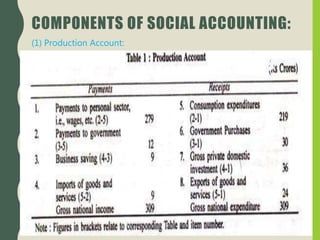

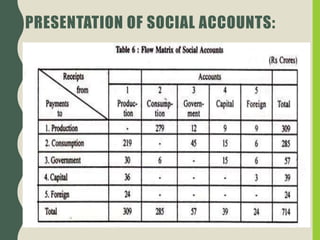

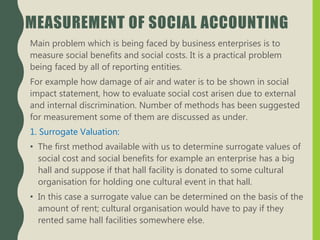

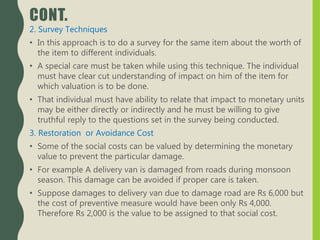

This document provides an overview of social accounting, including its meaning, objectives, components, and measurement. Social accounting aims to measure and report on an organization's social and environmental impacts. It covers areas like production, consumption, human resources, community involvement, and environmental protection. Measuring social costs and benefits is challenging but can be done using surrogate valuation, surveys, restoration costs, and other techniques. Social accounting helps organizations improve their public image, fulfill social obligations, and inform stakeholders of their social performance and responsibilities to society.