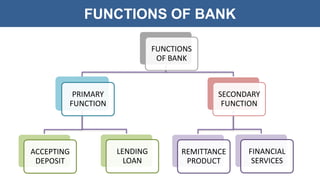

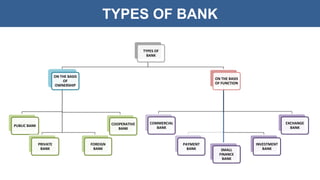

The document provides an overview of banking systems, detailing the definition of banks, their primary and secondary functions, and various types based on ownership and function. It explains how banks serve as financial intermediaries by accepting deposits and lending loans, while also offering remittance and financial services as part of their operations. Additionally, it categorizes banks into public, private, foreign, cooperative, payment, commercial, investment, and small finance banks, highlighting their specific roles within the financial sector.