This document provides an overview of simple and multiple linear regression analysis. It discusses key concepts such as:

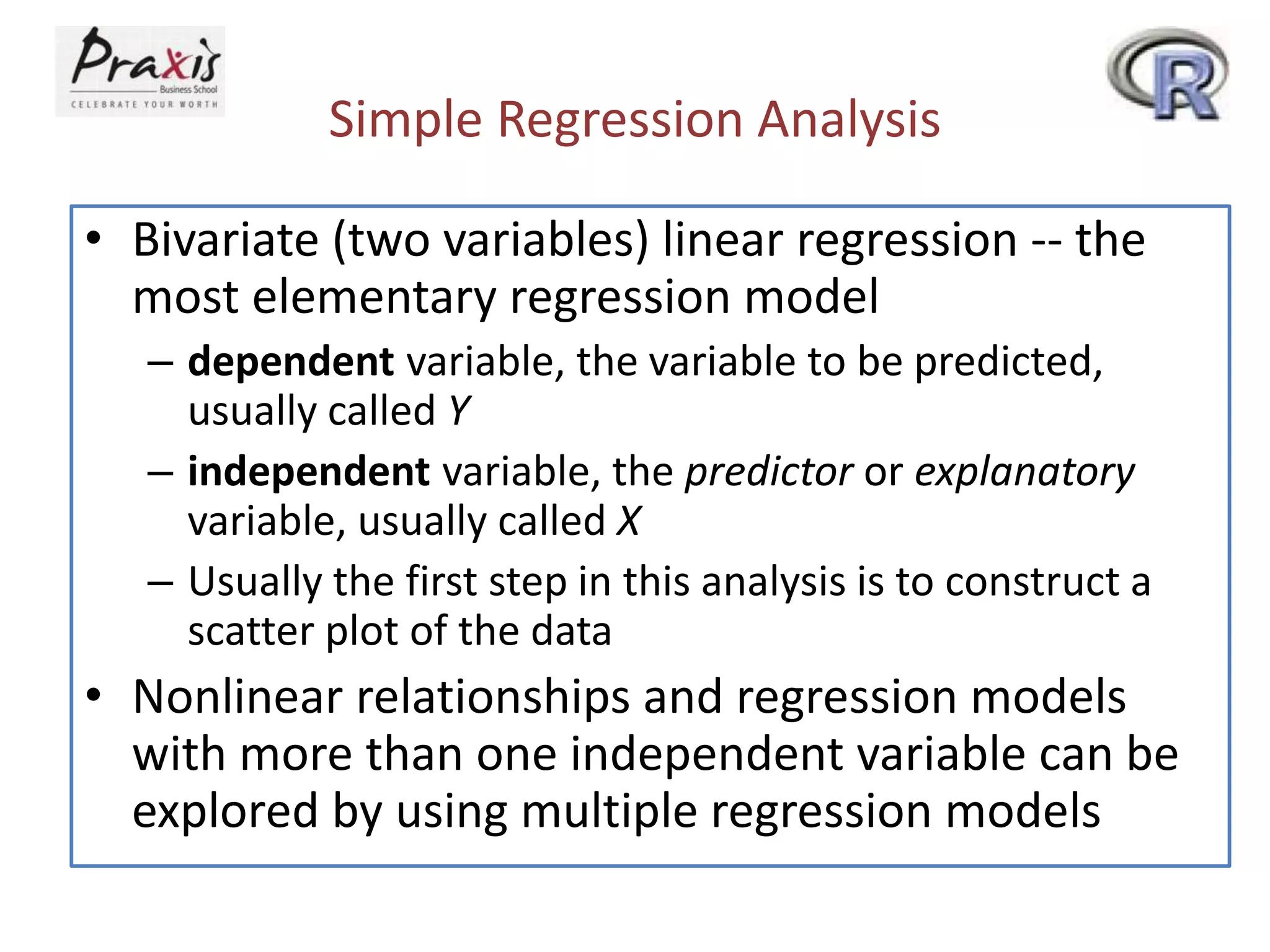

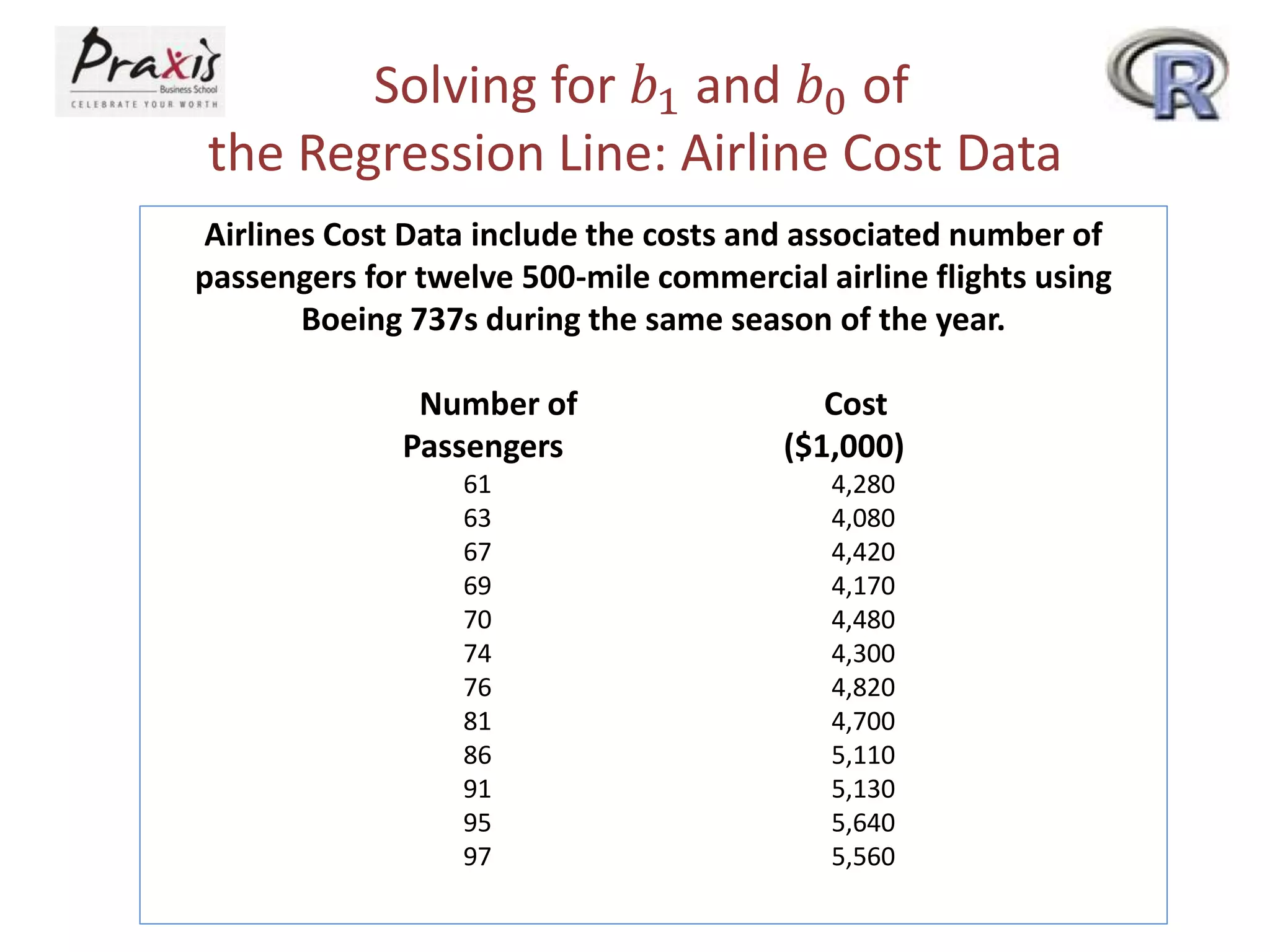

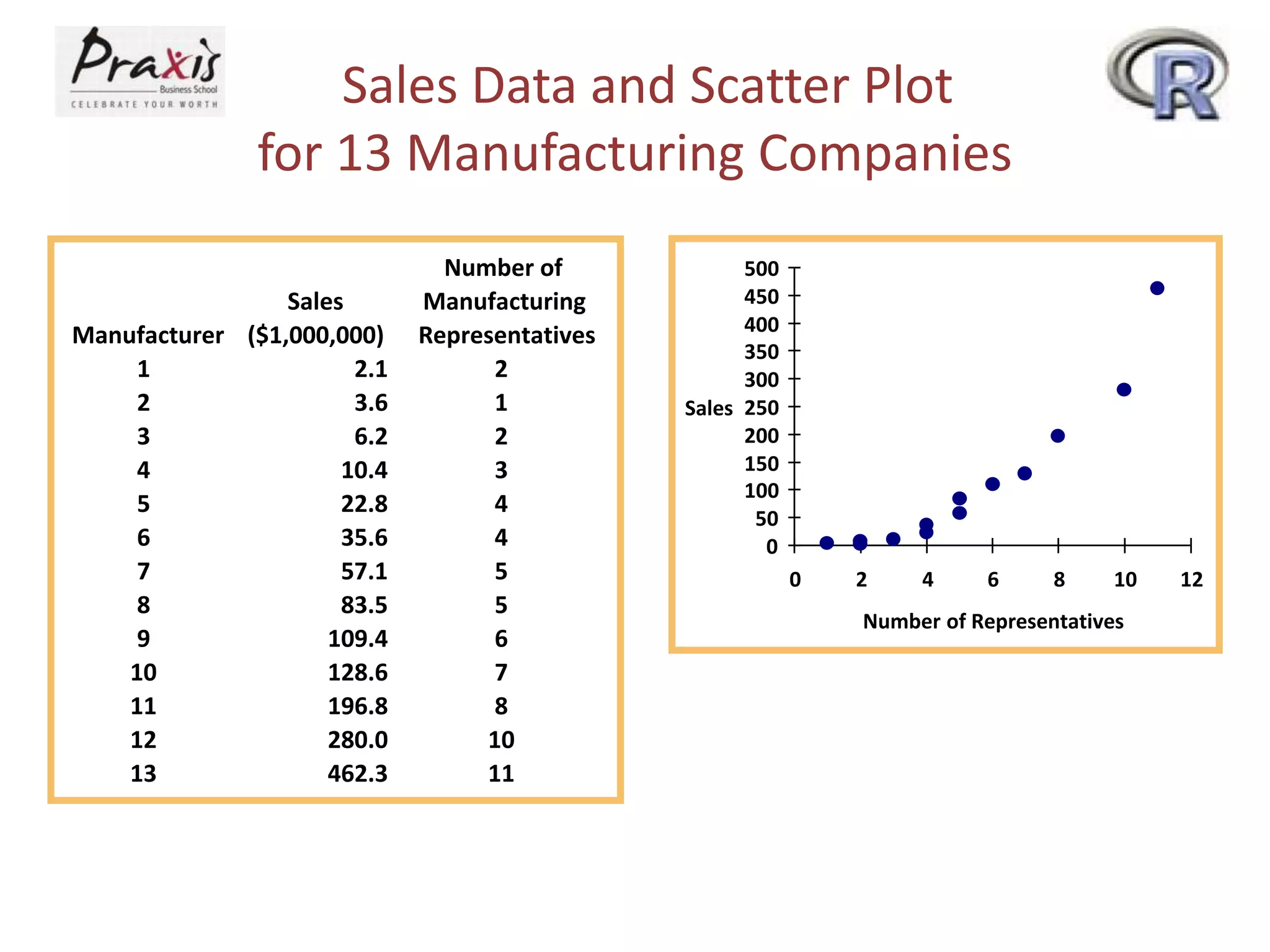

- Dependent and independent variables in bivariate linear regression

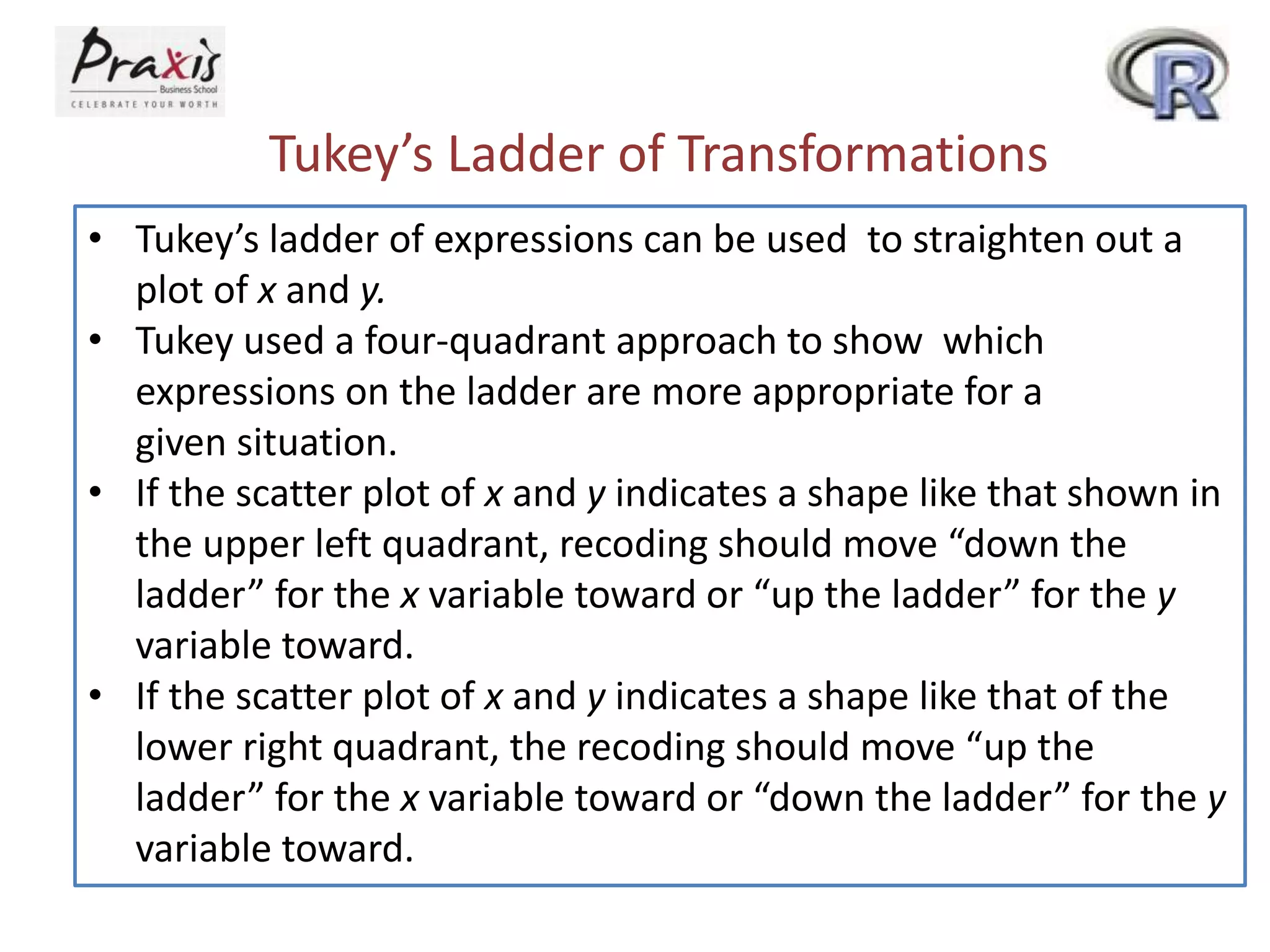

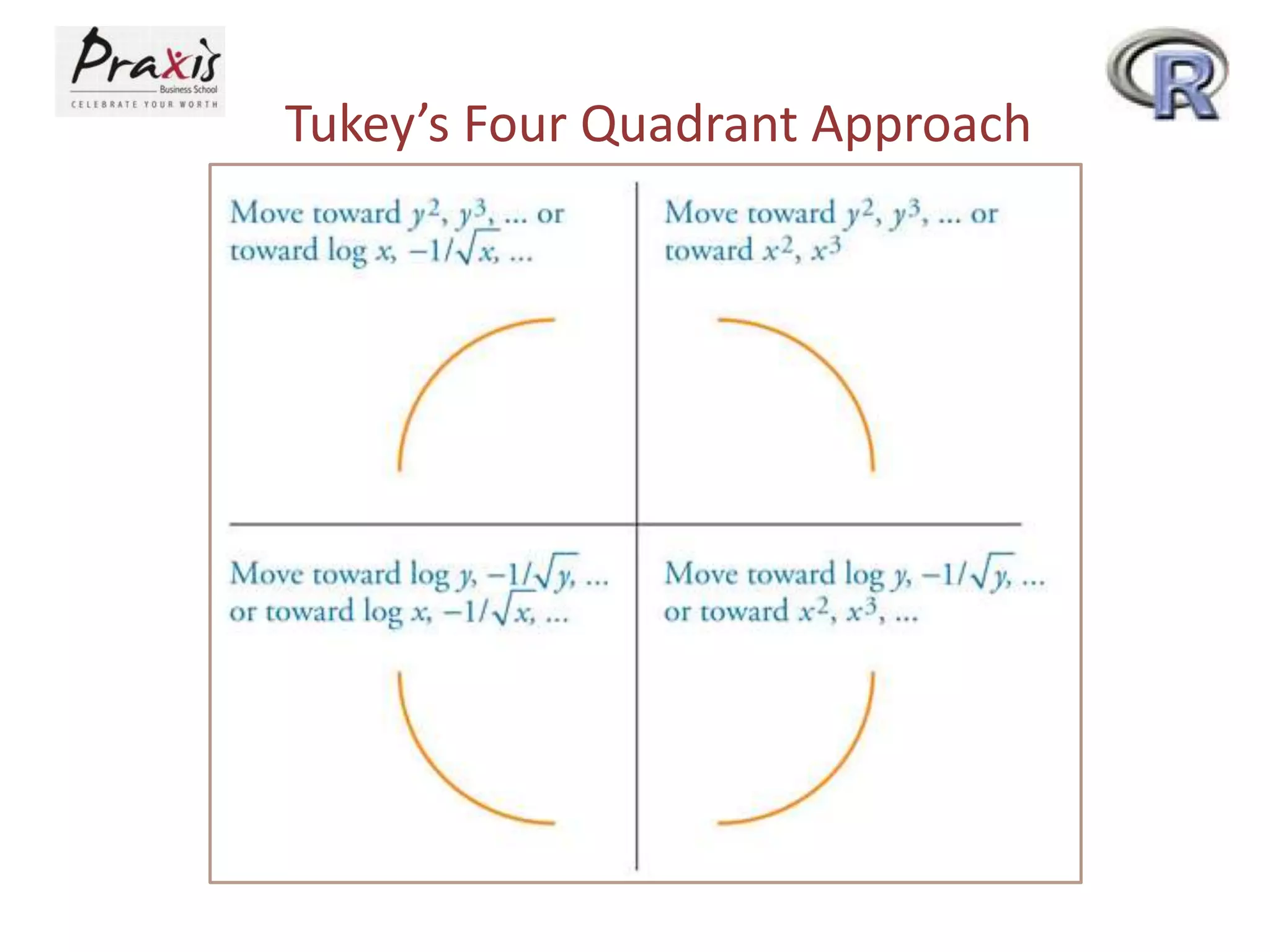

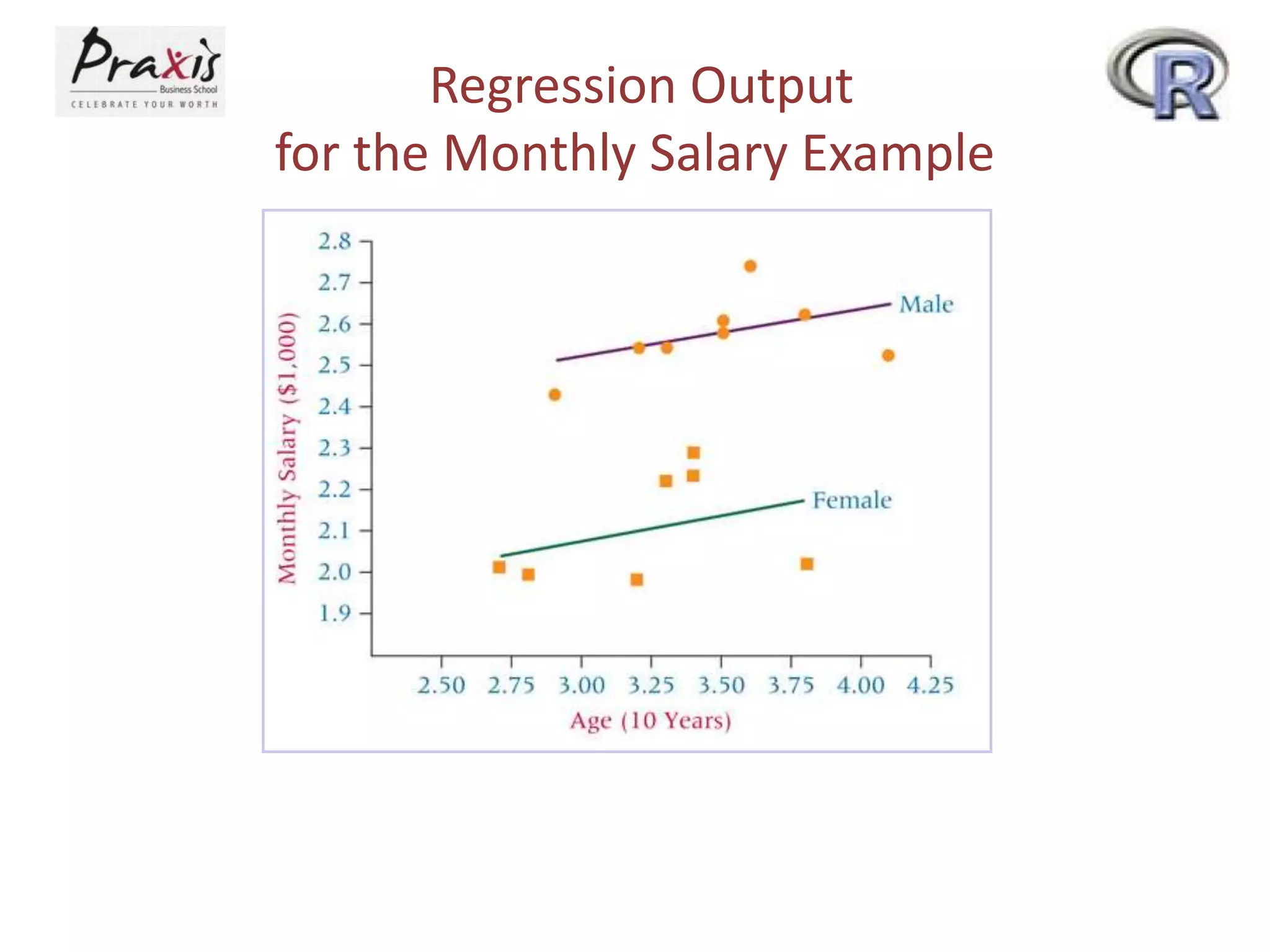

- Using scatter plots to explore relationships

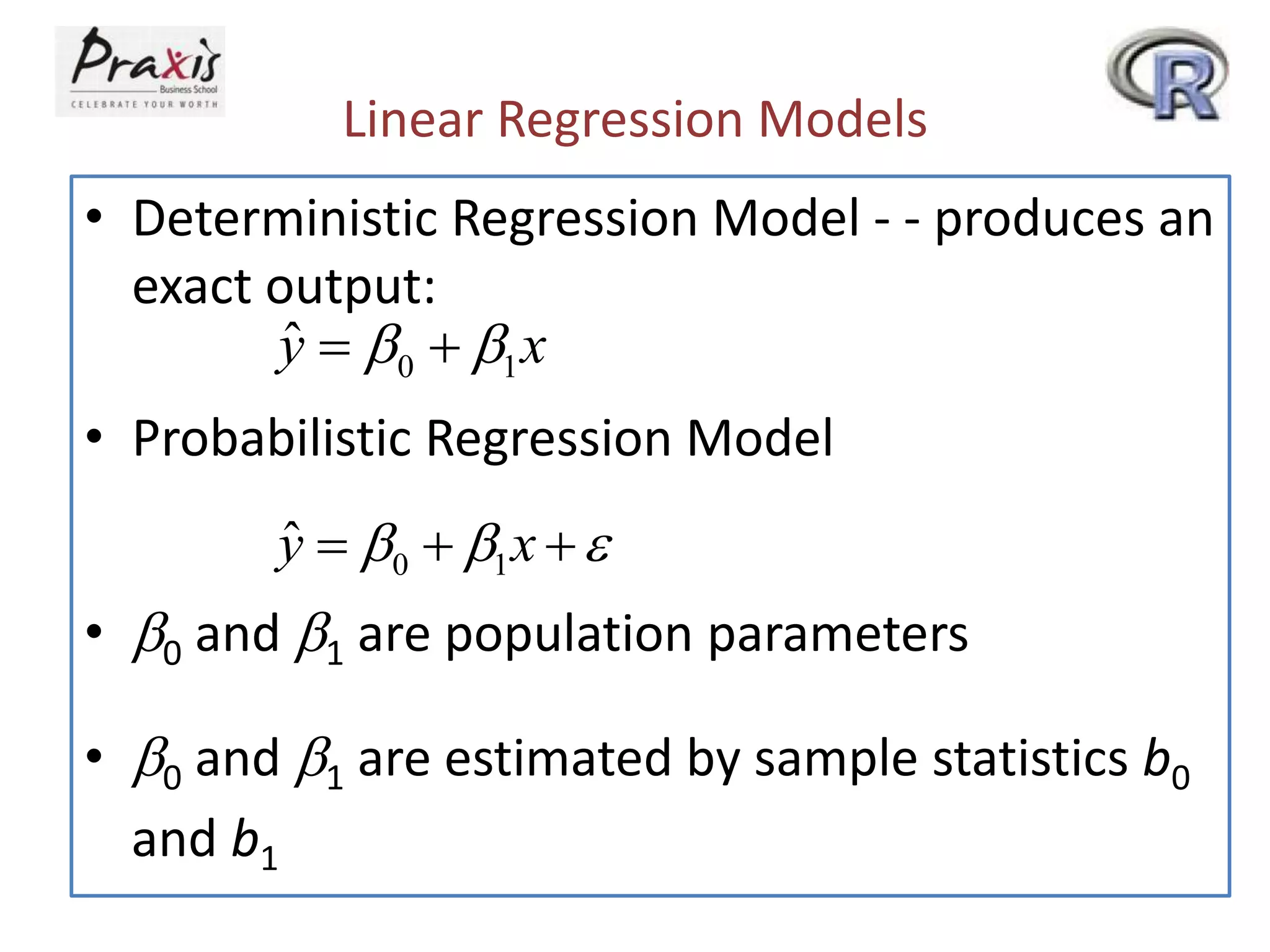

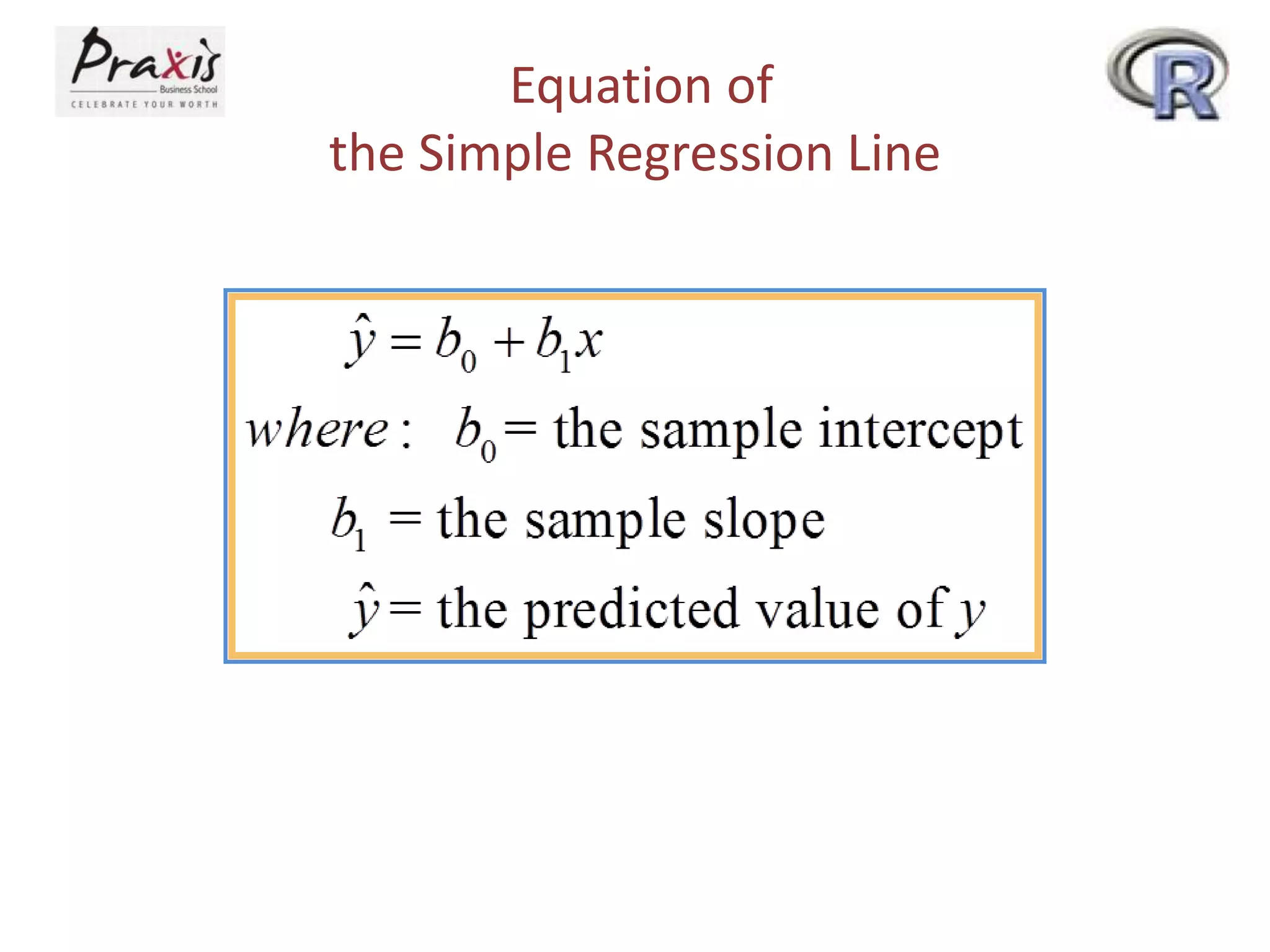

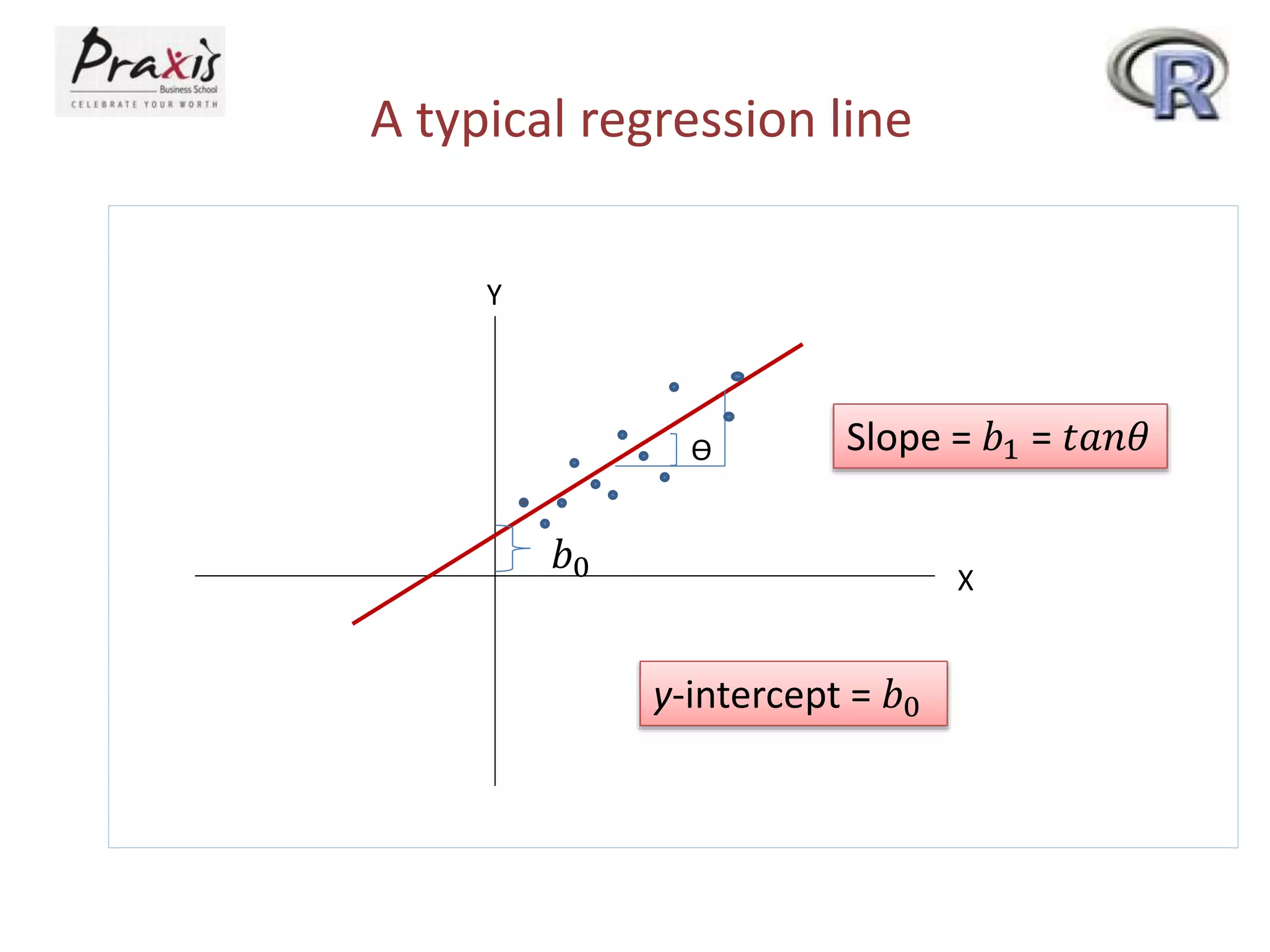

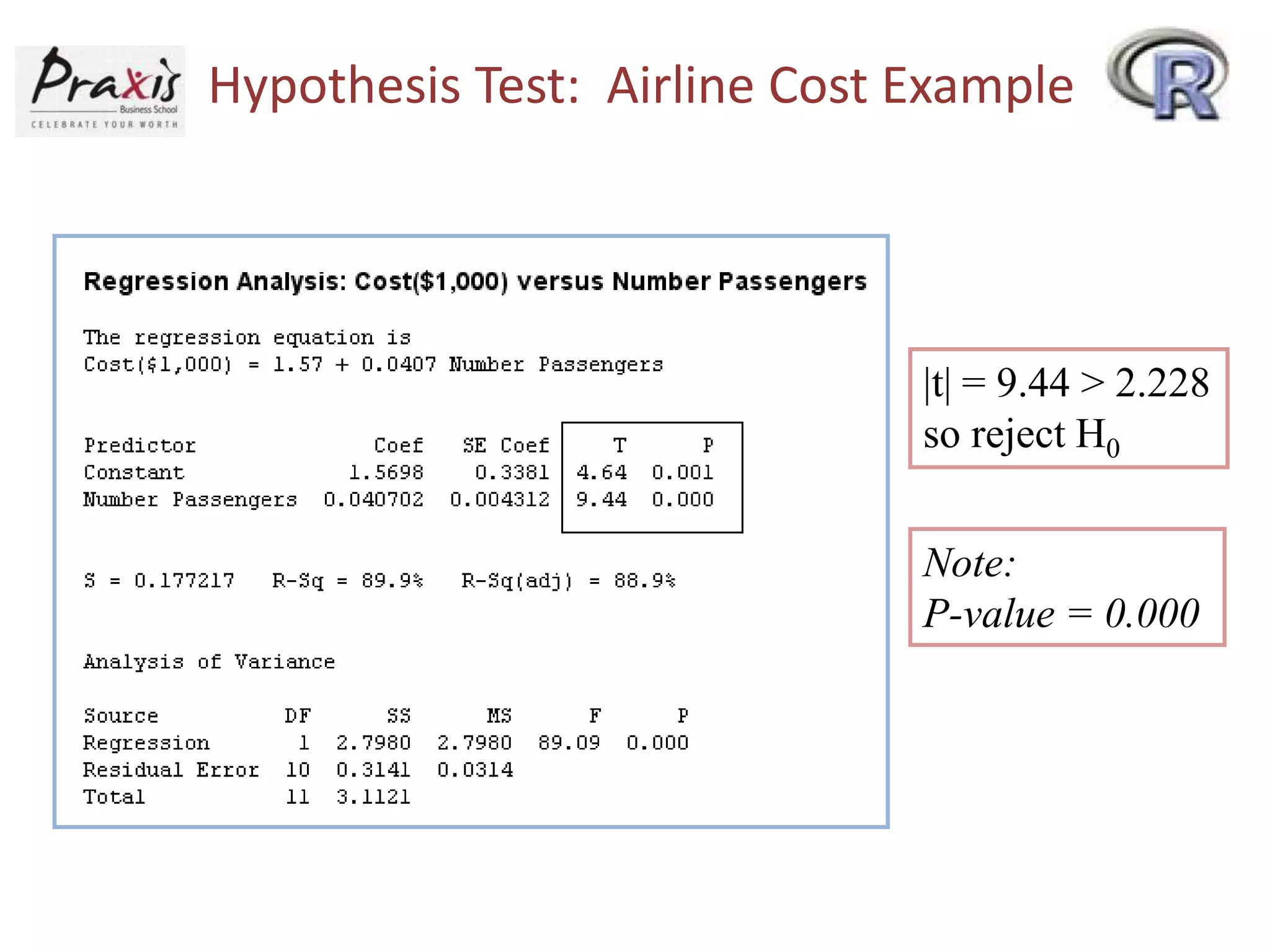

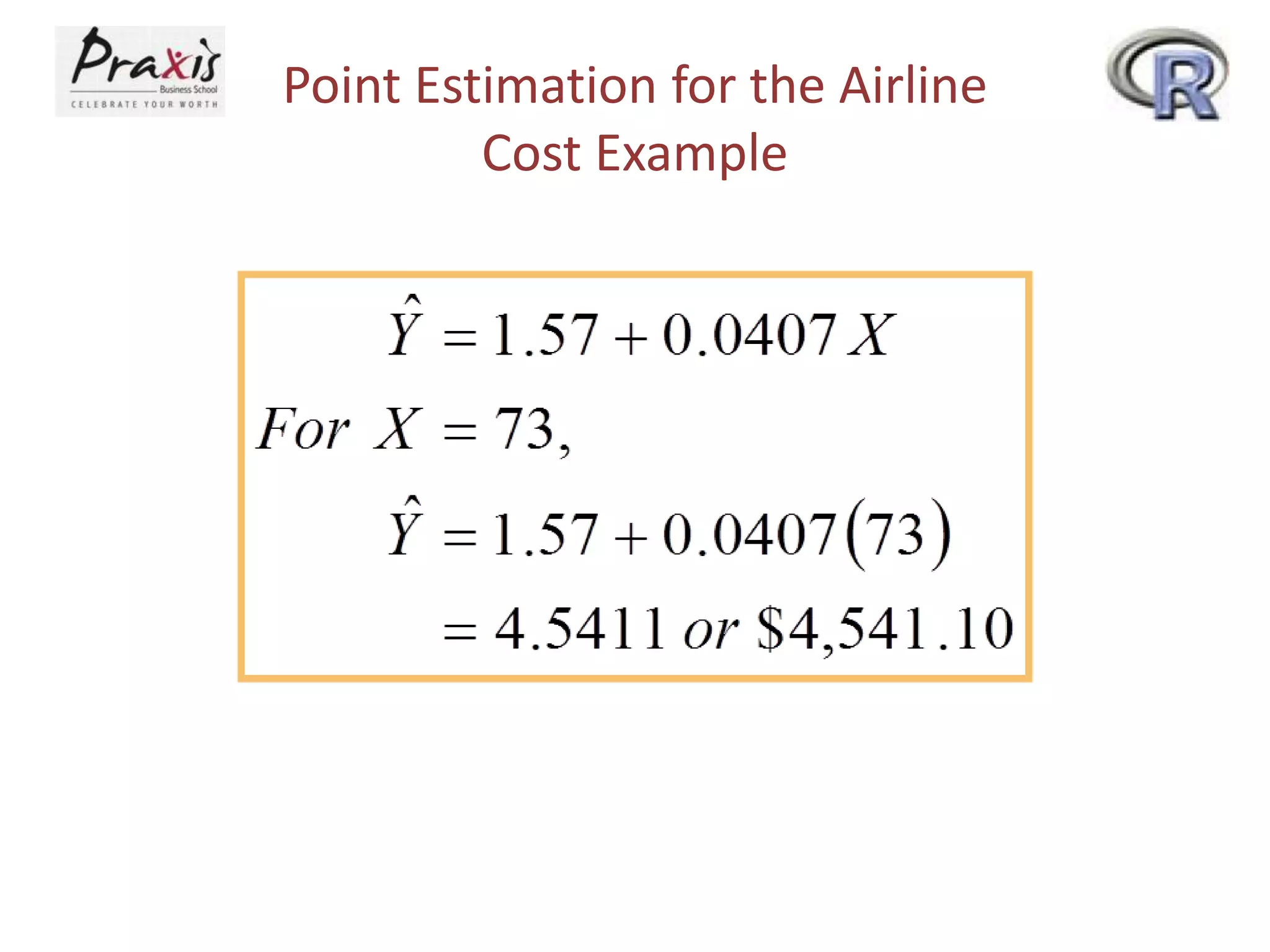

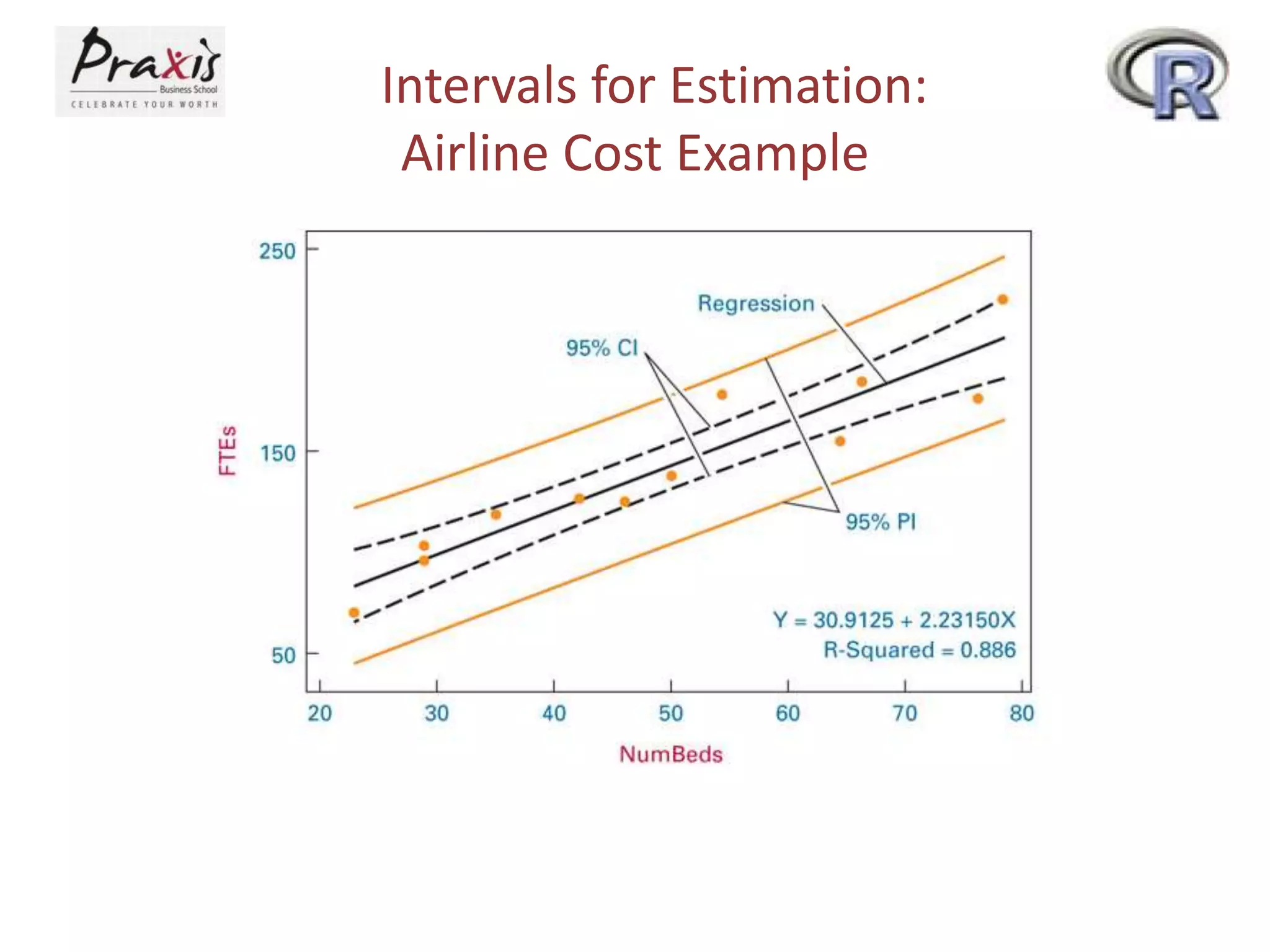

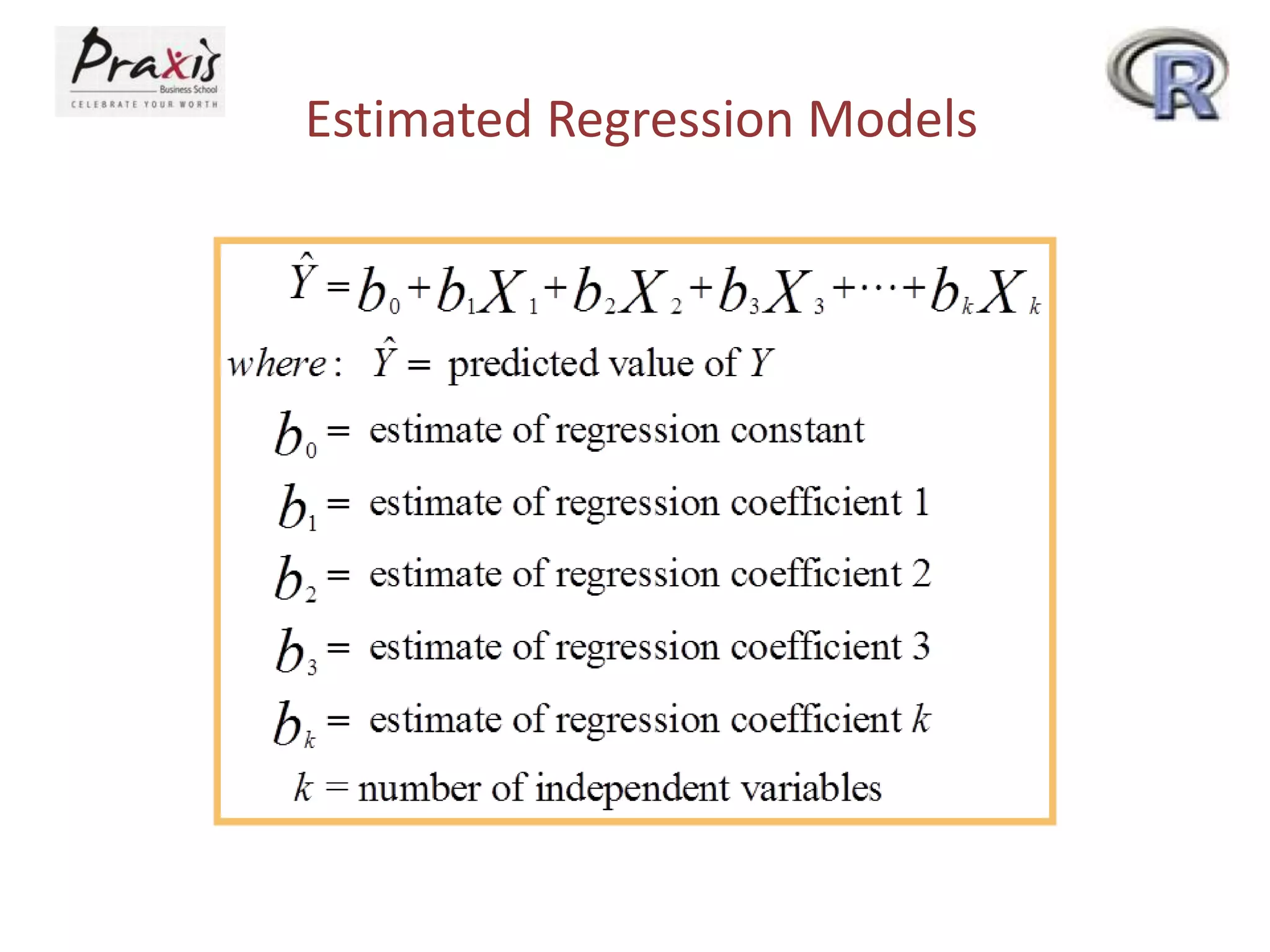

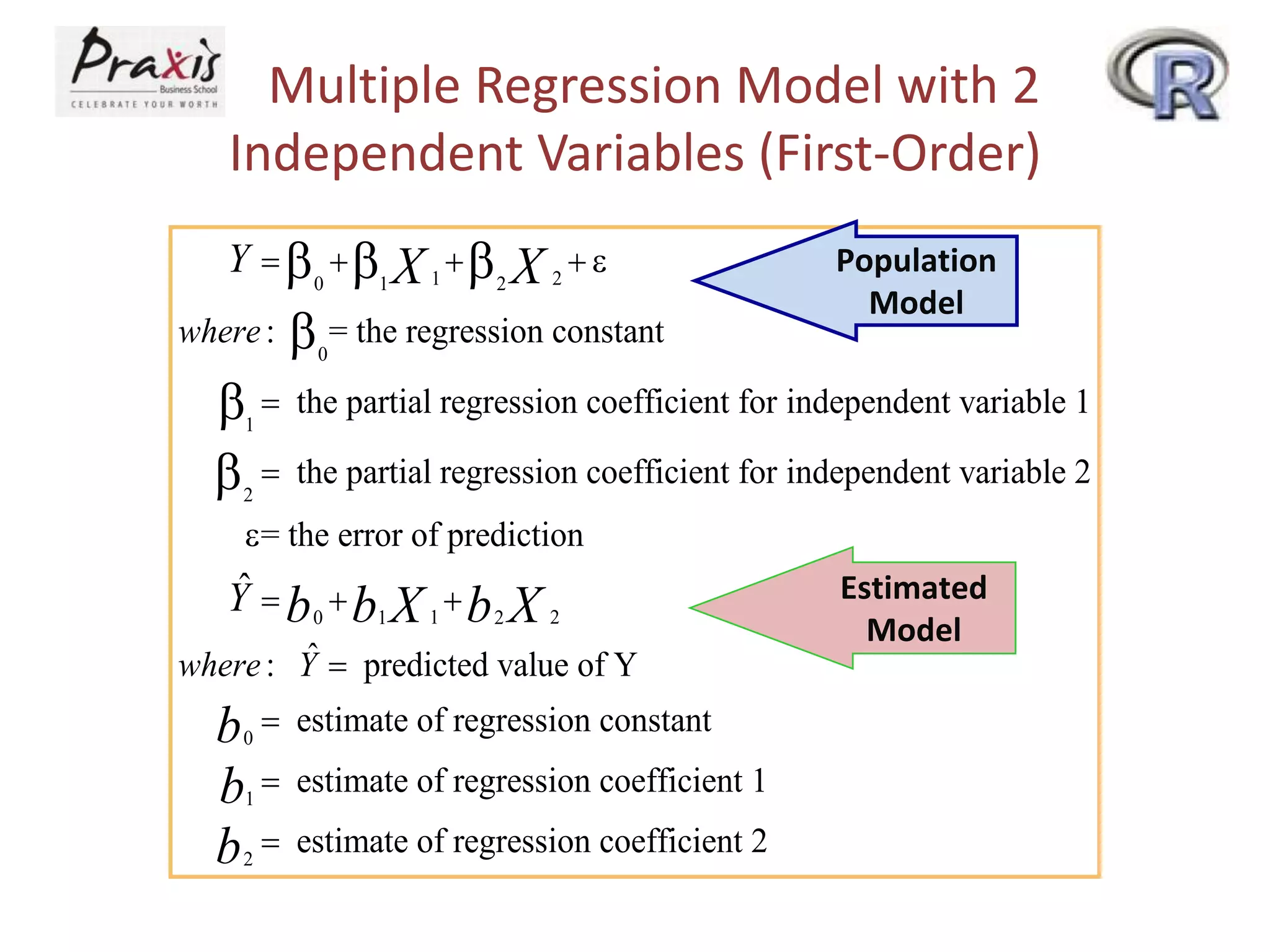

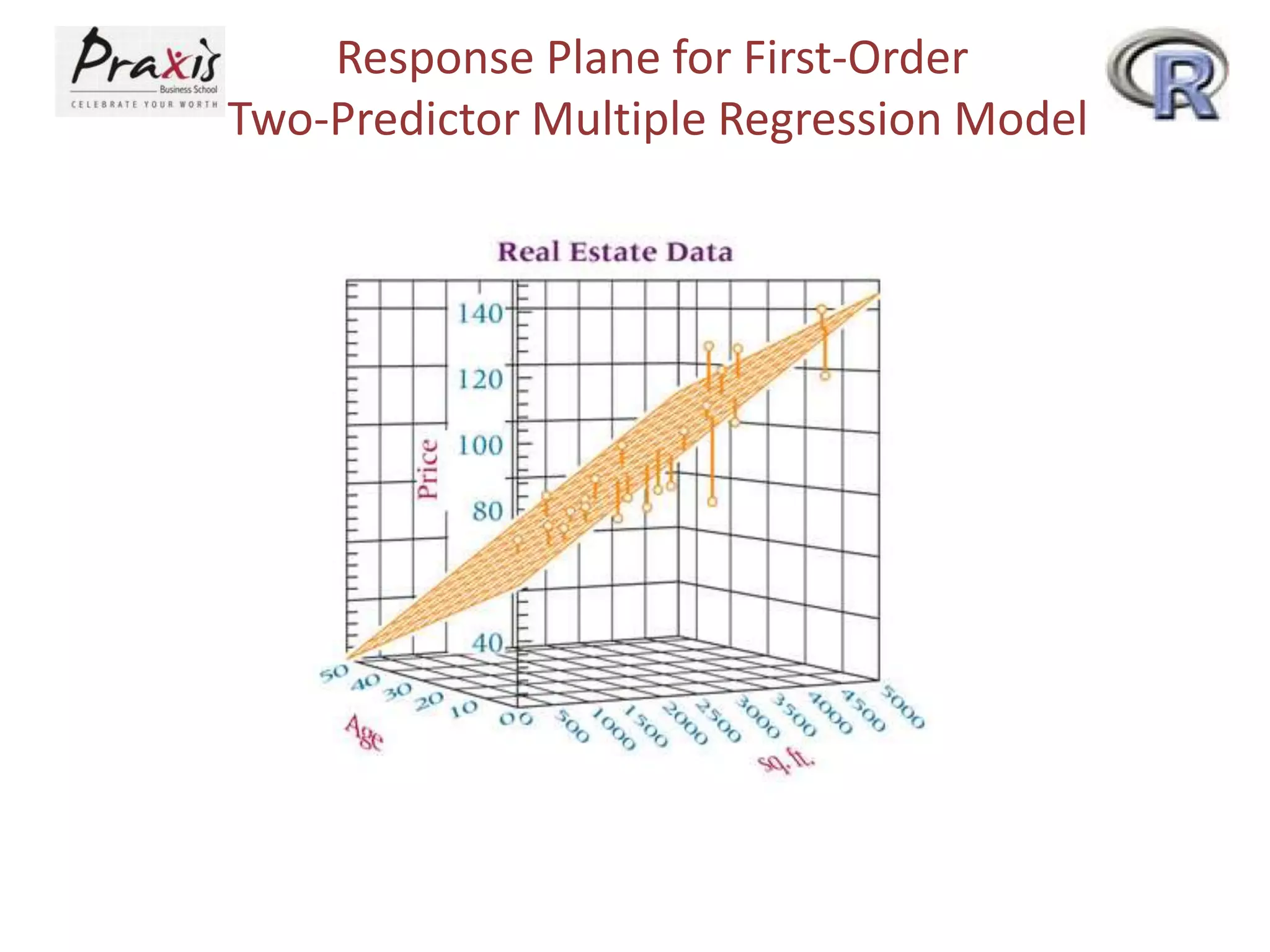

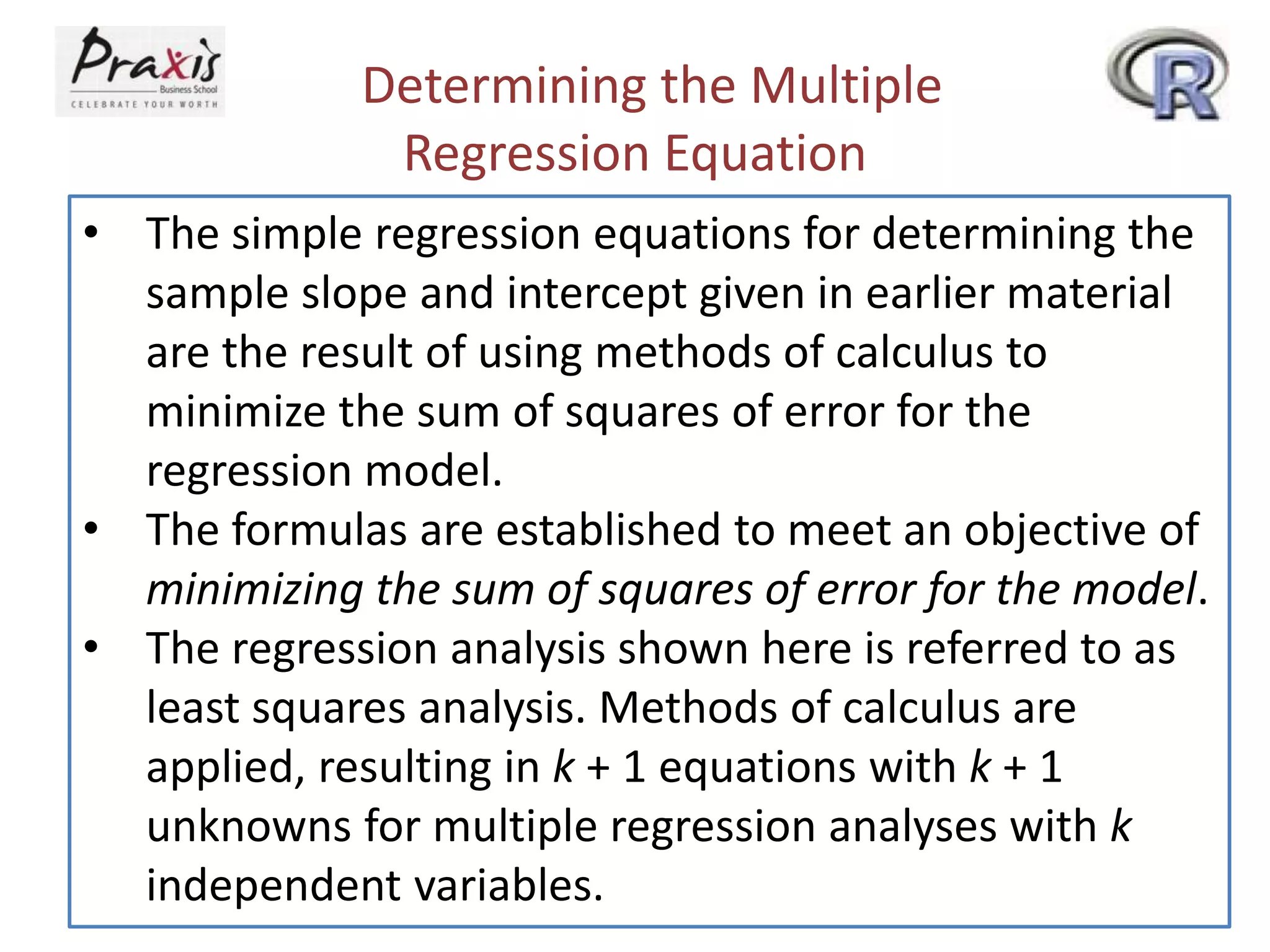

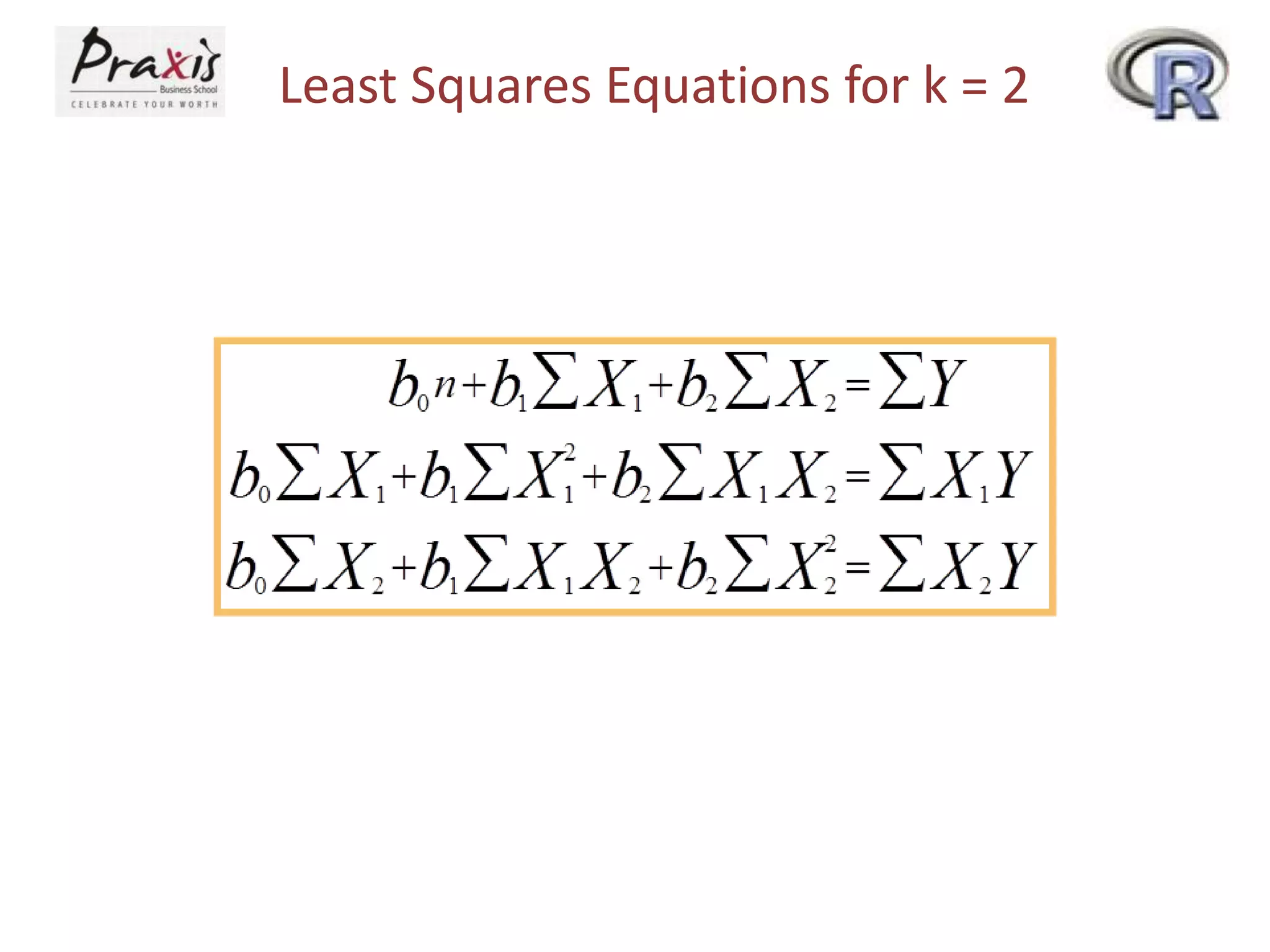

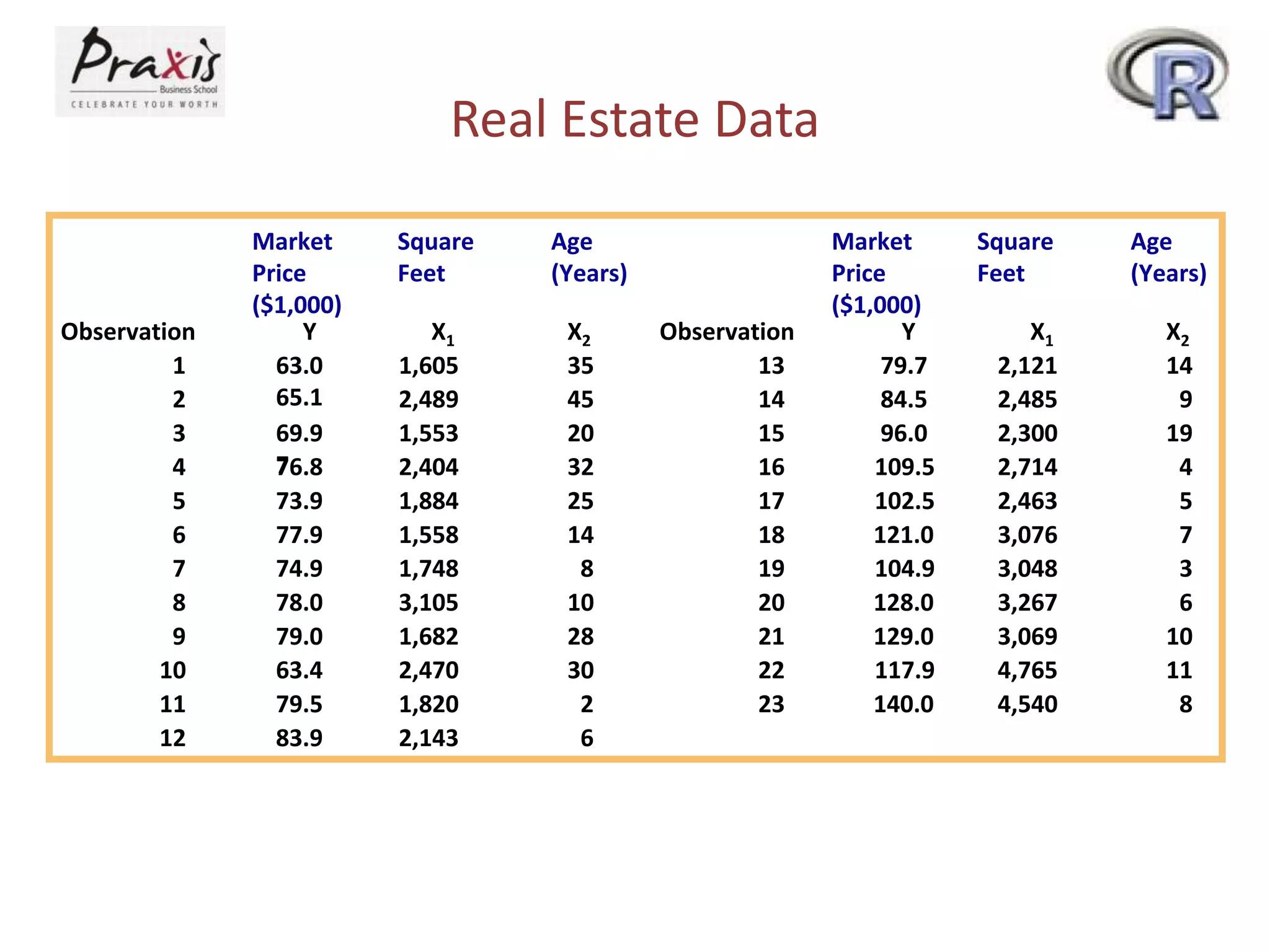

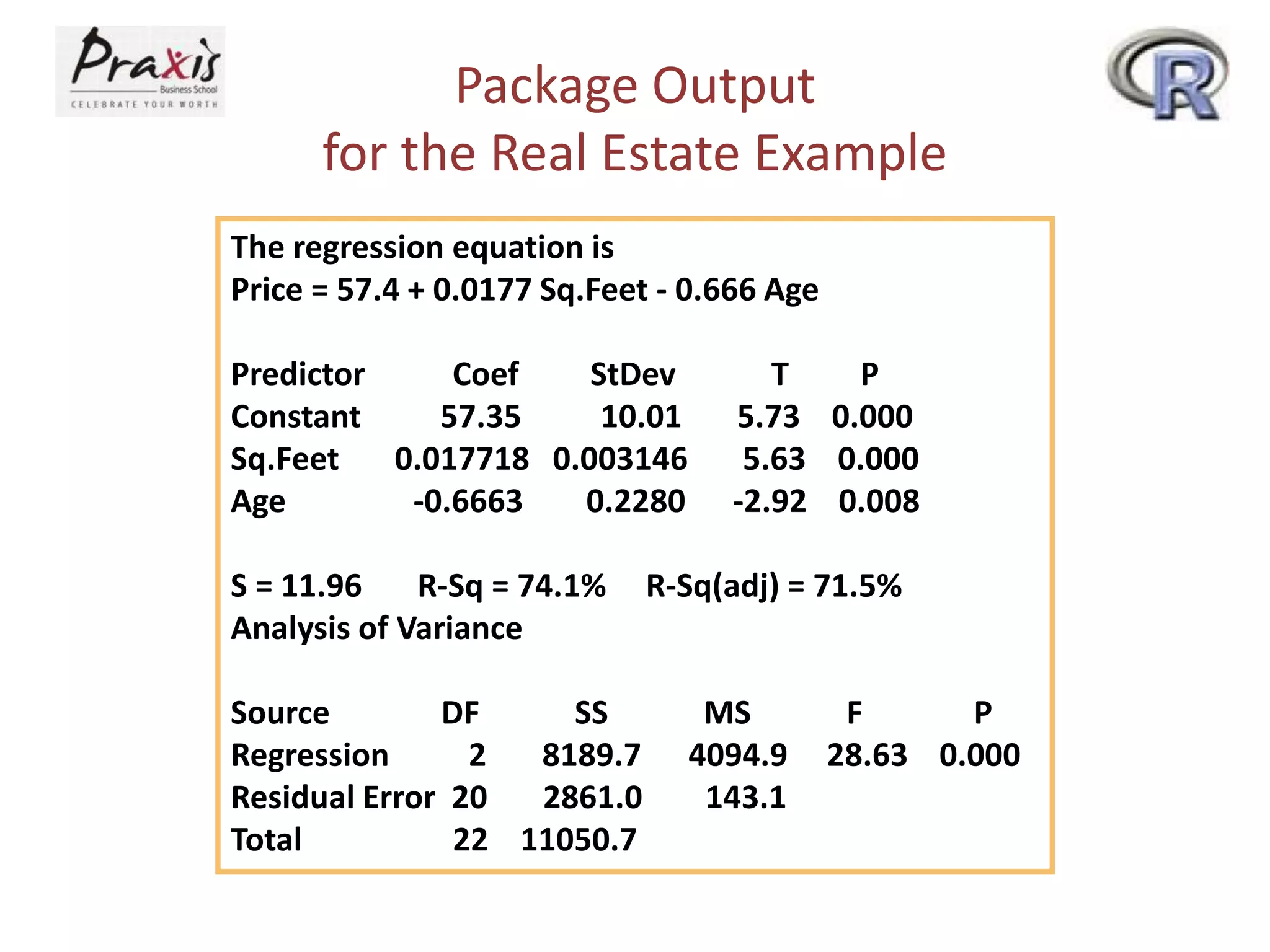

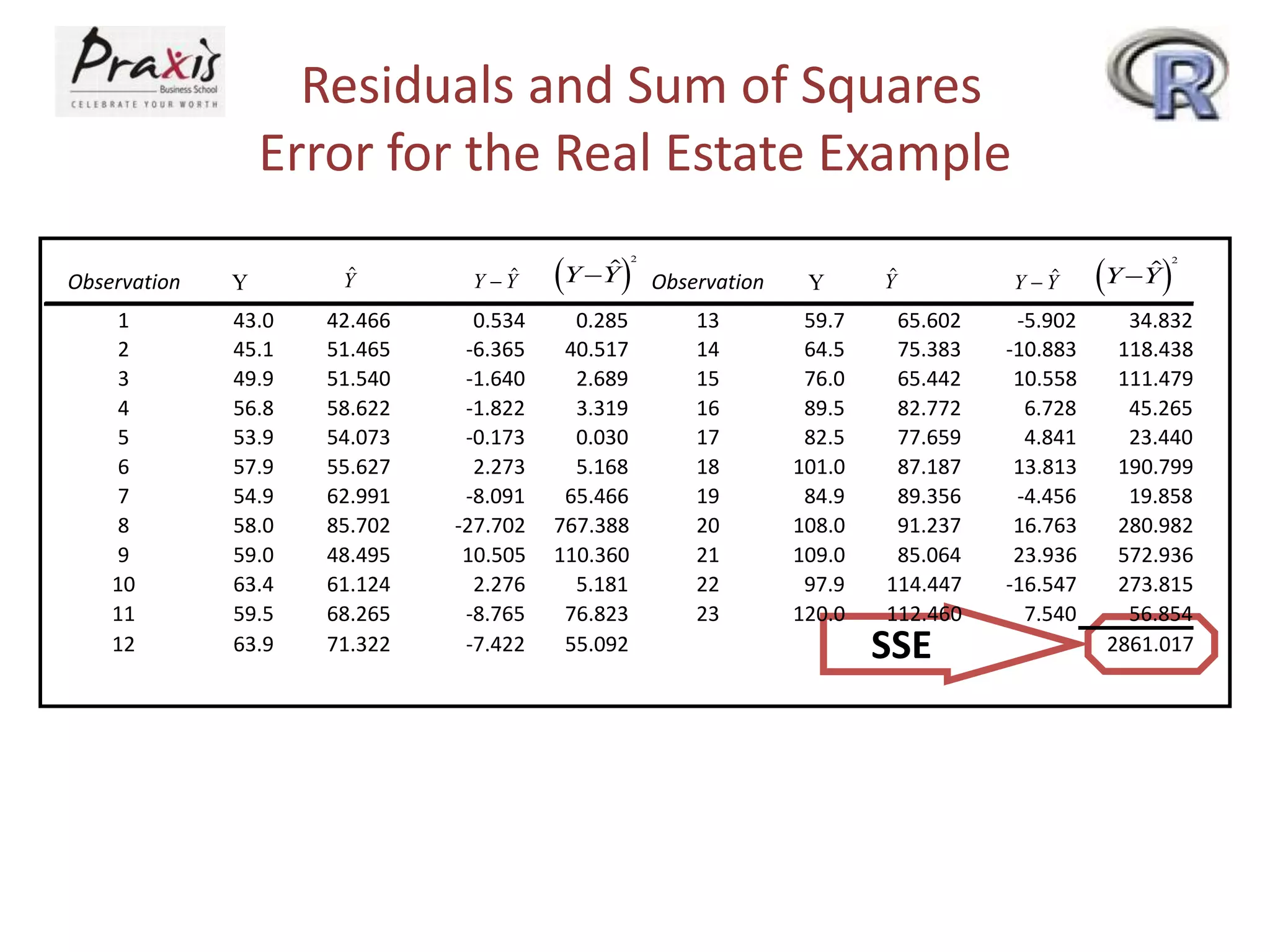

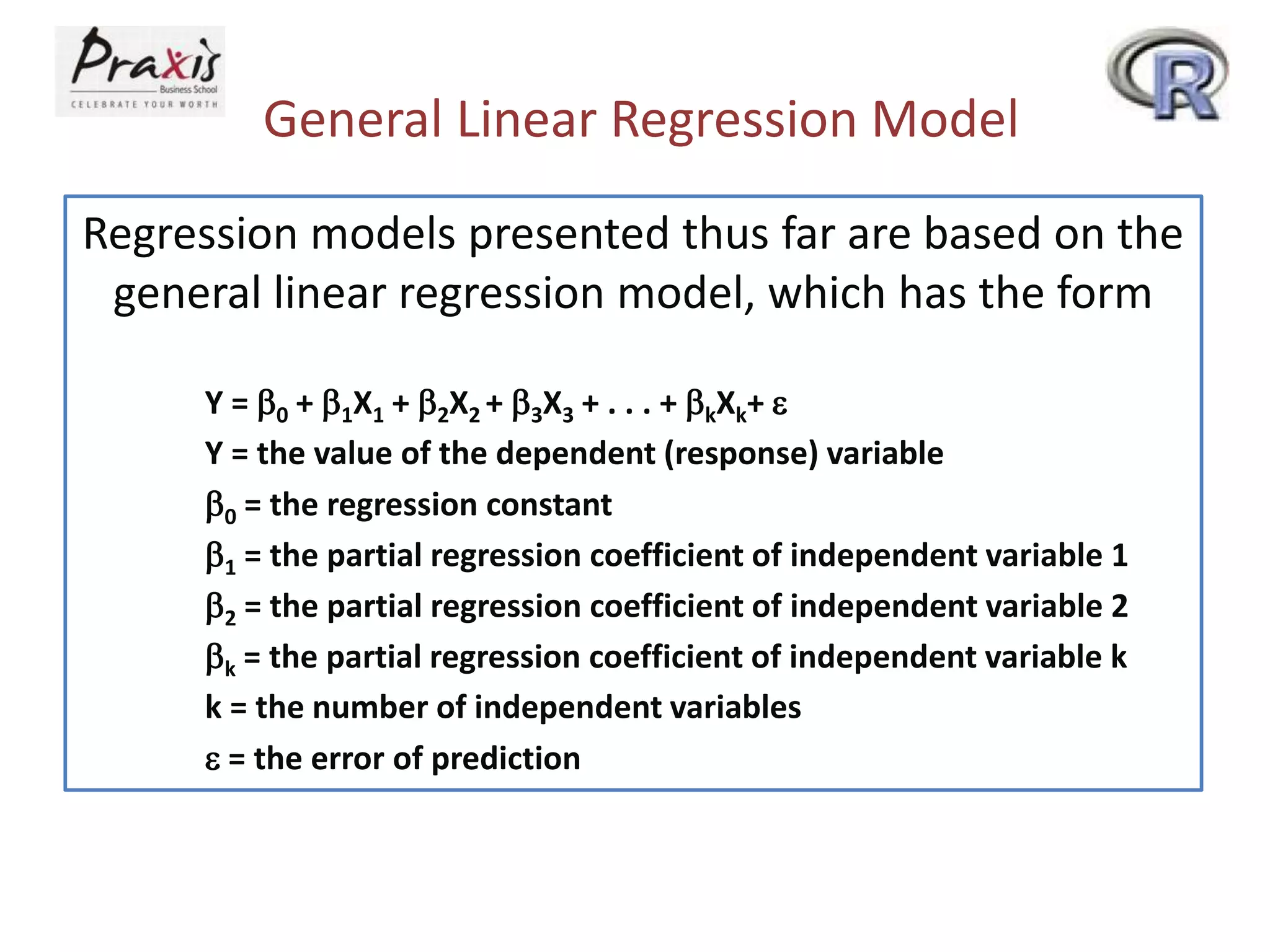

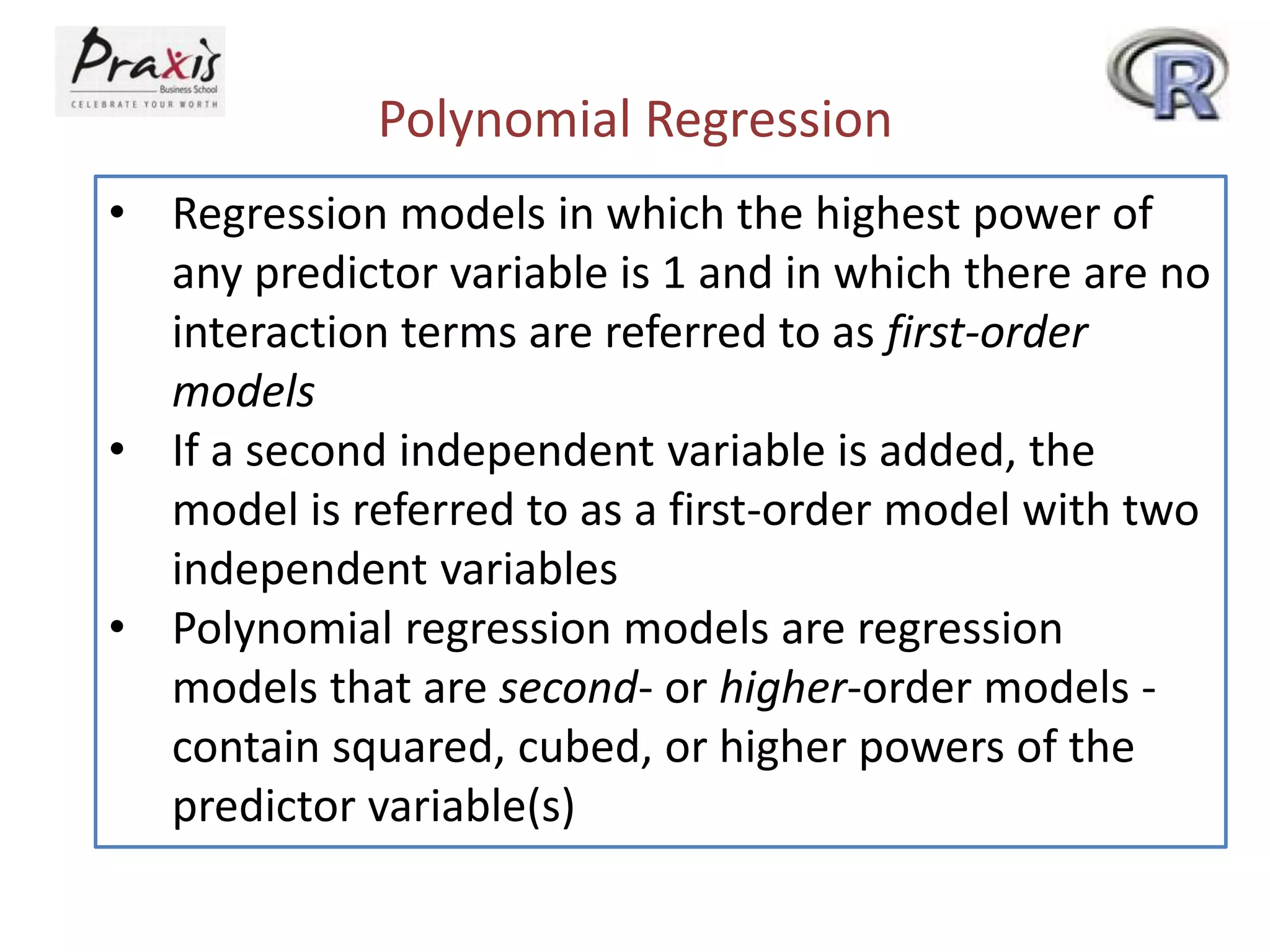

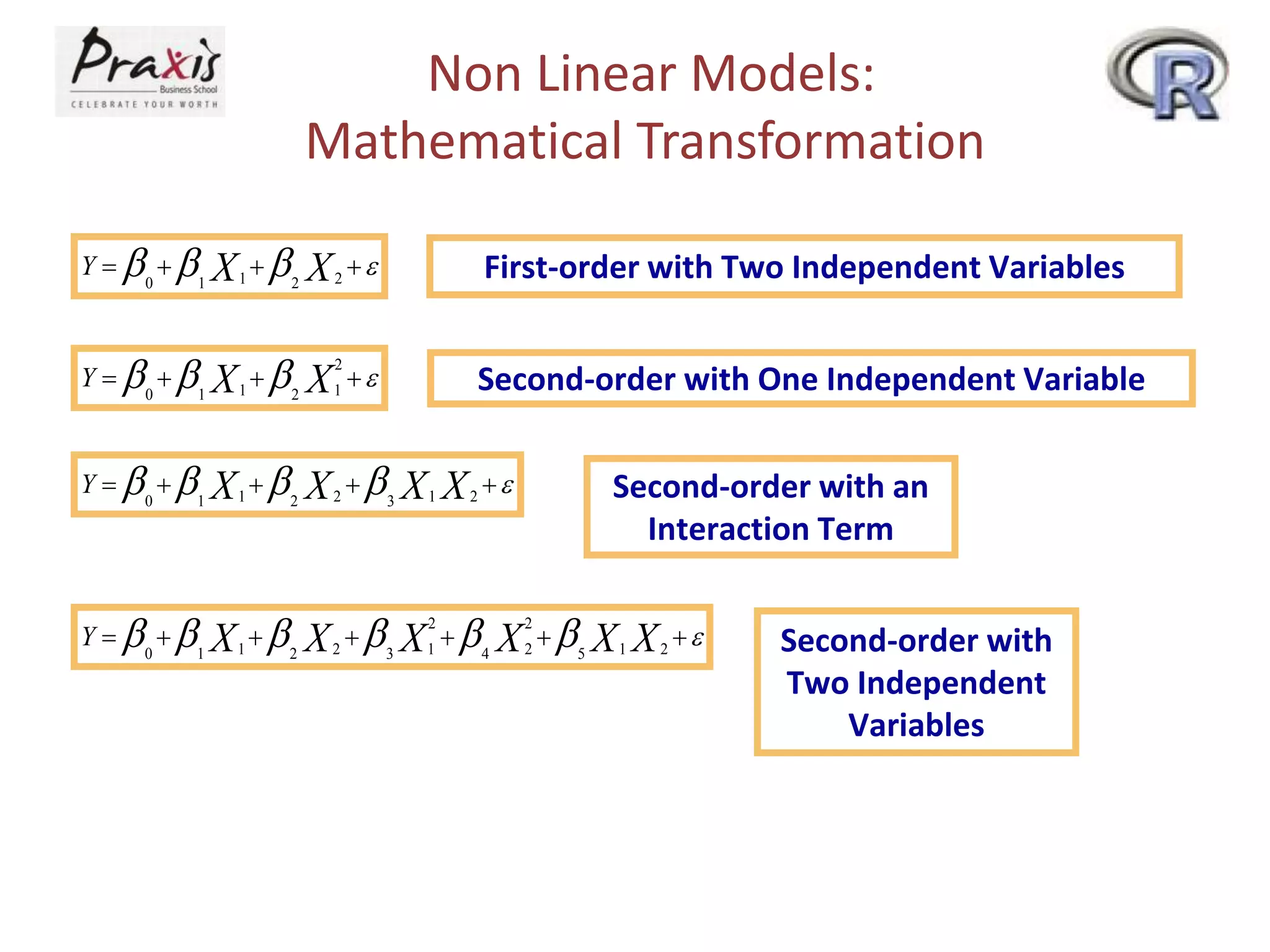

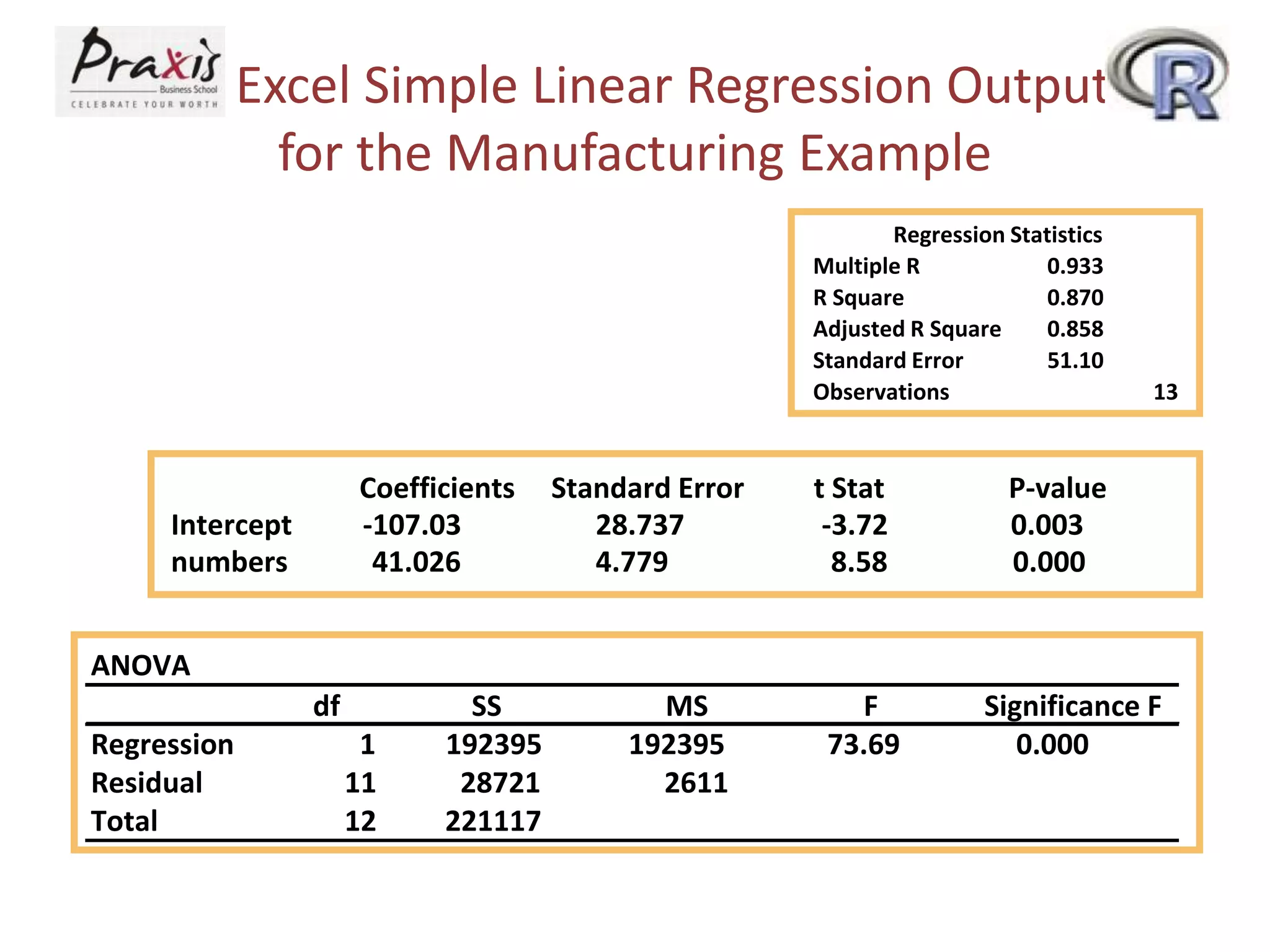

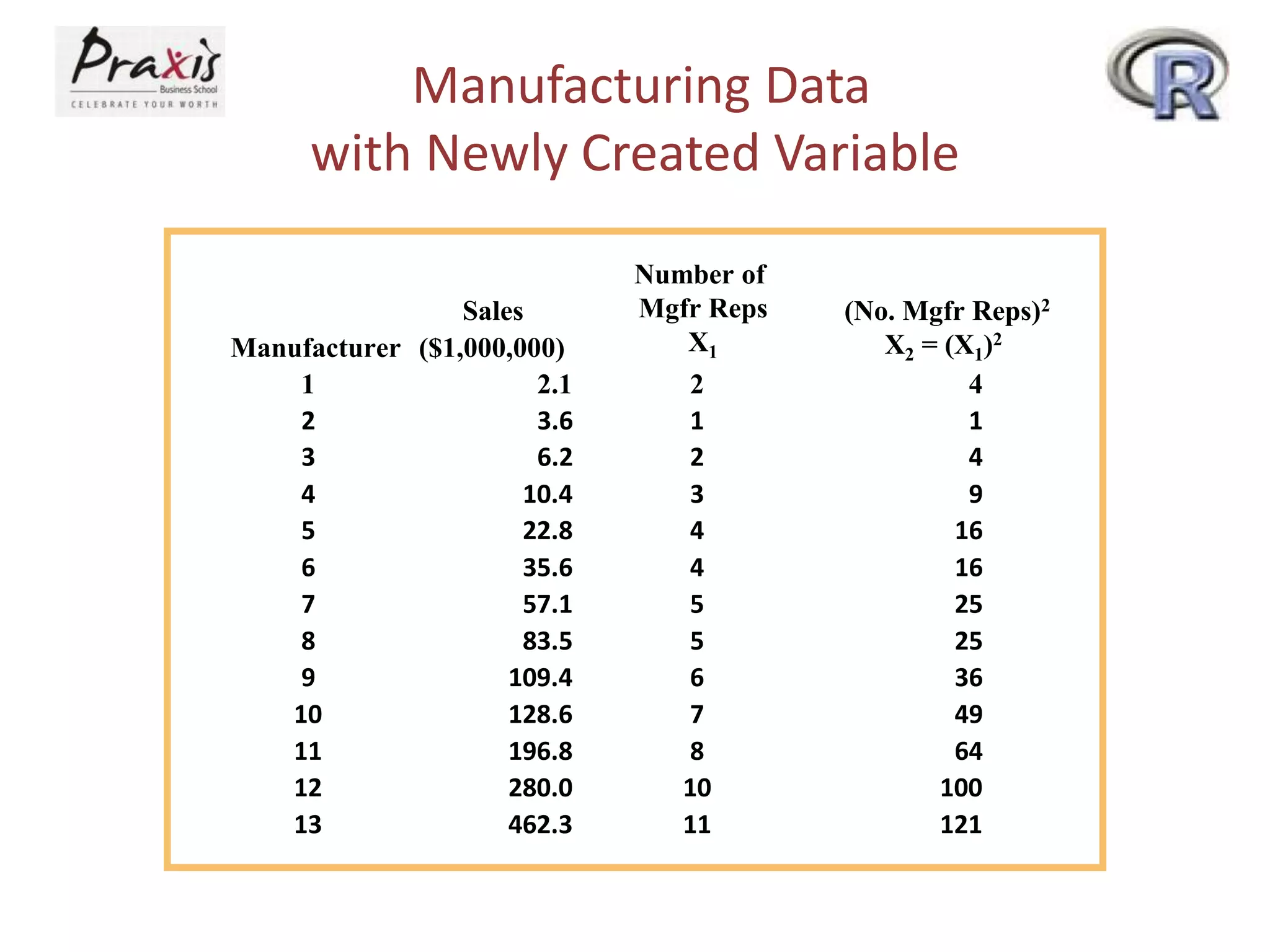

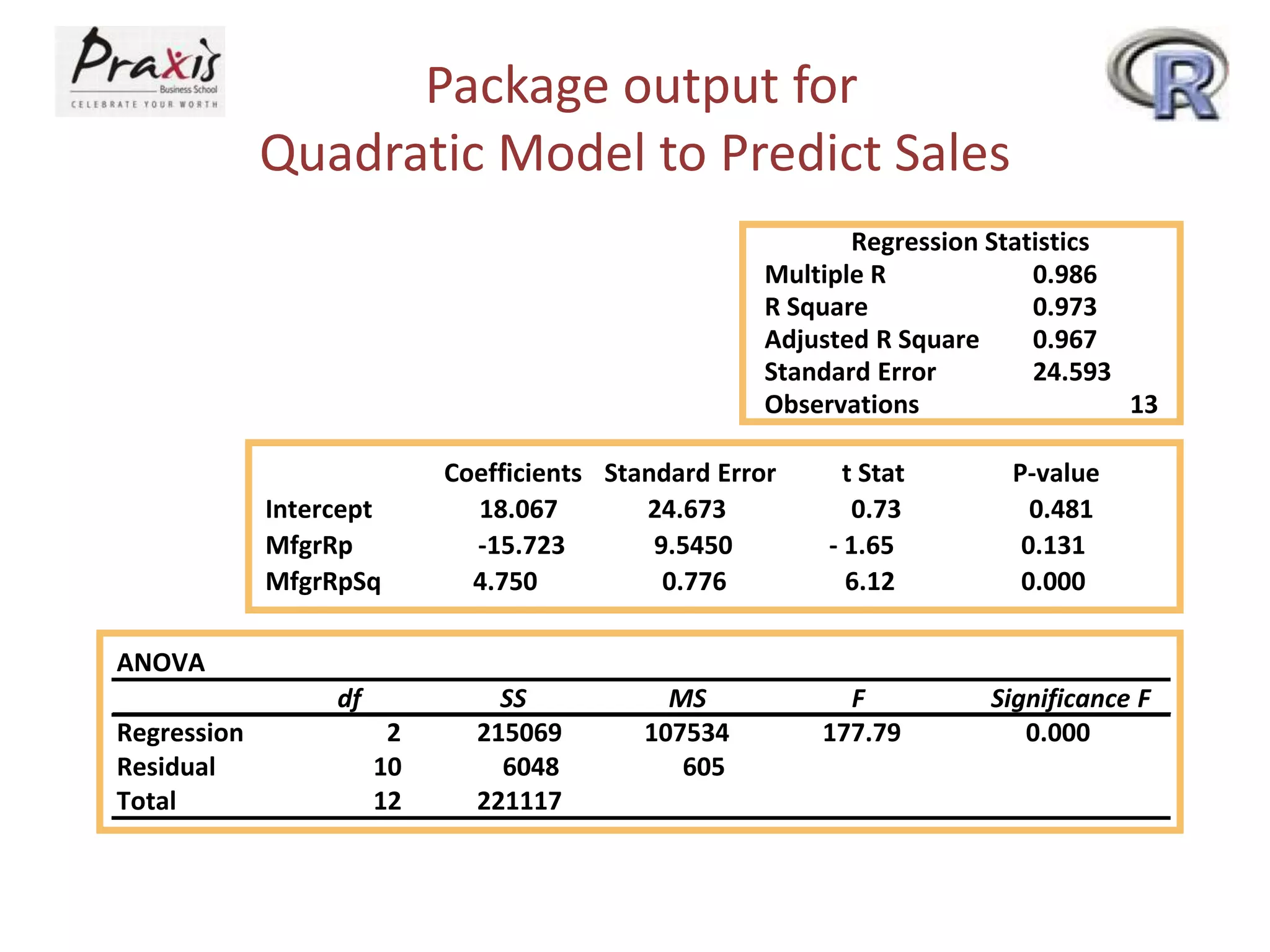

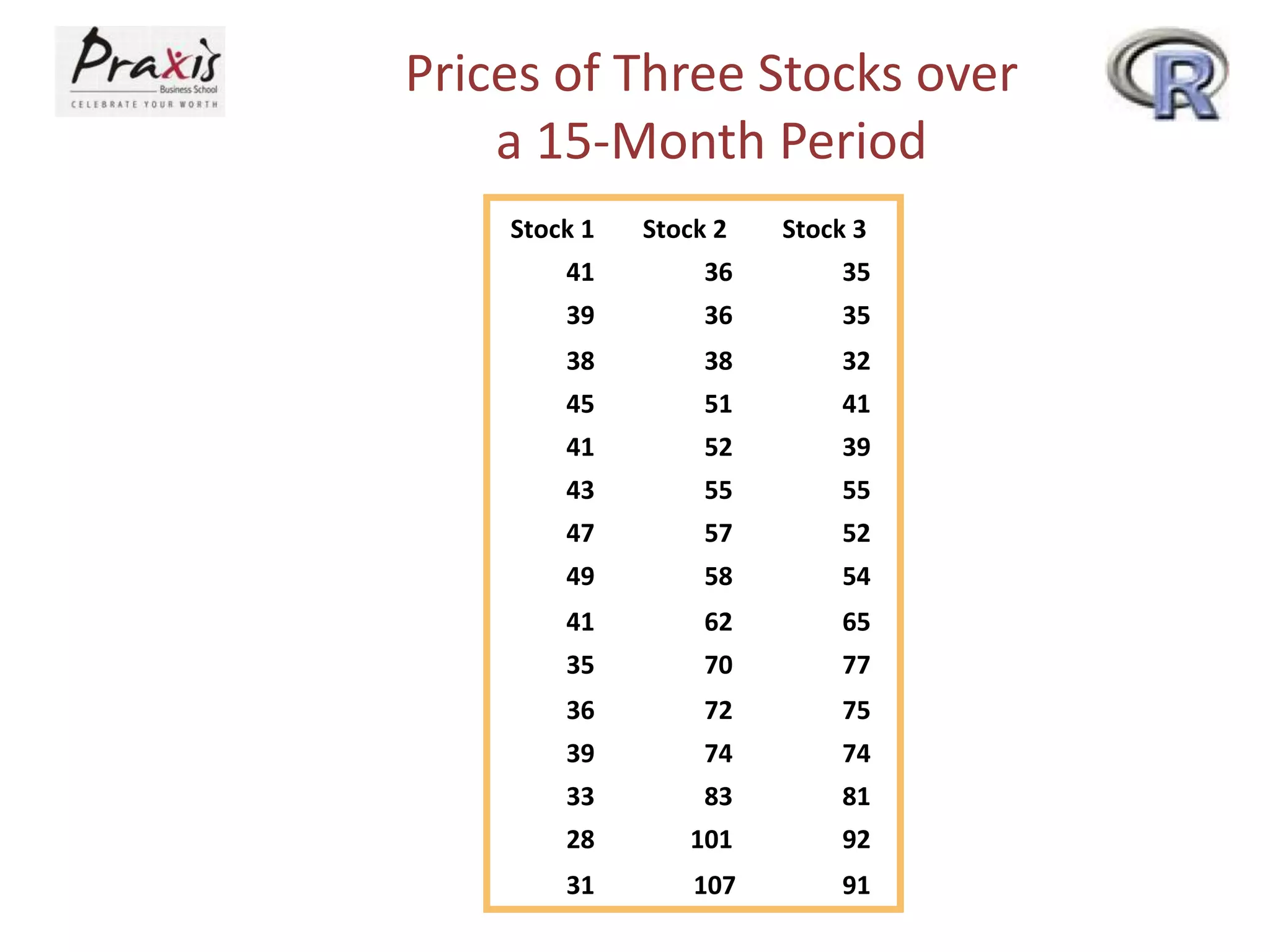

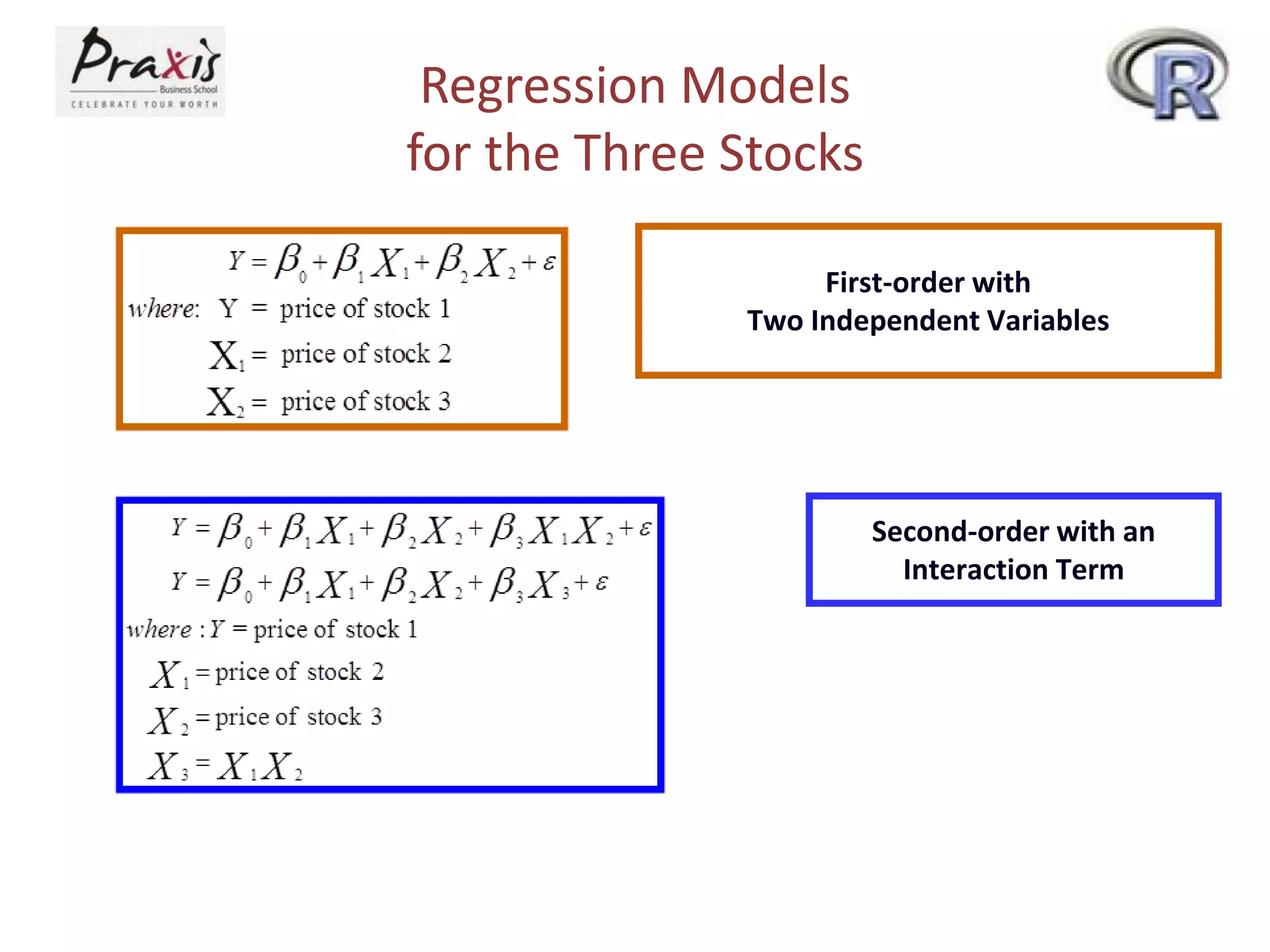

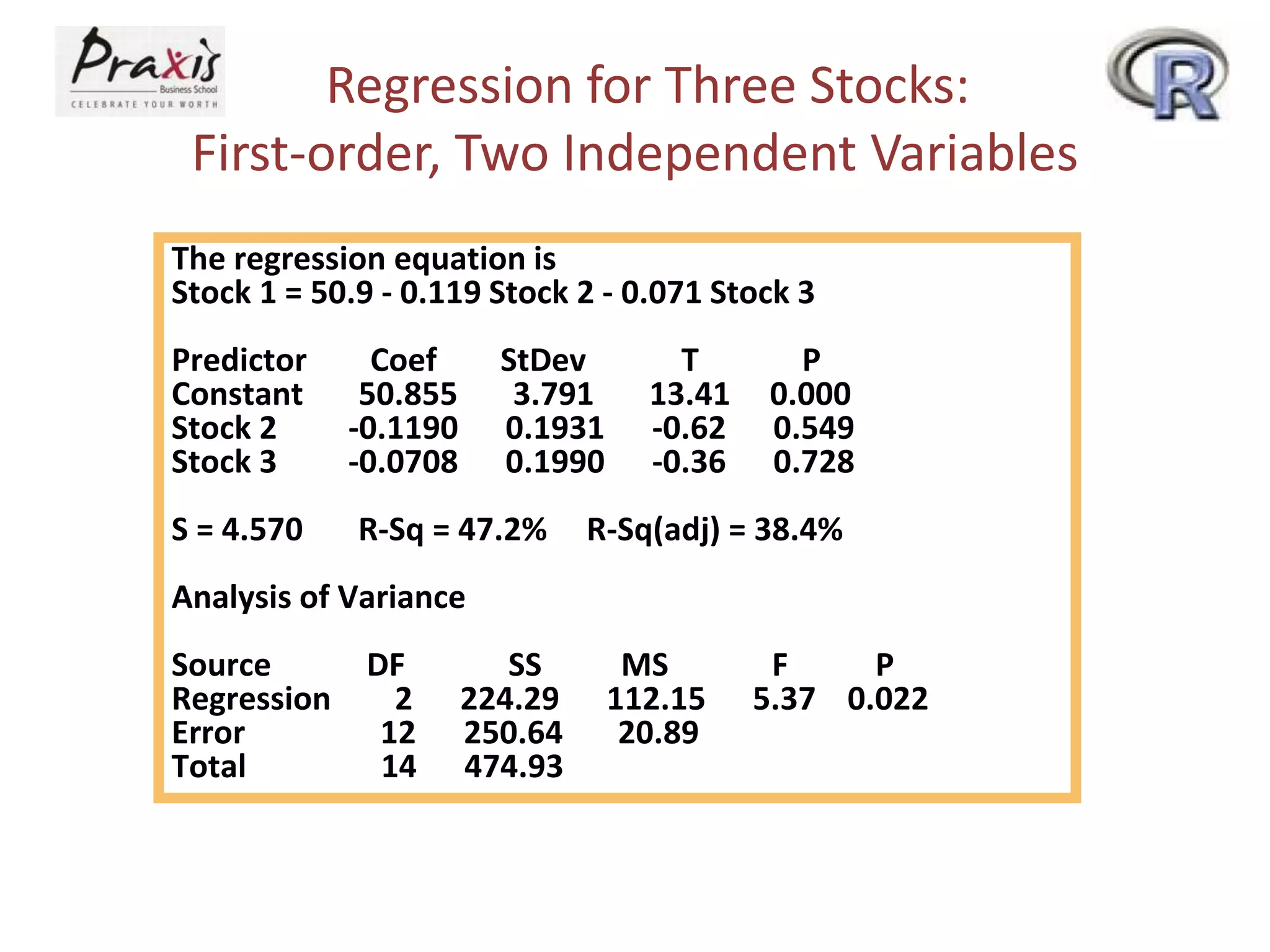

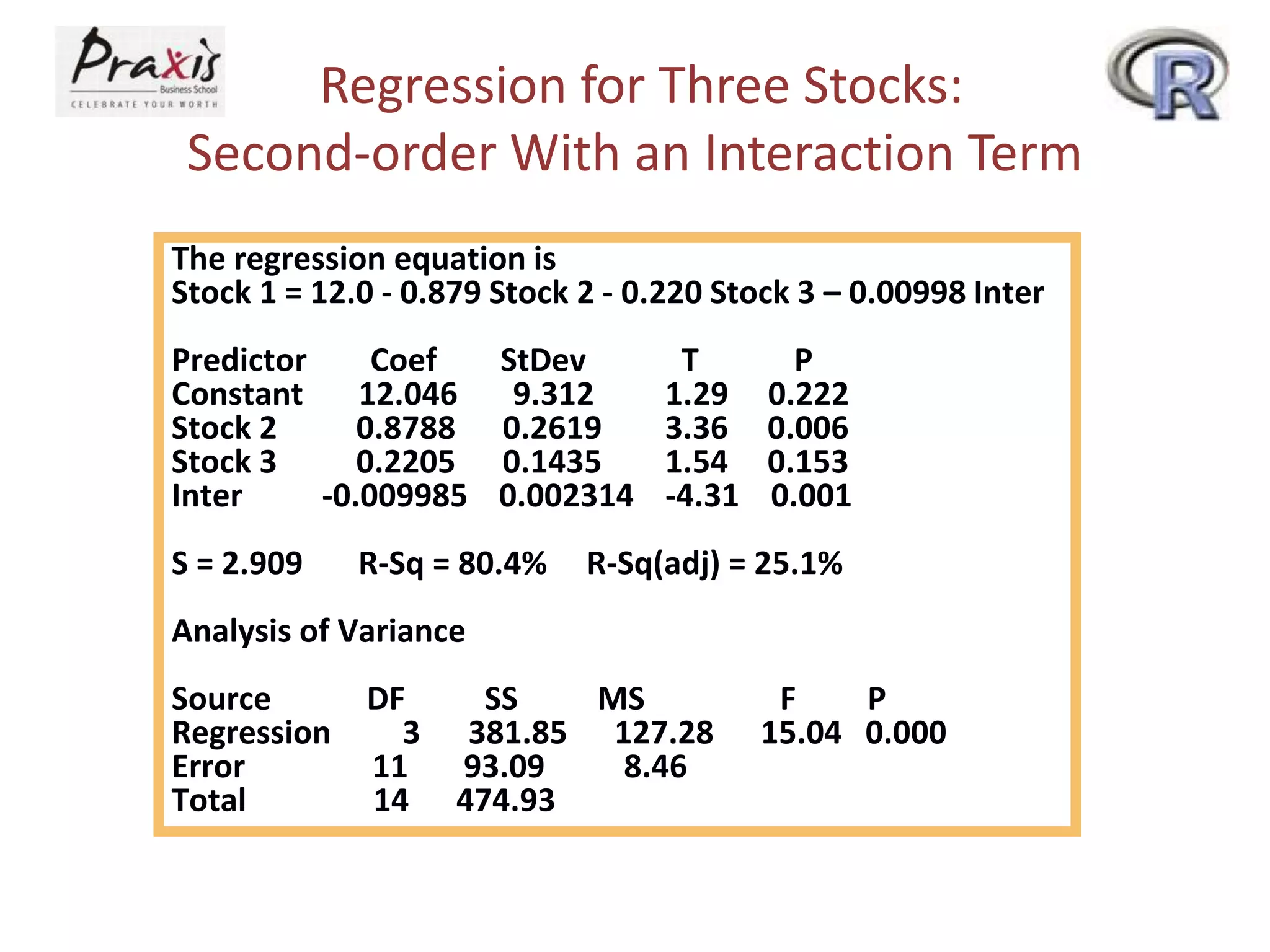

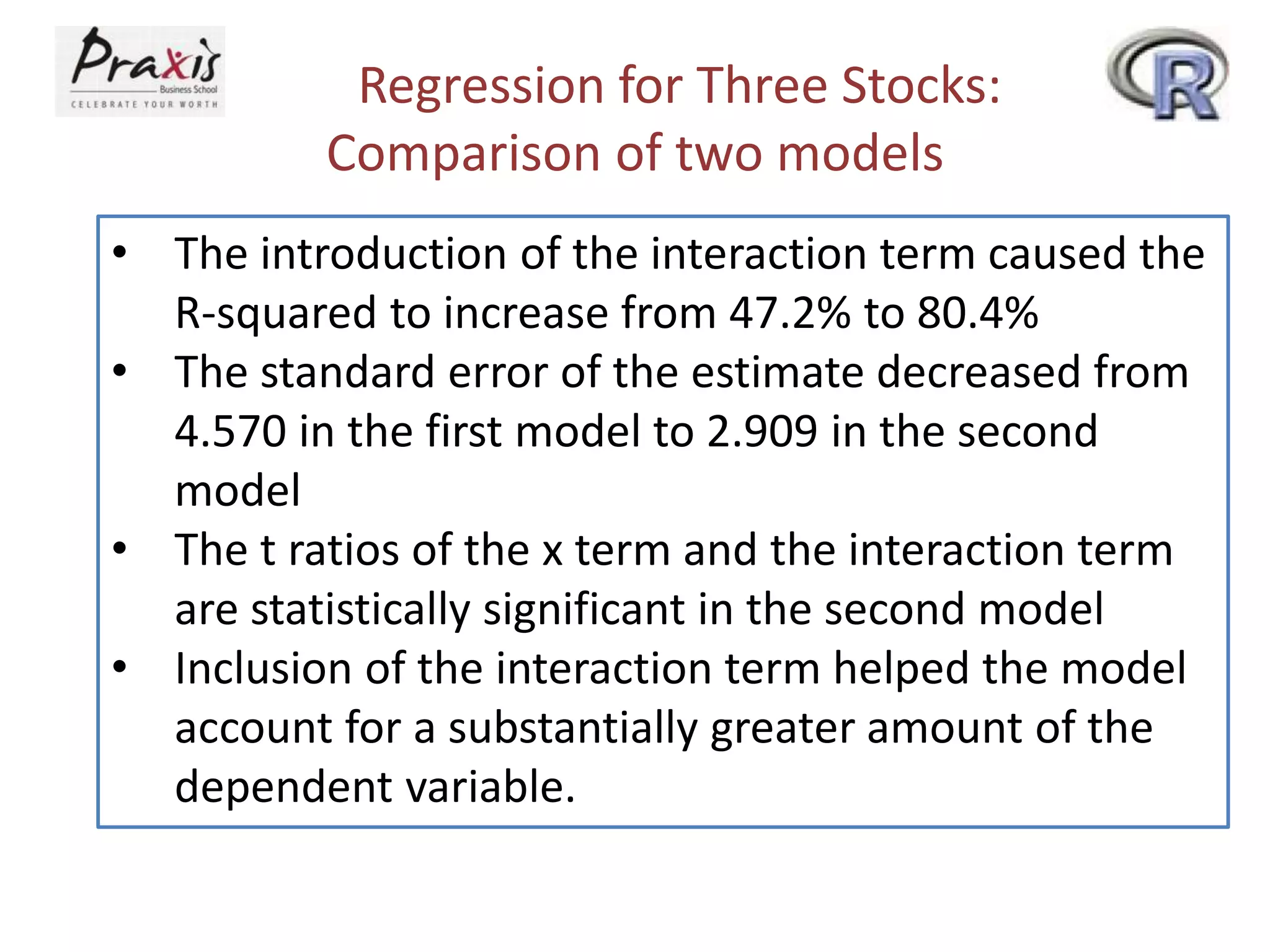

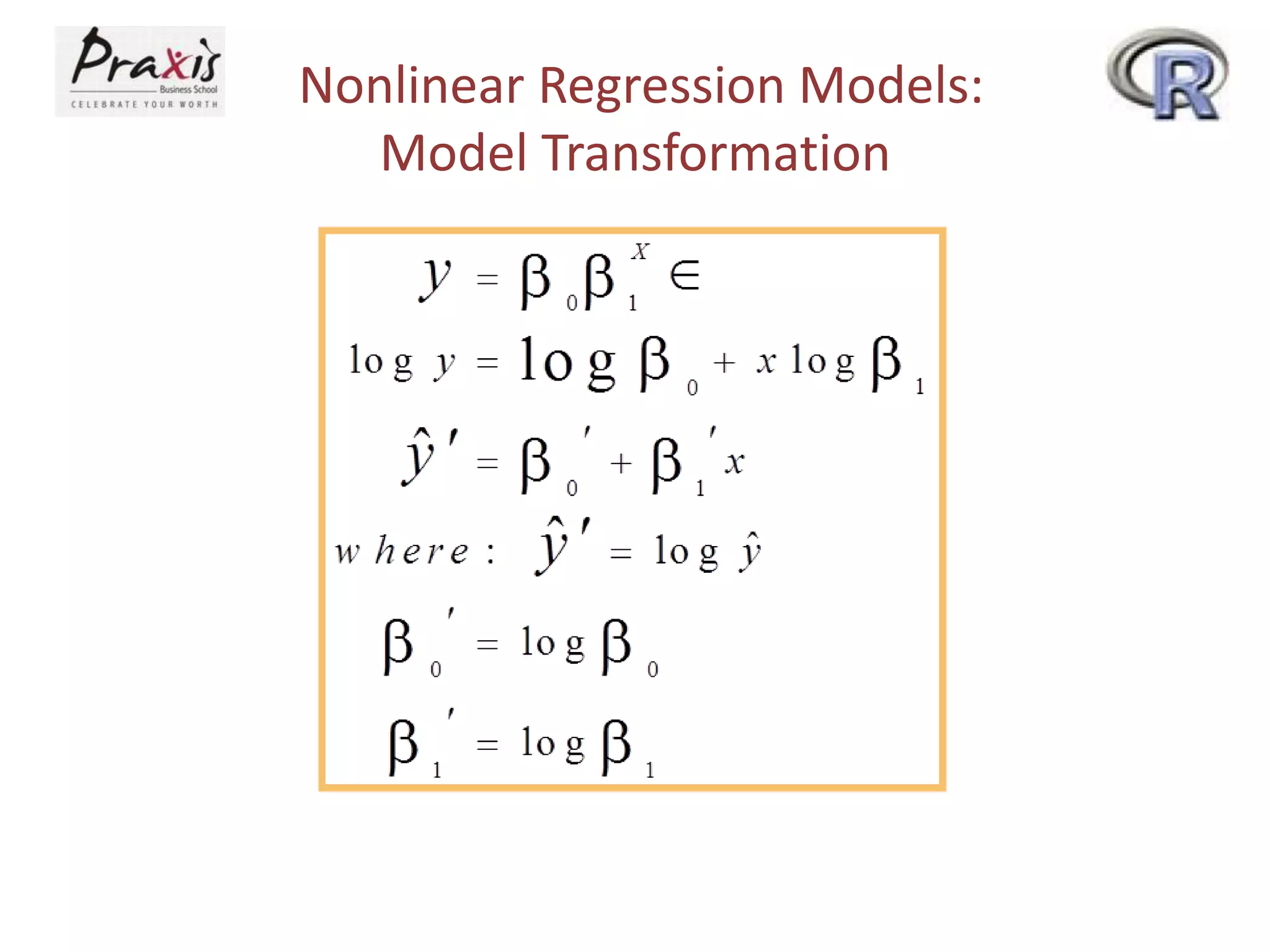

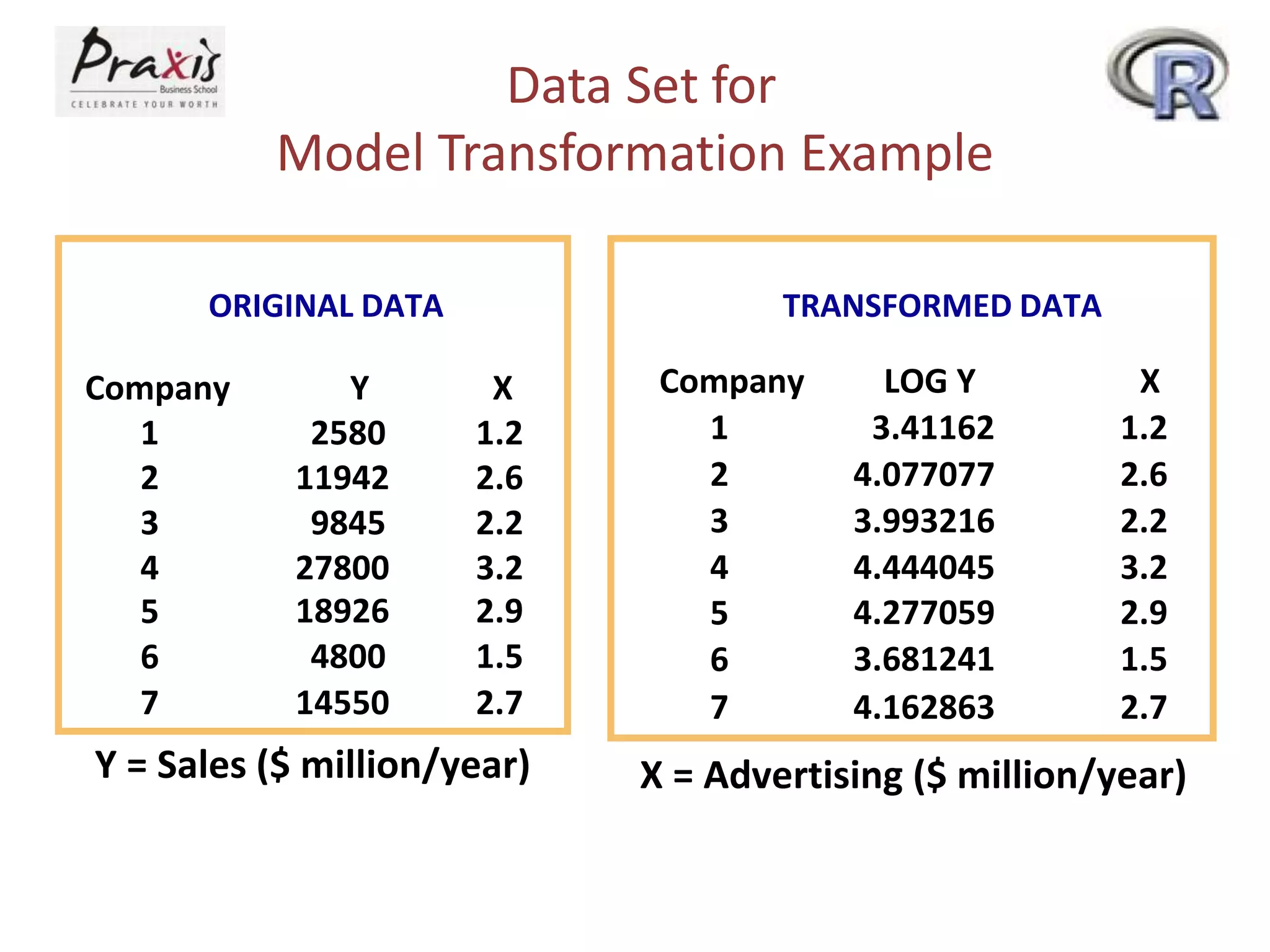

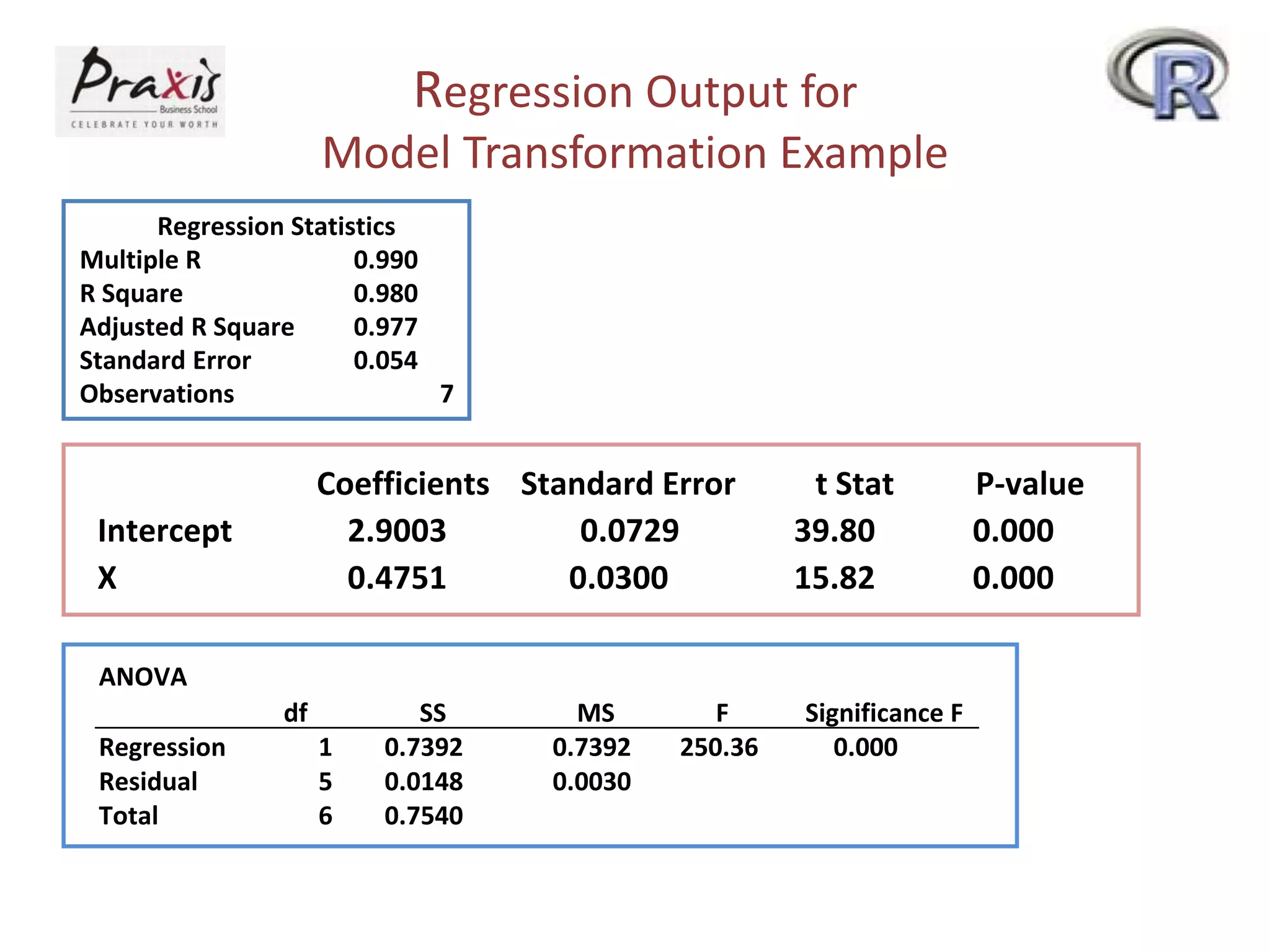

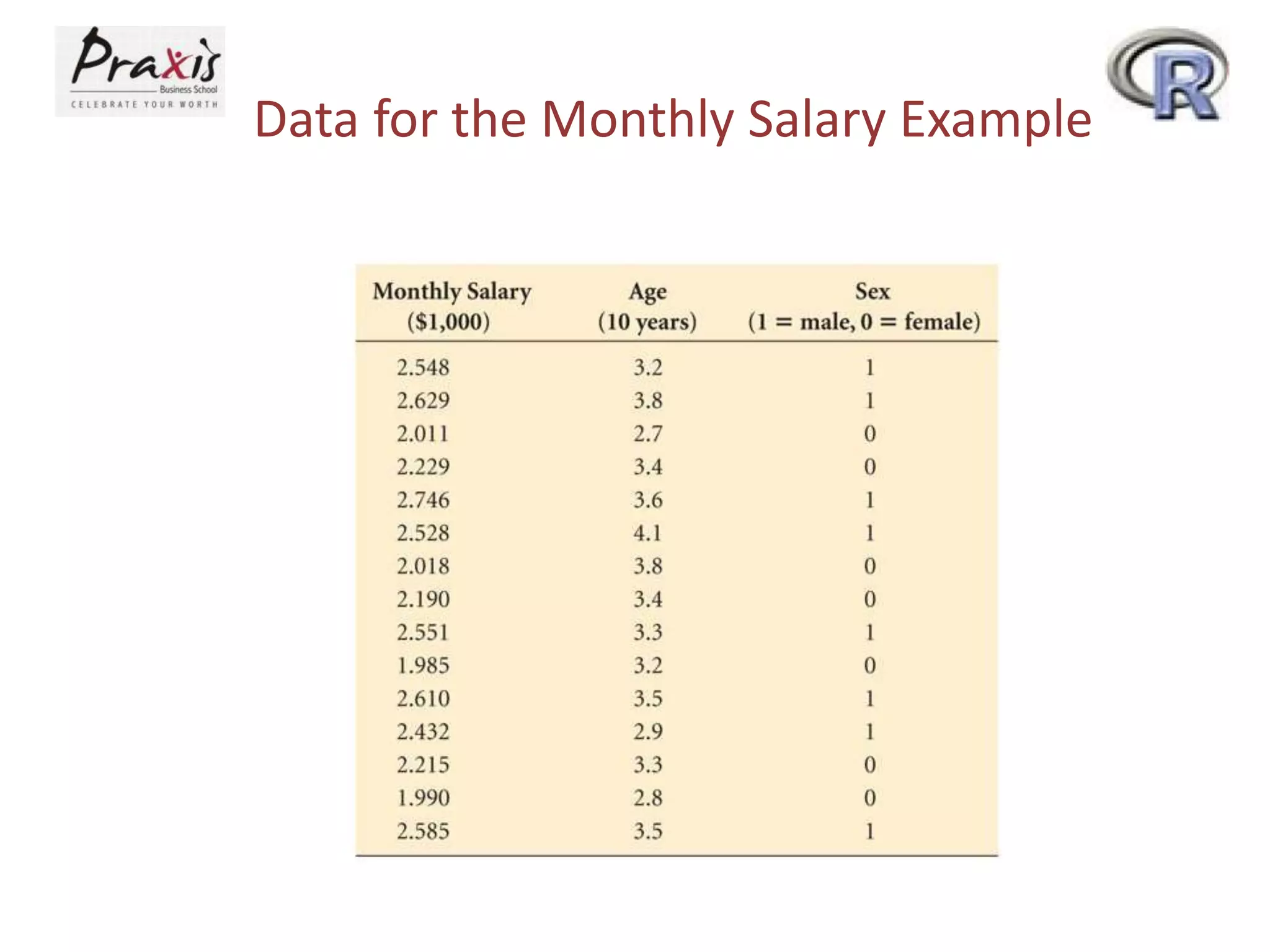

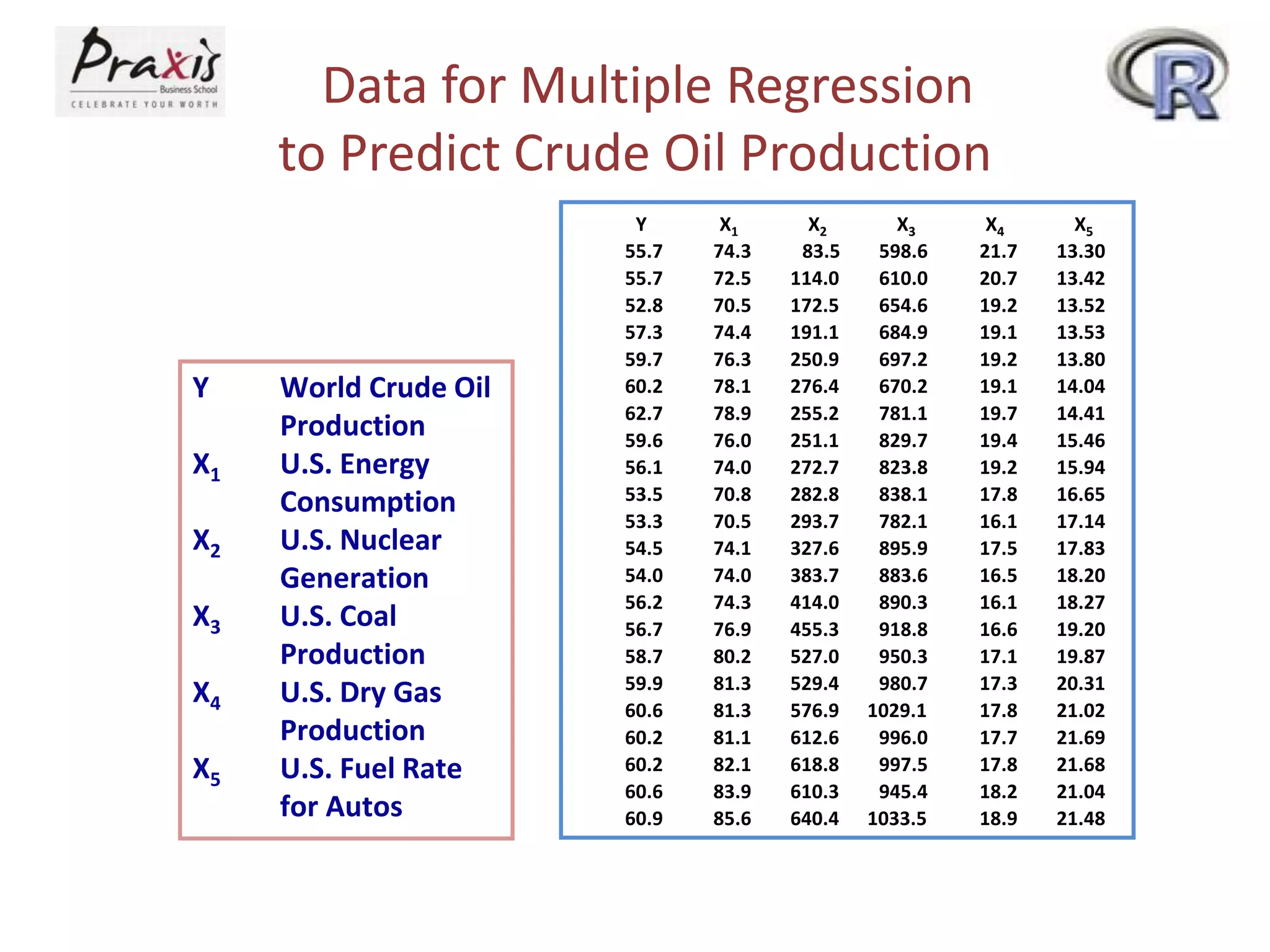

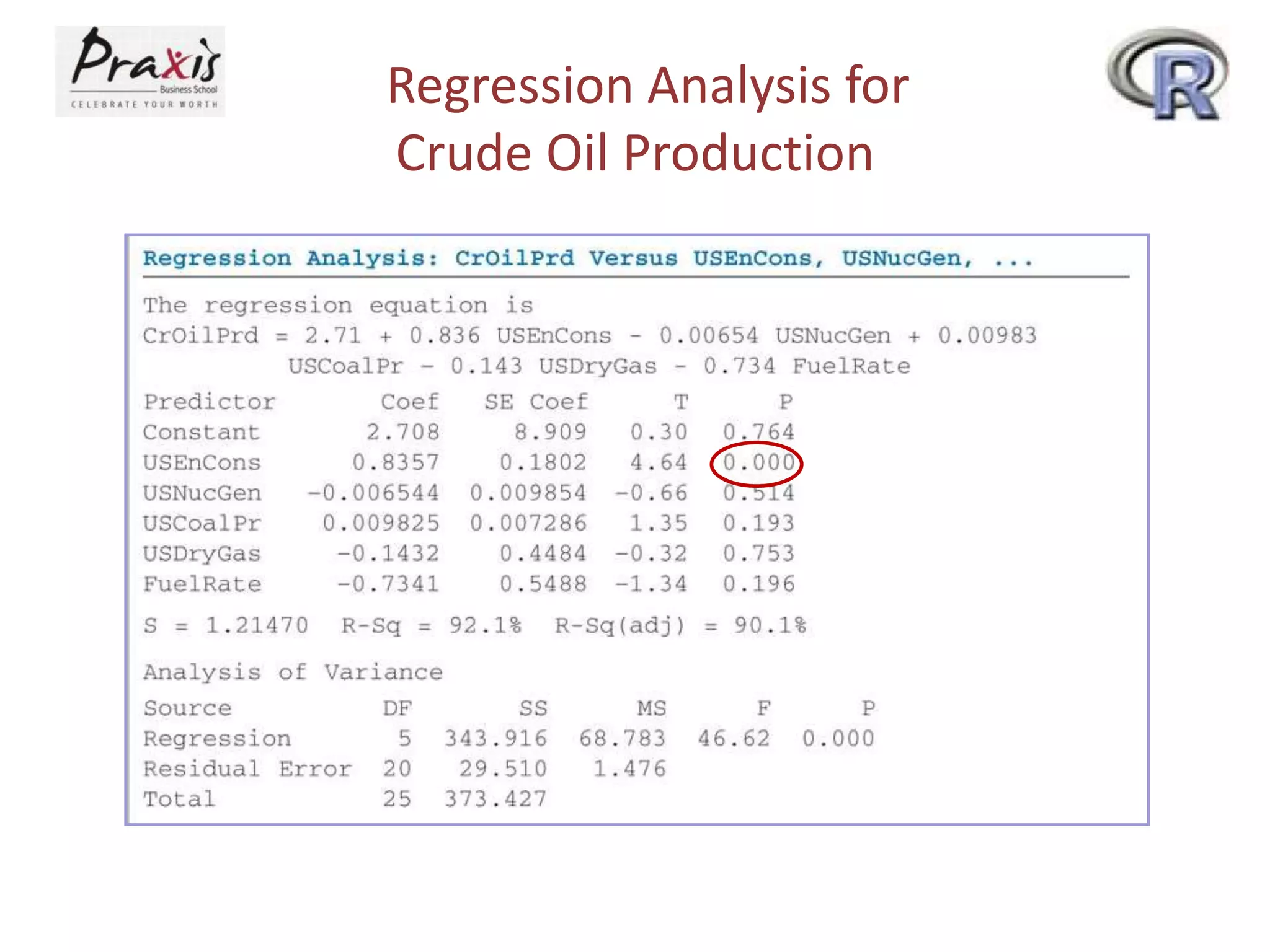

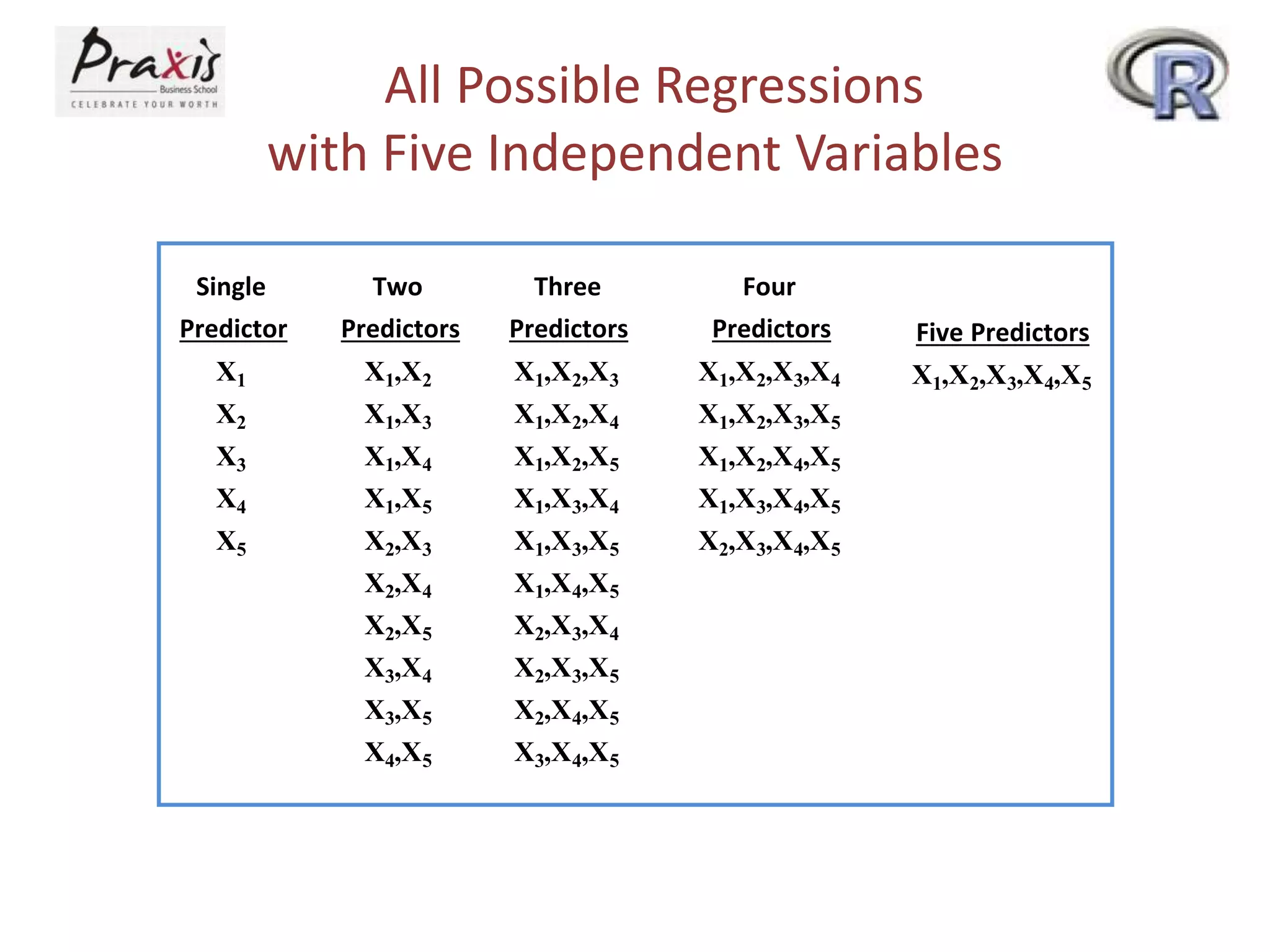

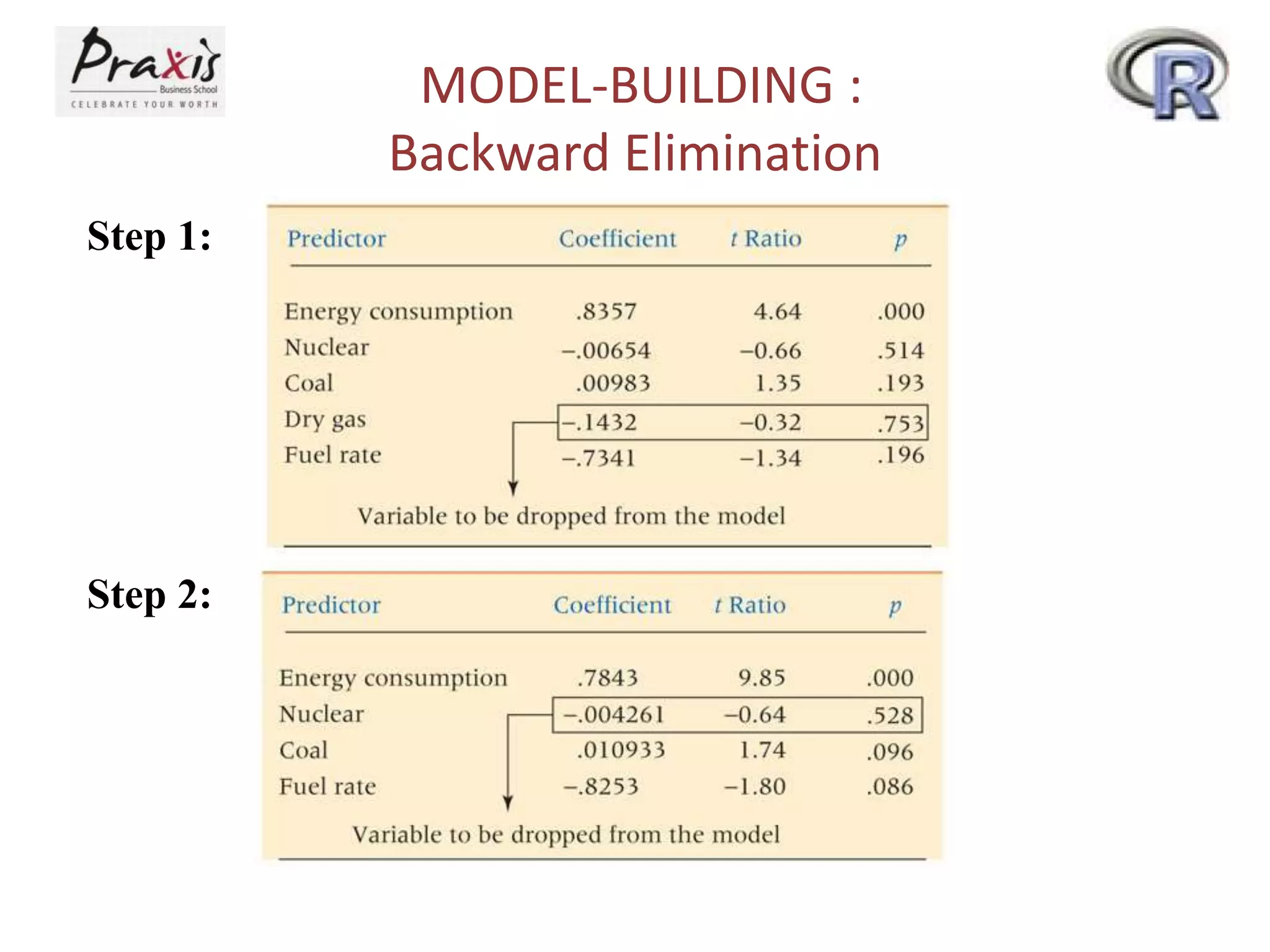

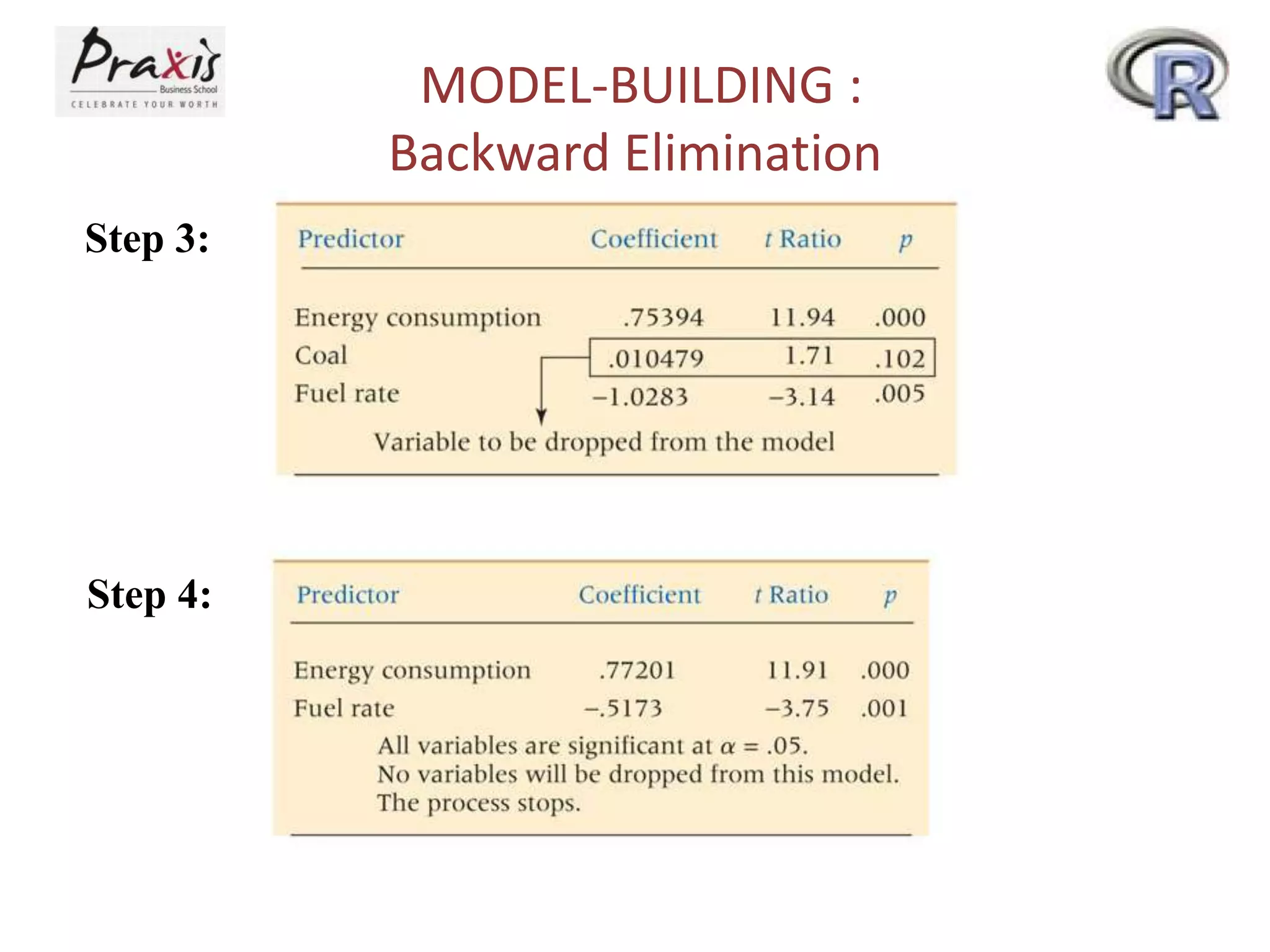

- Estimating regression coefficients and equations for simple and multiple regression models

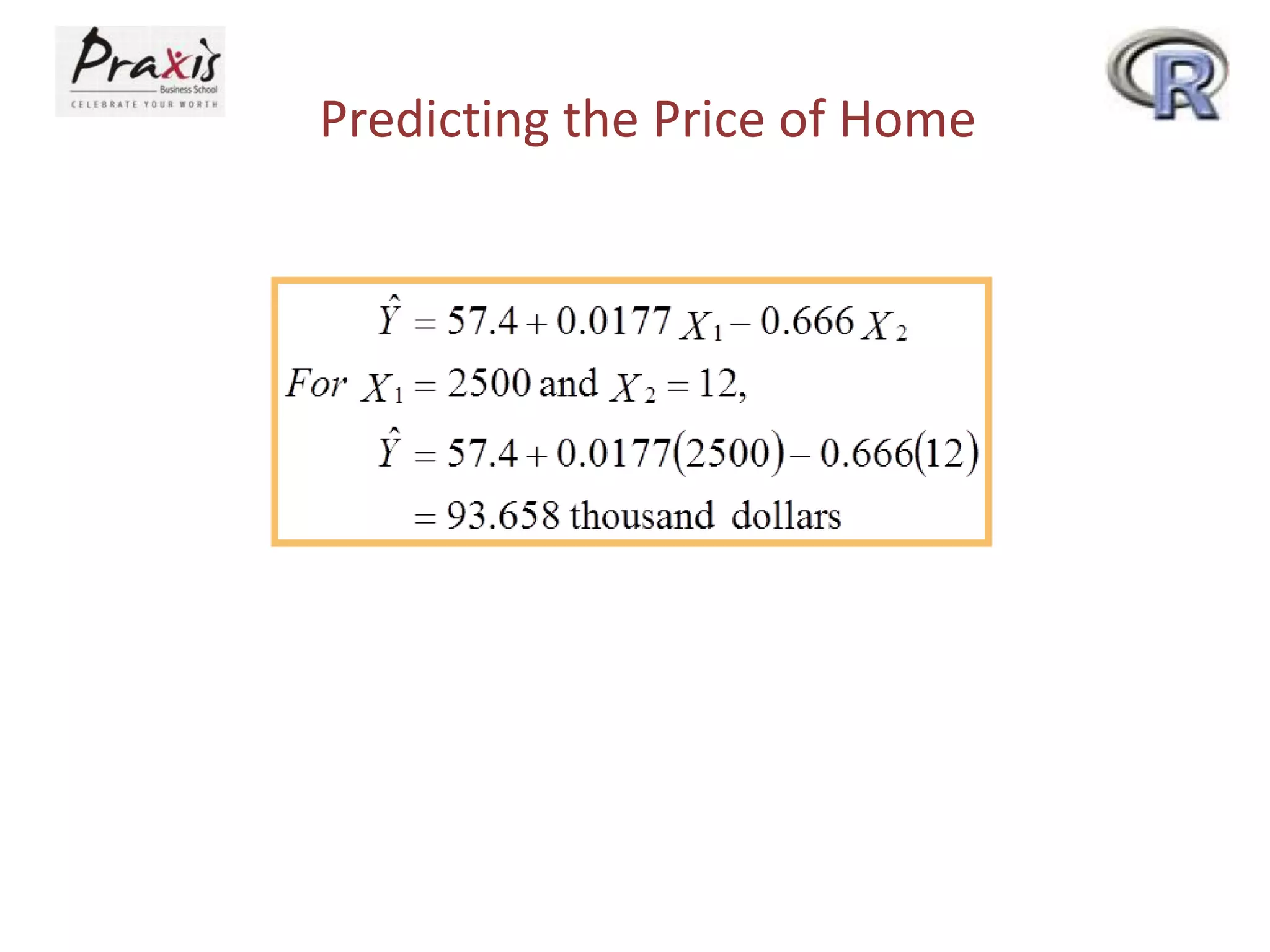

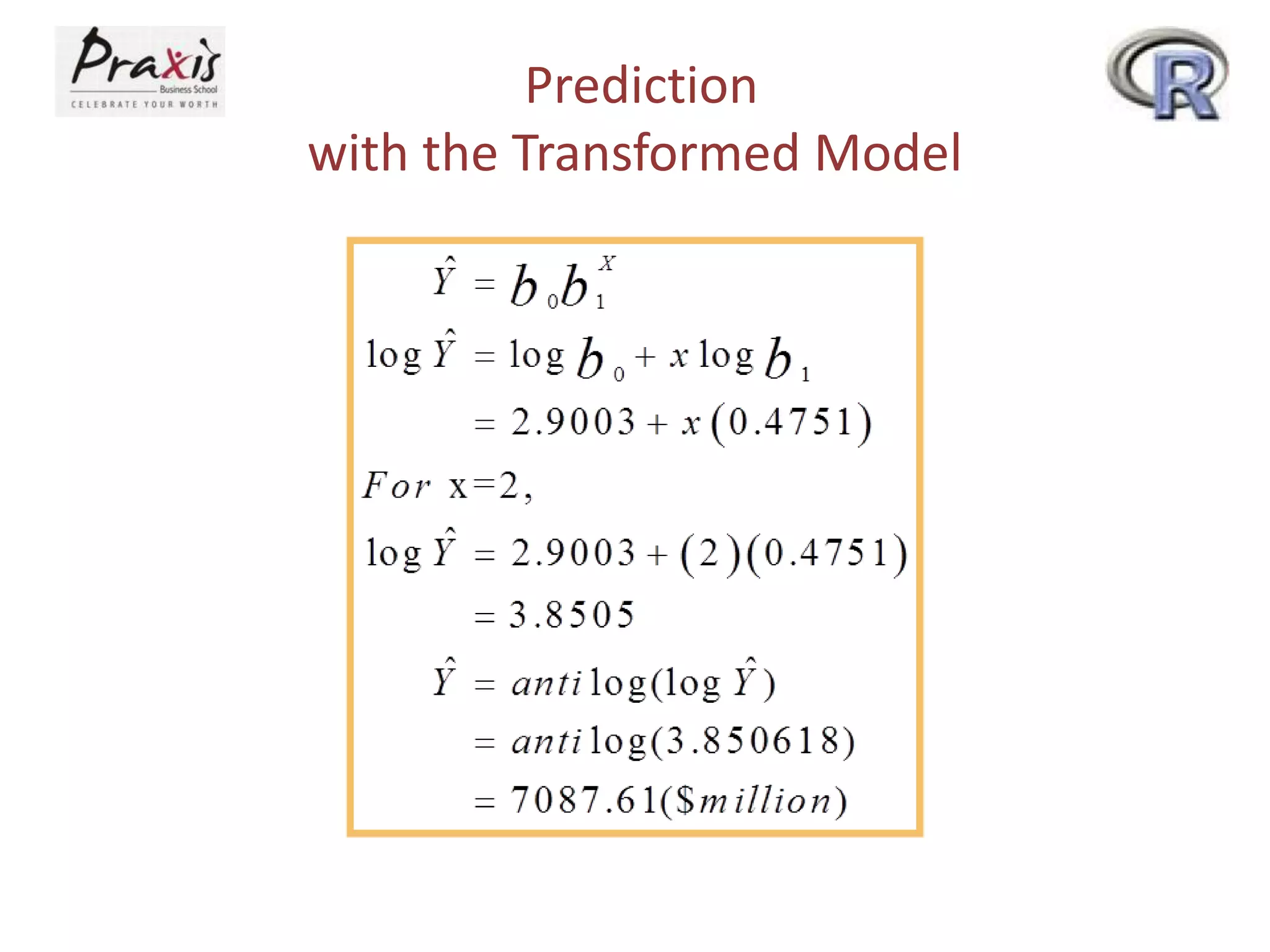

- Using regression models to predict outcomes based on independent variable values

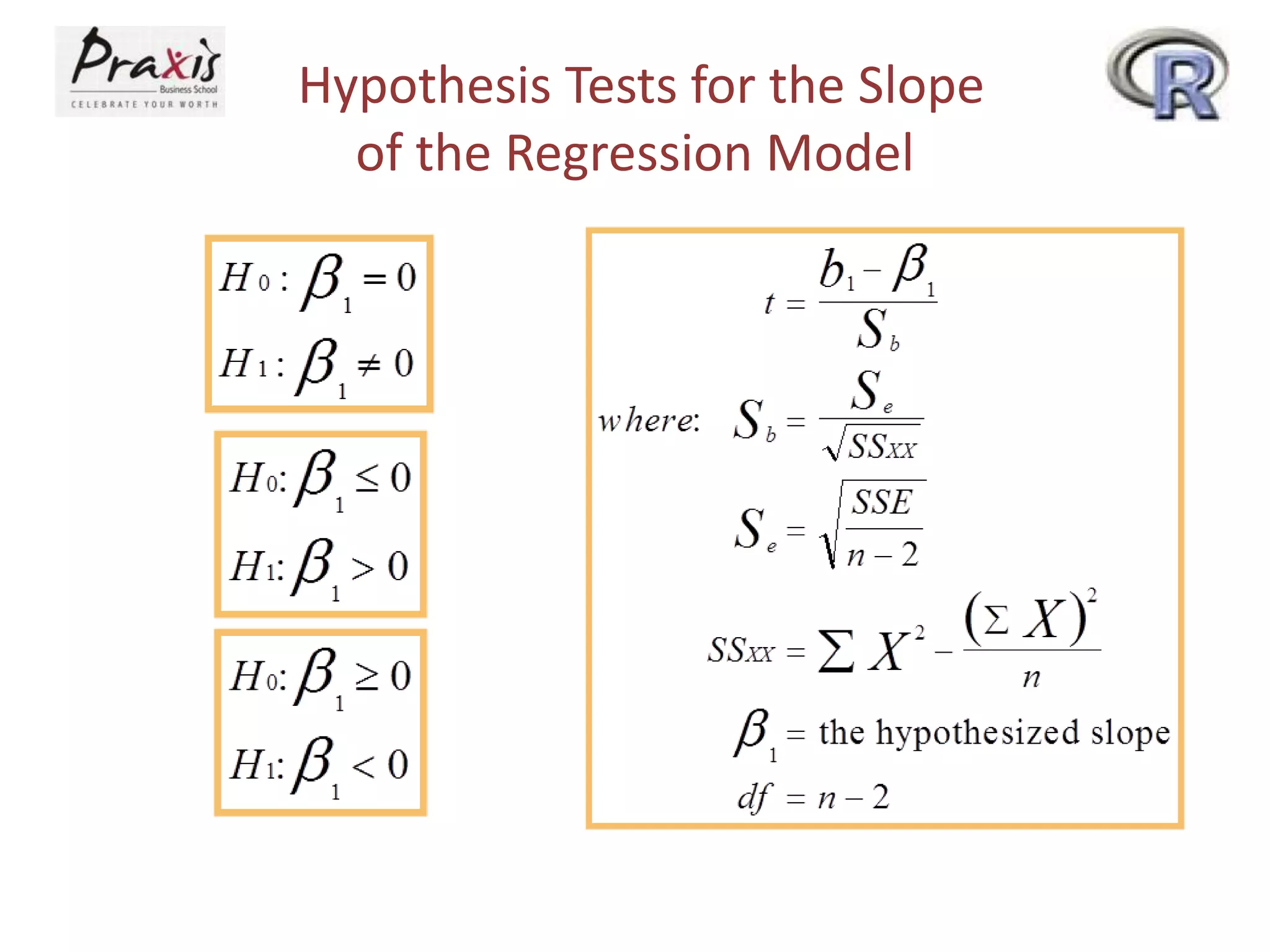

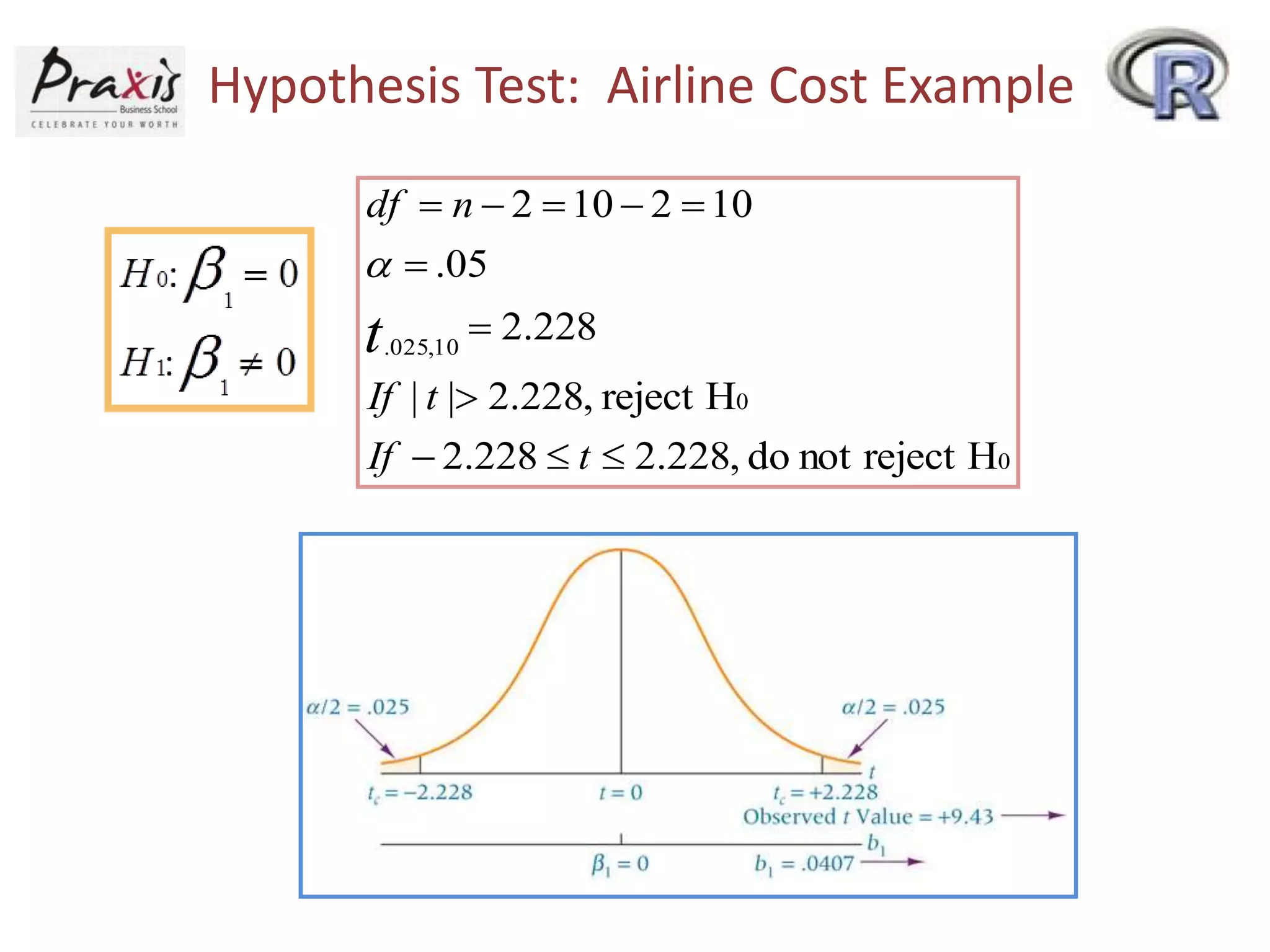

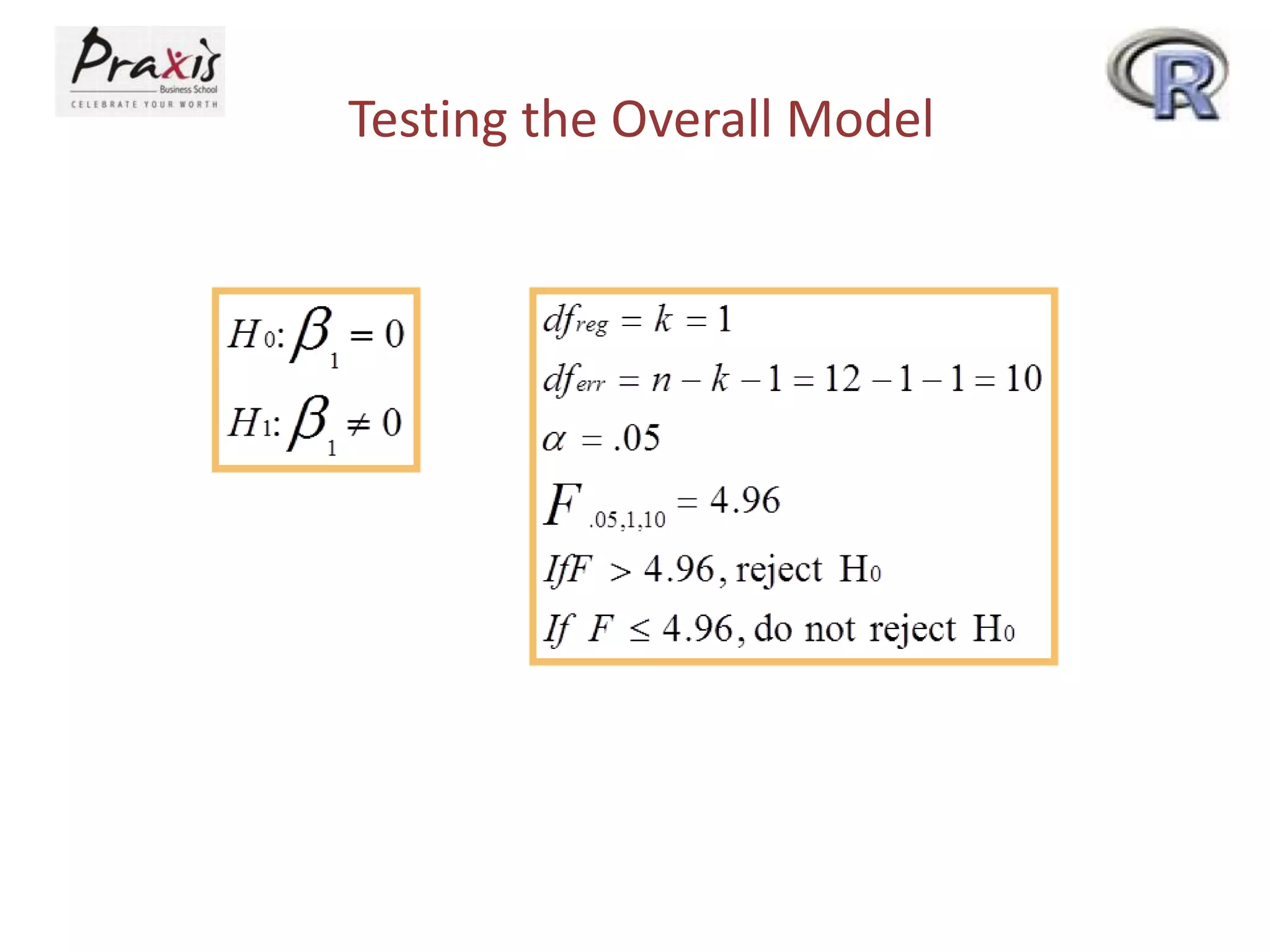

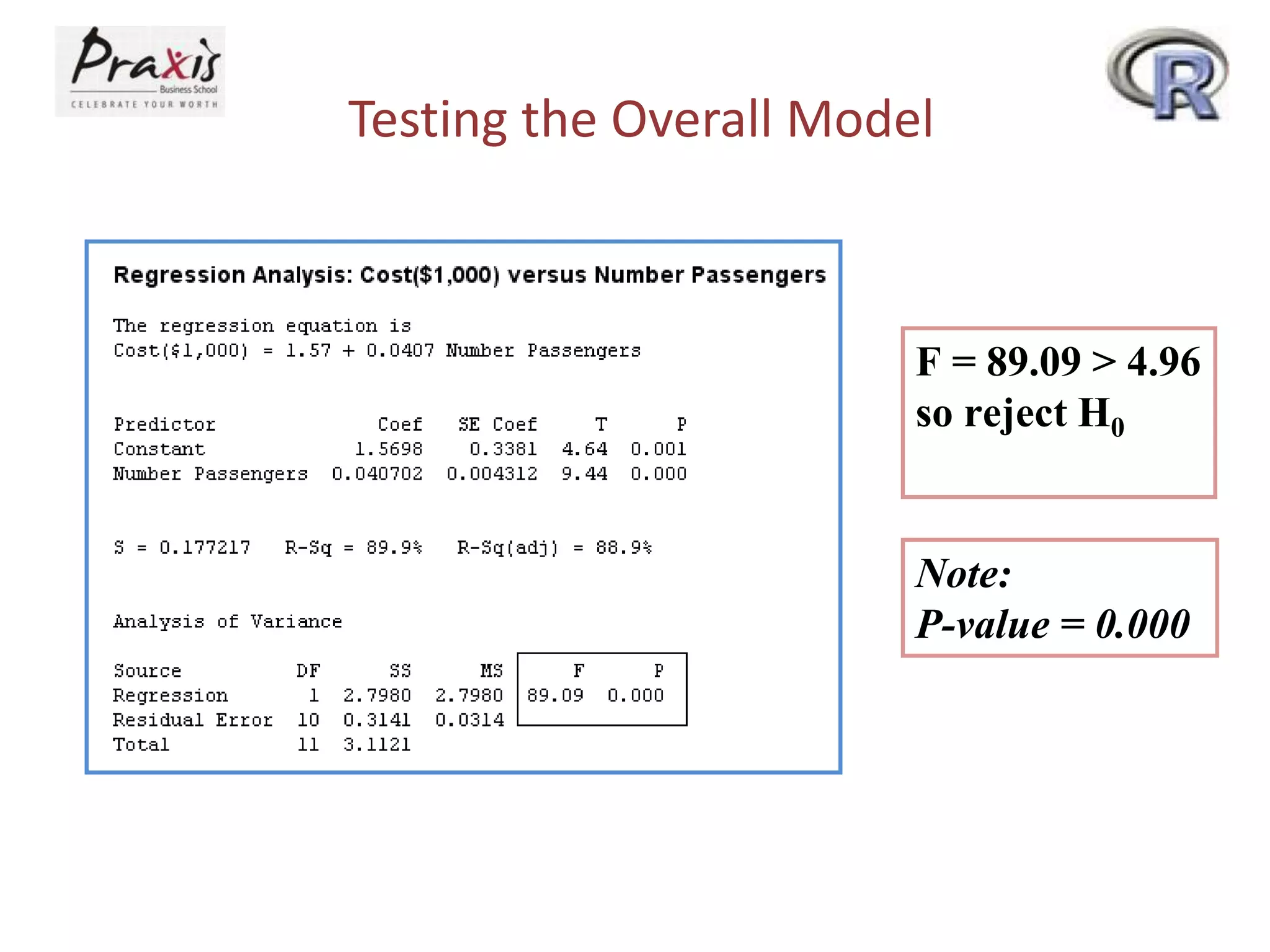

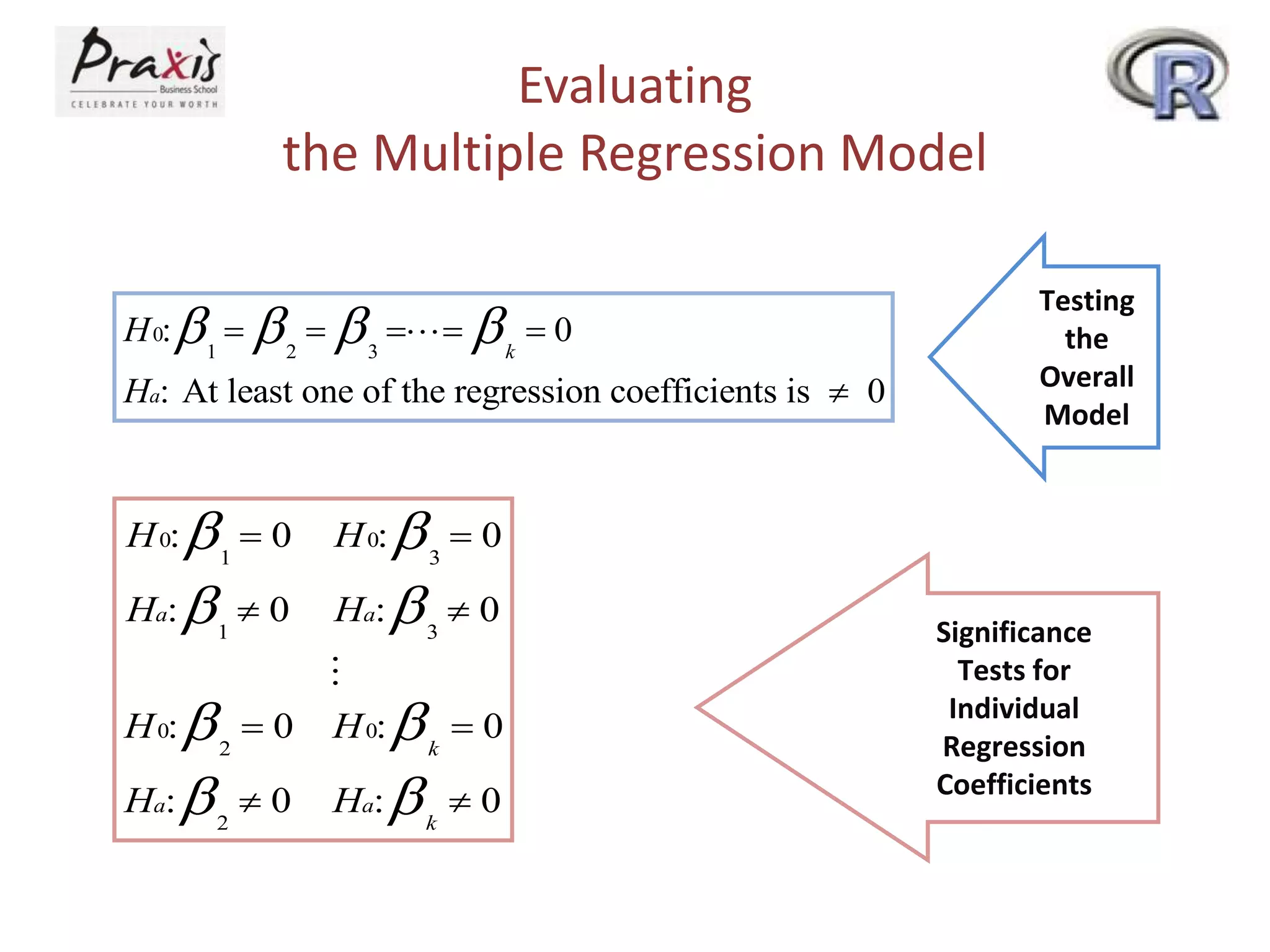

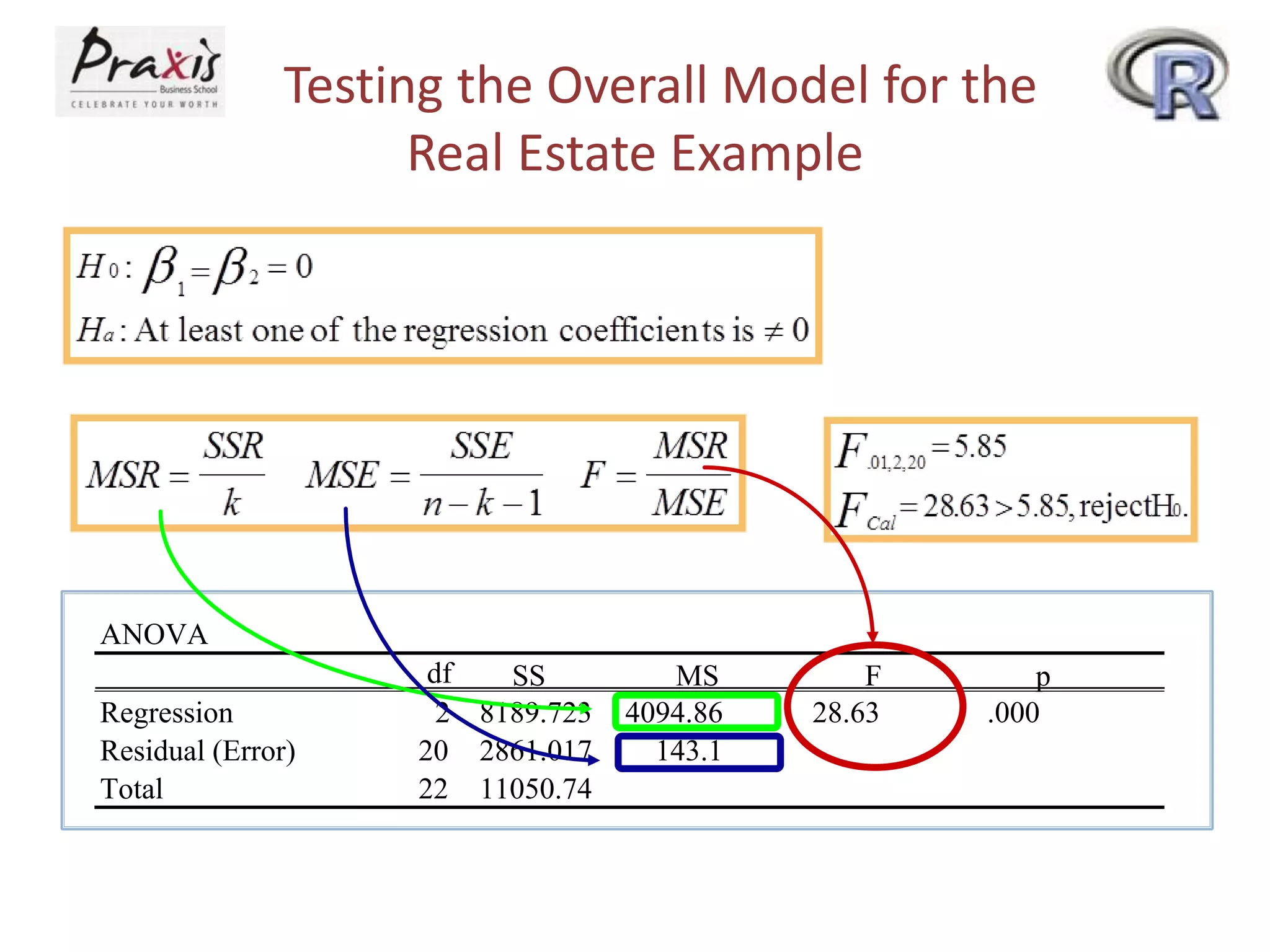

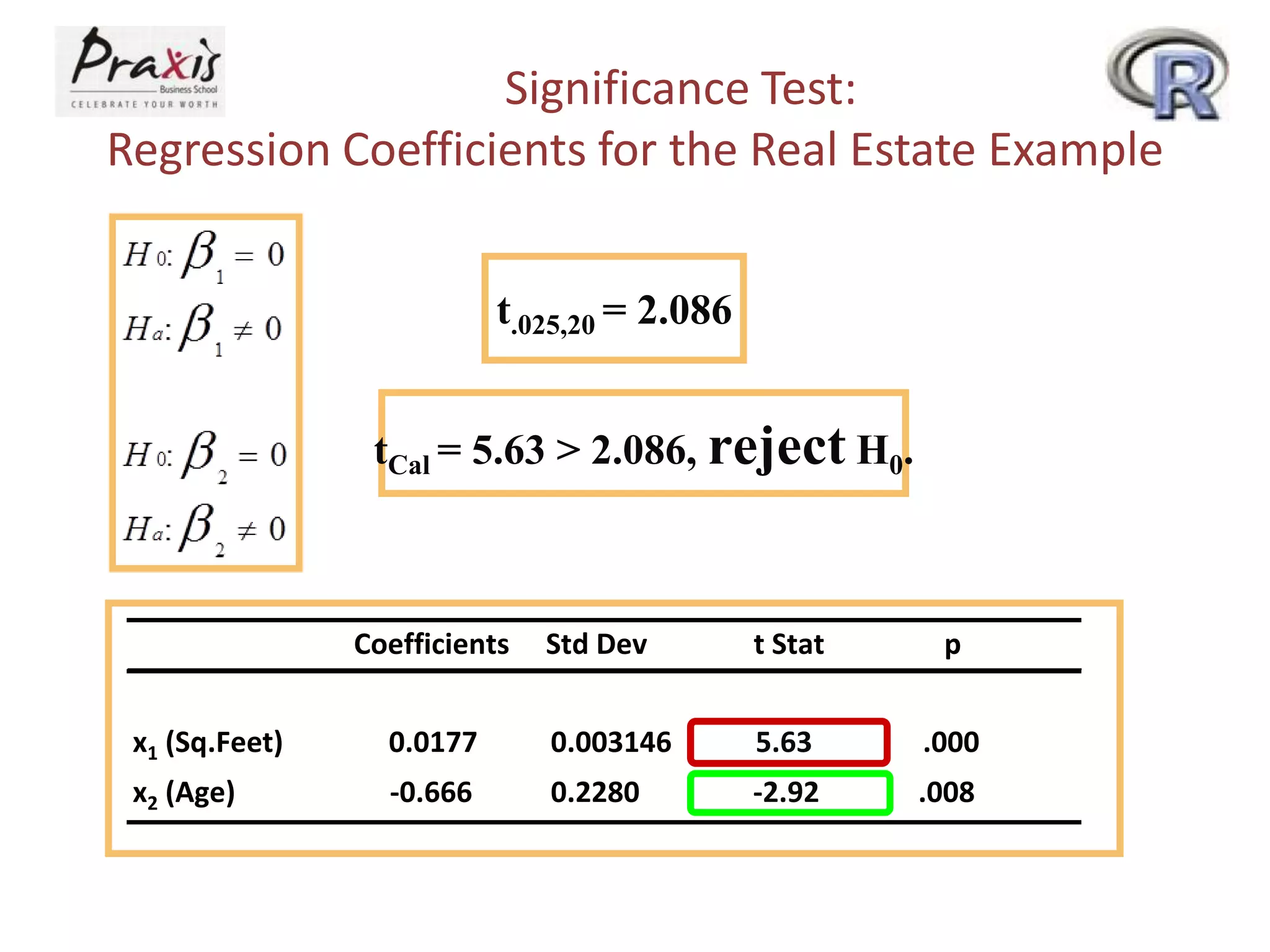

- Conducting statistical tests on overall regression models and individual coefficients