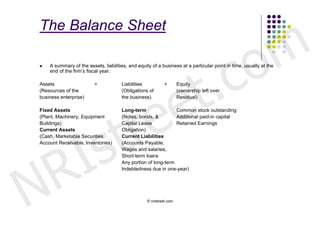

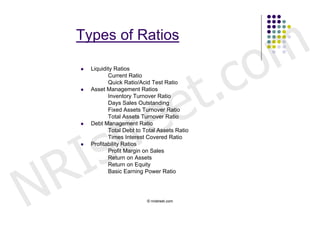

The document outlines the importance of financial statements and their analysis in corporate finance, focusing on managerial perspectives to maximize shareholder wealth. It highlights various types of financial statements—income statement, balance sheet, cash flow statement—and discusses methods like ratio analysis to evaluate a firm's financial health. Additionally, it covers the significance of these analyses in understanding strengths and weaknesses, financing decisions, and operational efficiency.