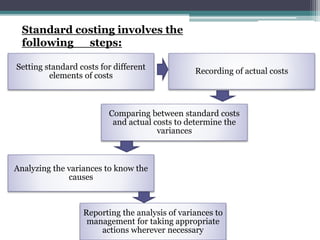

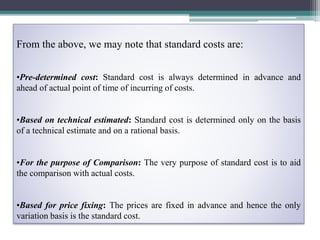

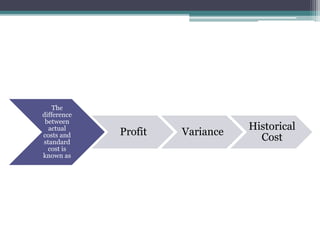

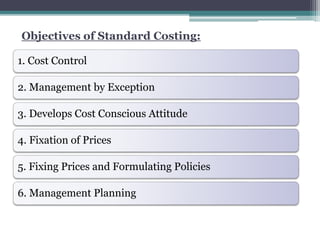

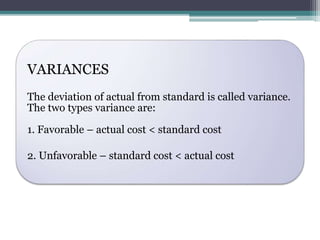

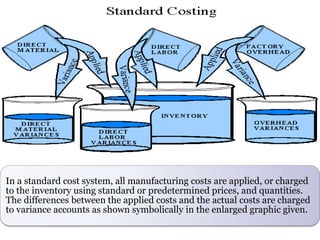

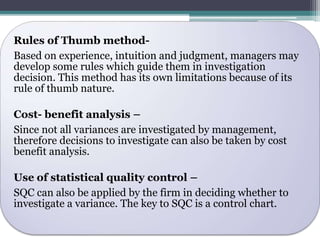

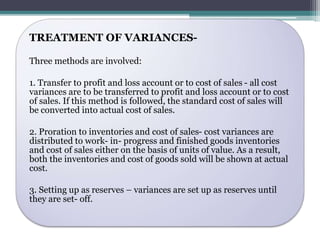

The document discusses standard costing, which involves setting standards for costs and revenues for controlling costs through variance analysis. It describes establishing standards for different cost elements like direct materials, direct labor, and overheads. Variances between actual and standard costs are analyzed to identify causes. Variance analysis helps reduce costs, measure efficiency, and control prices. The document outlines the standard costing process and advantages like effective cost control and developing cost consciousness.