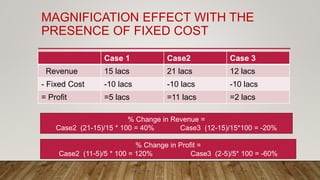

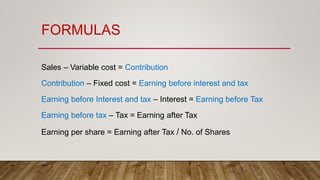

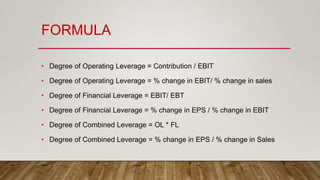

The document discusses leverage in financial management, focusing on how debt financing affects a firm's profitability through fixed costs. It explains operating, financial, and combined leverage, detailing how changes in sales can significantly impact profits due to fixed costs. Formulas for calculating the degrees of leverage are provided, illustrating the relationships between sales, profits, and costs.