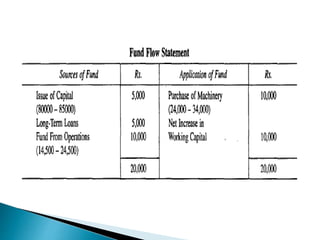

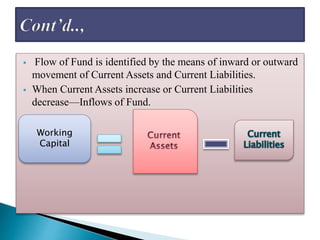

The document discusses funds flow statements and their preparation. It provides definitions of key terms like working capital and flow of funds. It explains that a funds flow statement depicts changes in working capital between two balance sheet dates by analyzing changes in current assets and current liabilities. The summary also shows how to prepare schedules of changes in working capital and sources and uses of funds statements to analyze the flow of funds.

![Schedule/Statement of Changes in Working Capital for the period from 31/03/06 to 31/03/07

Particulars/Account

Balance as on 31st March Working Capital Change

2006 2007 Increase Decrease

a) CURRENT ASSETS

1) Stock/Inventories

2) Sundry Debtors

3) Bills Receivable

4) Bank

5) Cash

826,000

1,200,000

800,000

500,000

84,000

724,000

1,280,000

721,000

483,000

118,000

80,000

34,000

102,000

79,000

17,000

TOTAL 3,410,000 3,326,000 114,000 198,000

b) CURRENT LIABILITIES

1) Bills Payable

2) Sundry Creditors

3) Provision for Taxation

400,000

1,400,000

200,000

680,000

1,220,000

180,000

180,000

20,000

280,000

TOTAL 2,000,000 2,080,000 200,000 280,000

Working Capital [(a) - (b)] 1,410,000 1,246,000

TOTAL 314,000 478,000

Net Change in Working Capital 164,000](https://image.slidesharecdn.com/fundsflowstatement-150402074123-conversion-gate01/85/Funds-flow-statement-16-320.jpg)

![Statement of Sources and Applications of Funds for the period from 31/03/06 to

31/03/07

Sources/Inflows of Funds Amount

Applications/Outflows

of Funds

Amount

Capital

Funds from Operations

[P/L Appropriation a/c]

2,50,000

2,86,000

Land and Buildings

Plant and Machinery

Bank Loan

3,50,000

50,000

3,00,000

5,36,000 7,00,000

Change in Fund (Working

Capital)

1,64,000

Since the Applications/outflows are more than the Sources/Inflows of Funds there is a Net

decrease in Fund (Working Capital) = 700,000 – 536,000 = 164,000](https://image.slidesharecdn.com/fundsflowstatement-150402074123-conversion-gate01/85/Funds-flow-statement-20-320.jpg)