Embed presentation

Downloaded 186 times

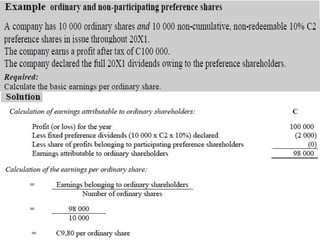

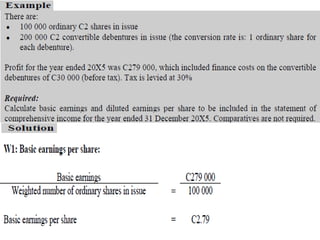

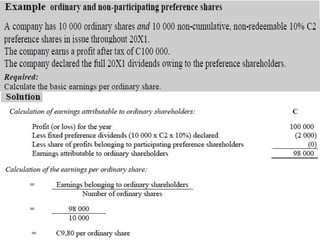

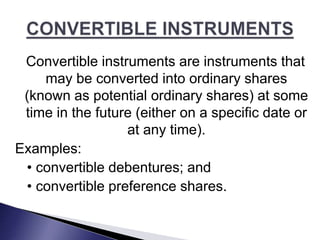

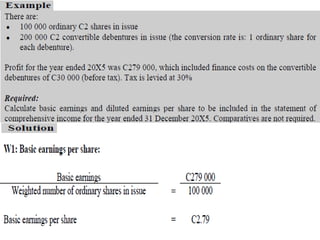

Earnings per share is a ratio used to analyze financial statements that measures a company's profit allocated to each outstanding share of common stock. International Accounting Standard 33 was developed to standardize how earnings per share is calculated, which involves dividing earnings attributable to ordinary shareholders by the weighted average number of ordinary shares. There are two types of earnings per share calculations: basic EPS uses actual ordinary shares outstanding, while diluted EPS considers additional potential ordinary shares, such as from convertible bonds, that would lower per-share earnings if converted.