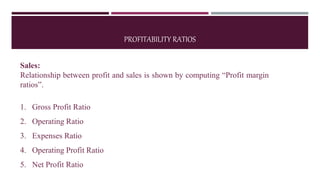

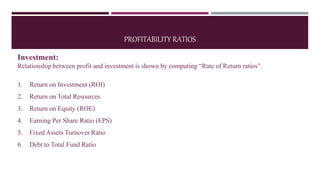

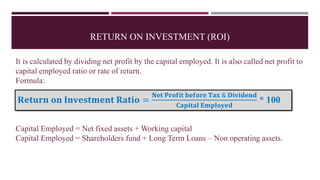

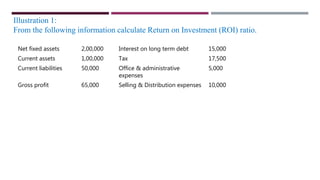

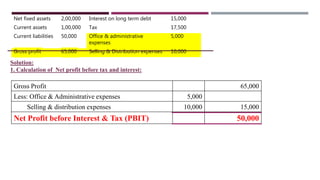

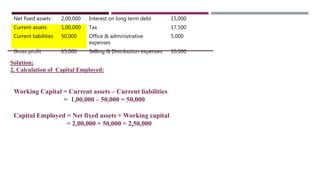

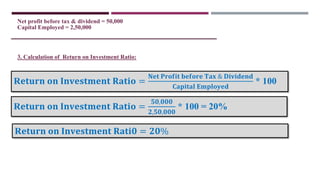

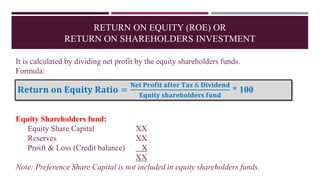

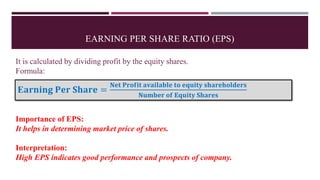

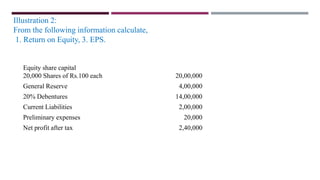

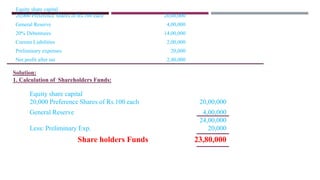

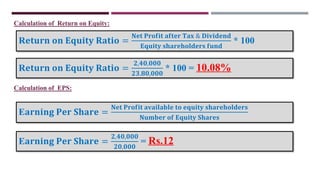

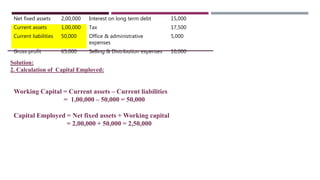

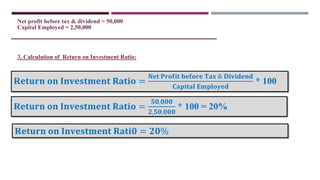

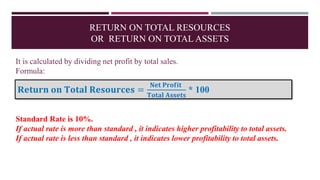

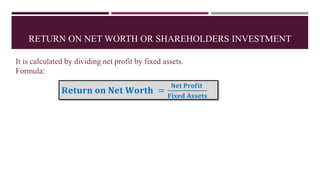

The document discusses management accounting ratio analysis, focusing on profitability ratios, which measure a business's efficiency and control over its activities. It details various profitability ratios, including profit margin and return on investment (ROI), along with formulas and illustrations for calculating these ratios. Additionally, it covers metrics such as return on equity (ROE) and earnings per share (EPS), explaining their significance in evaluating a company's financial health.