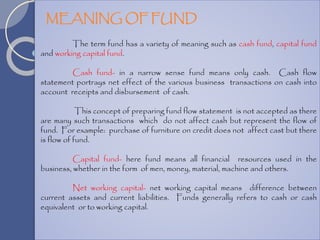

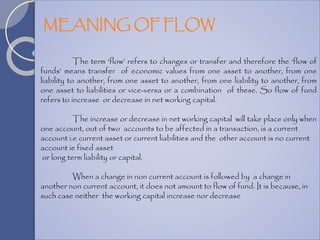

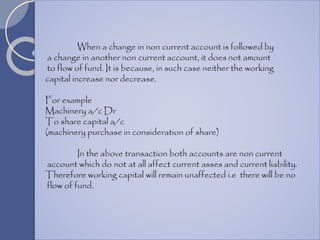

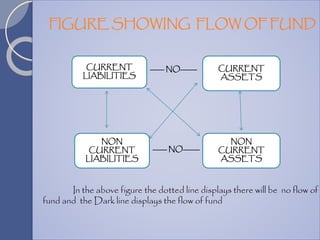

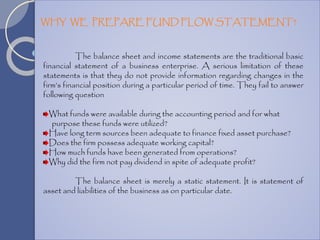

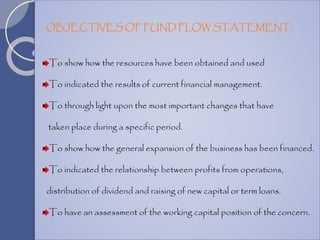

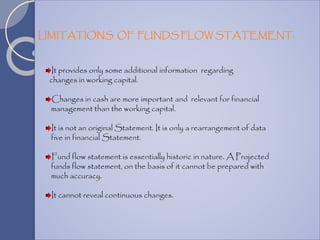

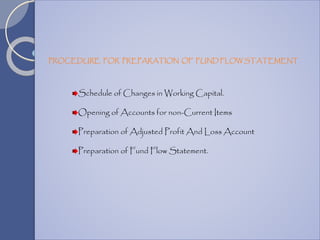

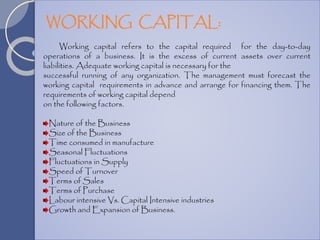

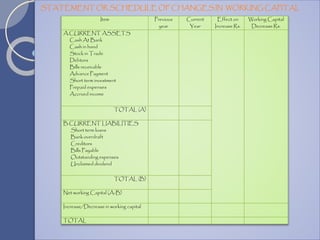

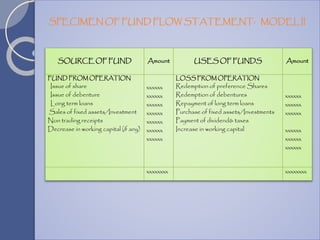

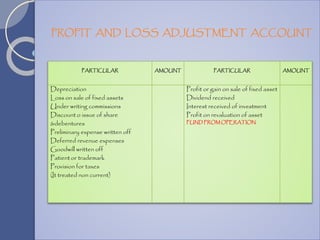

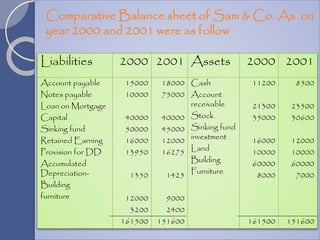

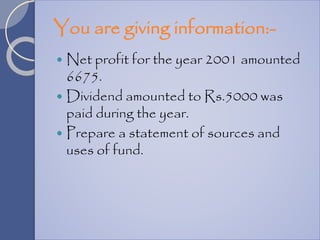

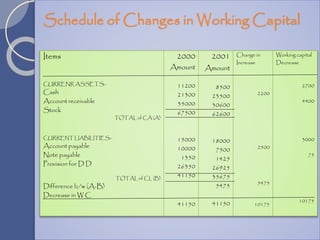

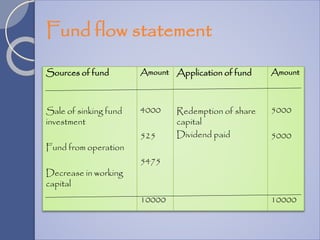

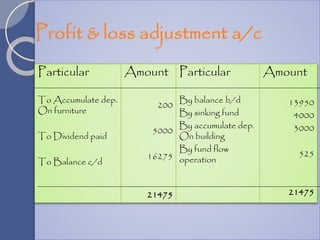

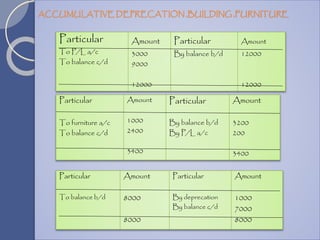

The document provides information on fund flow statements, including their meaning, definition, purpose, and preparation. It defines a fund flow statement as a report on the movement of funds or working capital during an accounting period. It explains how working capital is raised and used. The summary then outlines some key points on the meaning of funds, items that constitute sources and uses of funds, and the objectives and limitations of fund flow statements.