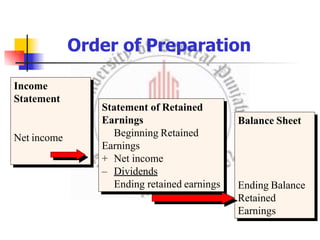

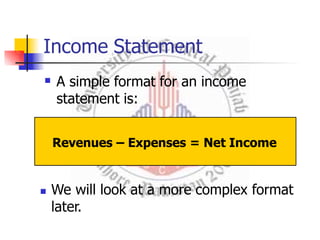

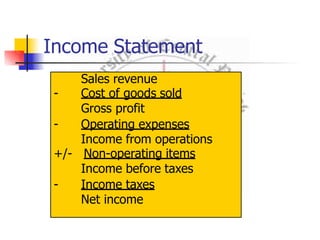

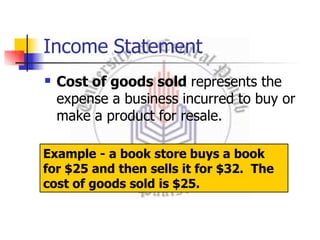

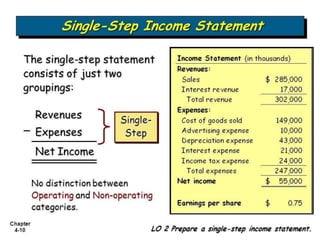

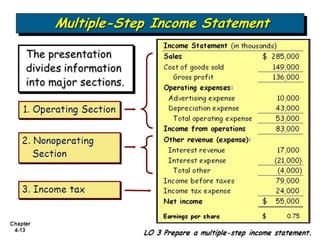

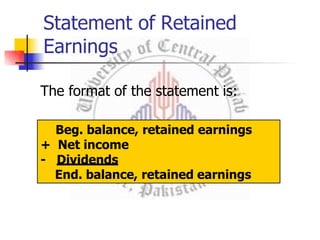

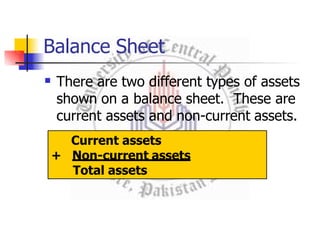

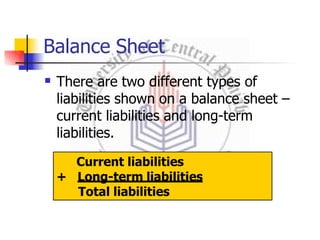

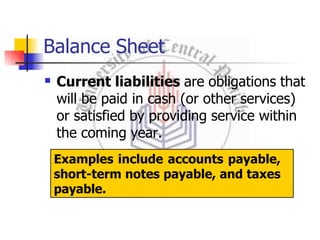

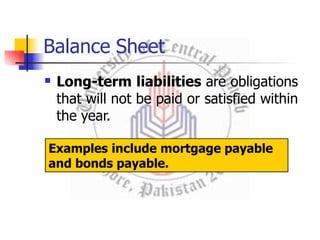

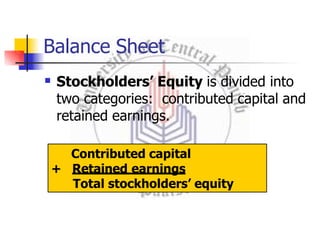

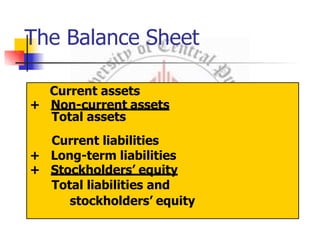

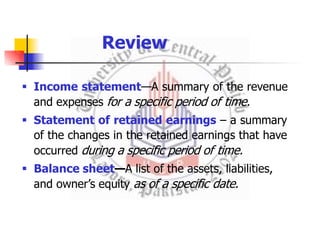

The document is a tutorial on preparing three essential financial statements: the income statement, the statement of retained earnings, and the balance sheet. It outlines the formats and purposes of these statements, emphasizing their roles in reporting a business's financial performance and position over a specified period. Key concepts such as revenues, expenses, and the classifications of assets and liabilities are also discussed.