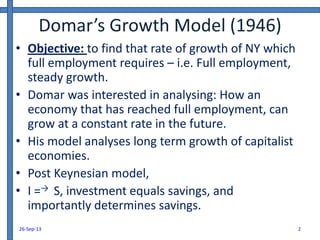

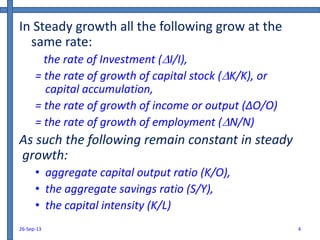

Domar's growth model from 1946 analyzes how a capitalist economy can grow at a constant rate after reaching full employment. It assumes aggregate supply equals aggregate demand during steady growth. The model shows that for steady growth, the rates of investment, capital stock growth, output growth, and employment growth must all be equal. It derives the equation that the growth rate equals the savings ratio multiplied by the incremental output-capital ratio. Investment has dual effects of increasing both aggregate demand and productive capacity in the long-run.