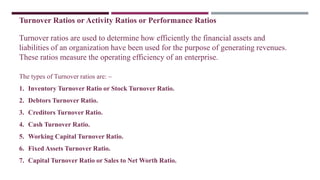

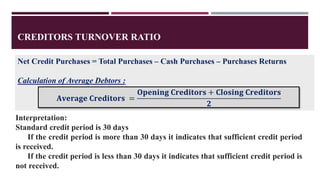

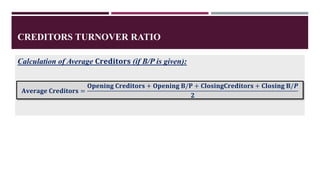

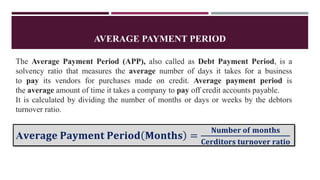

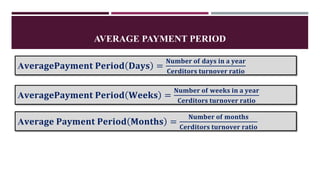

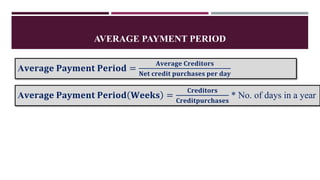

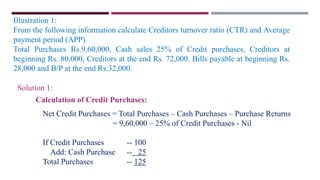

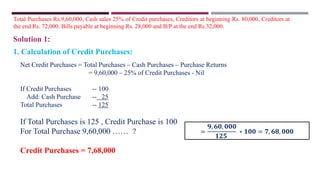

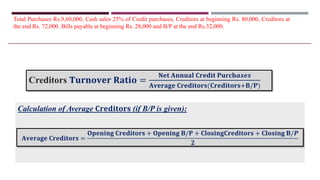

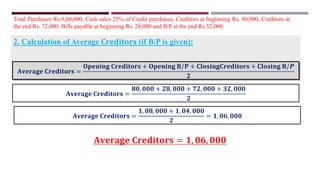

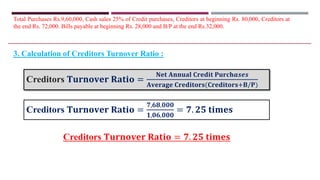

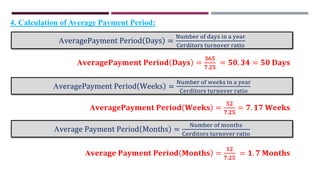

The document provides a detailed overview of management accounting ratio analysis, particularly focusing on turnover ratios, which assess the efficiency of a firm in utilizing its financial assets and liabilities to generate revenue. It elaborates on various types of turnover ratios including the creditors turnover ratio and its calculation, as well as the concept of the average payment period for evaluating payment efficiency to vendors. Additionally, practical examples and formulas for calculating these ratios are included to aid understanding.