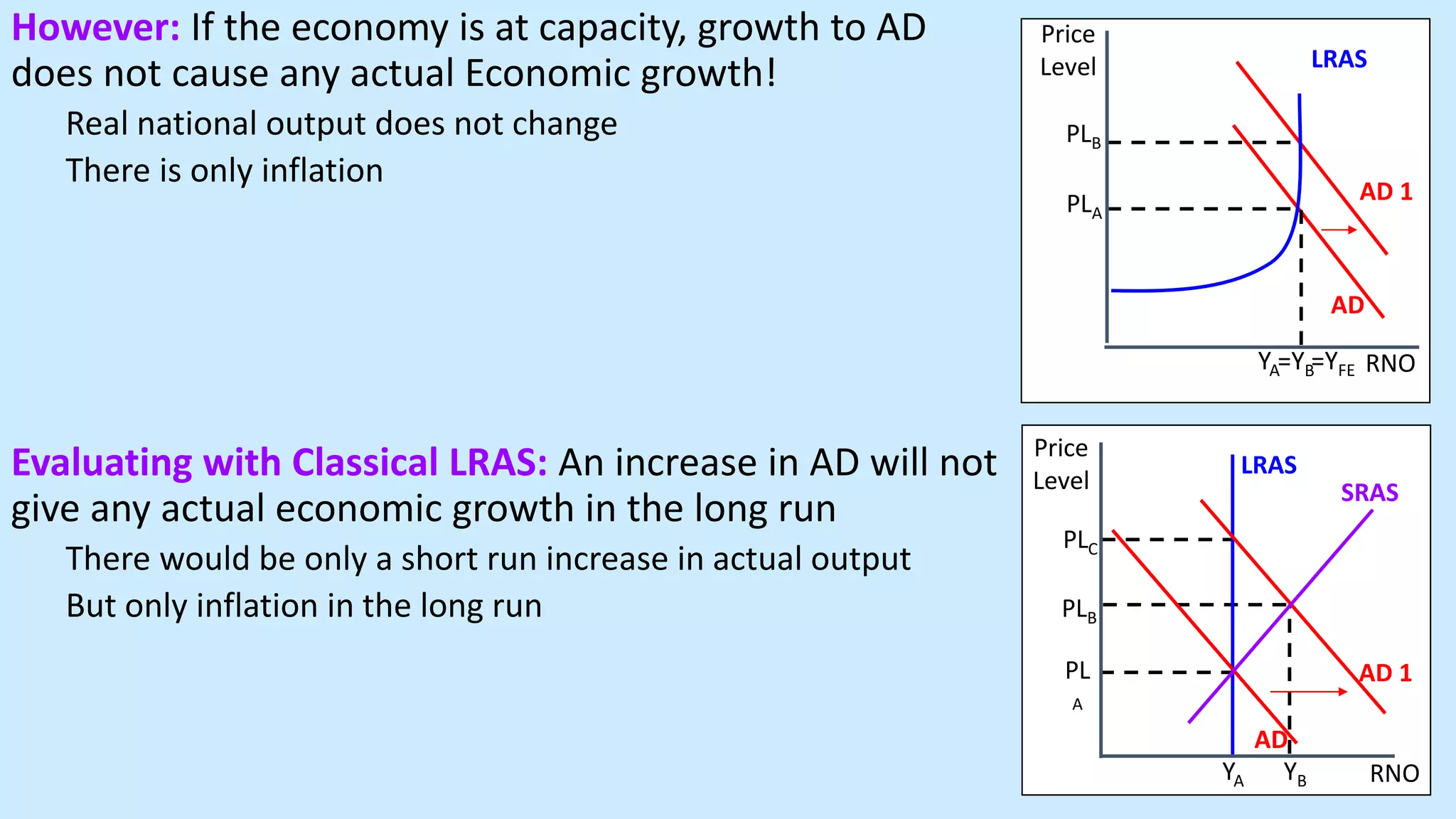

The document discusses economic growth, differentiating between actual and potential growth, with actual growth resulting from increased aggregate demand while potential growth requires improvements in the factors of production. It highlights demand-side and supply-side causes of growth, constraints on growth due to factors like poor capital markets and labor shortages, and the concept of export-led growth. Additionally, the document outlines the benefits and drawbacks of export-led growth, including potential over-dependence on global markets and inflation concerns.