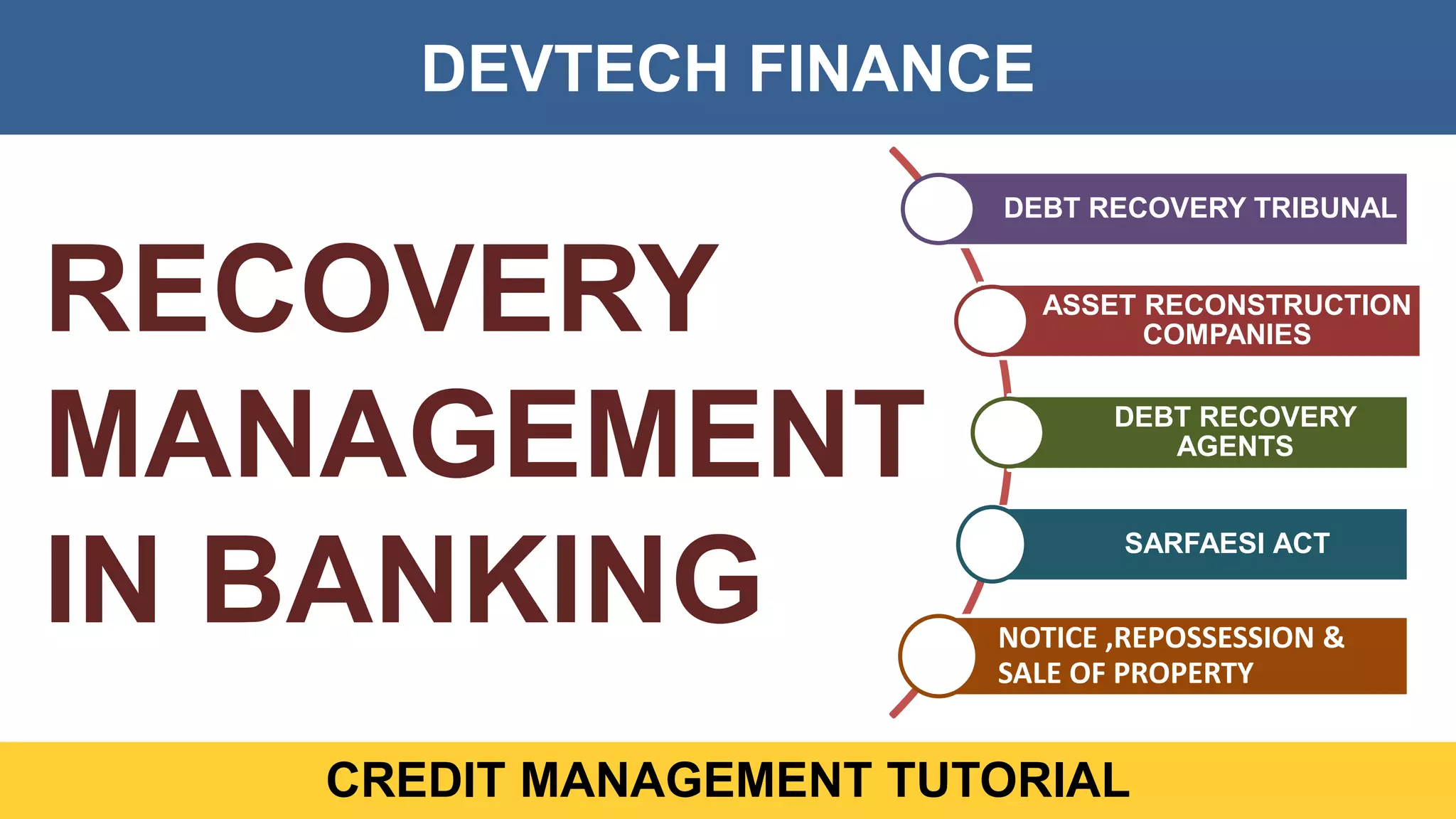

The document outlines the processes involved in recovery management within banking, emphasizing the importance of recovering loans to maintain bank profitability. It details legal and non-legal measures for debt recovery, including notices to borrowers, repossession of property, and the role of debt recovery tribunals and asset reconstruction companies. Additionally, it highlights the need for trained debt recovery agents to handle cases sensitively and in compliance with regulations.