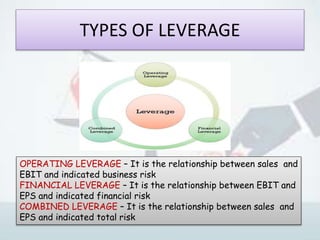

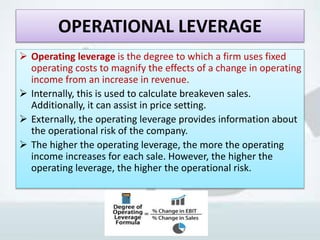

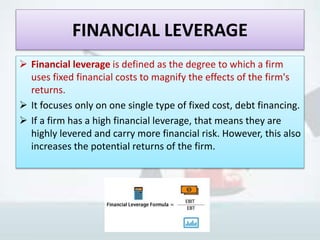

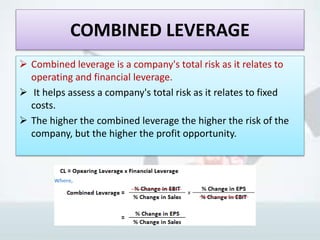

Leverage refers to the use of borrowed funds to acquire assets in the hope that the returns will exceed the cost of borrowing. There are three main types of leverage: operating leverage measures the relationship between sales and operating income; financial leverage measures the relationship between operating income and earnings per share; and combined leverage measures the relationship between sales and earnings per share to indicate total risk. Operating leverage depends on fixed operating costs and how they impact profits with changes in revenue. Financial leverage focuses on how fixed financing costs, like debt, impact returns. Combined leverage assesses a company's overall risk from fixed costs.