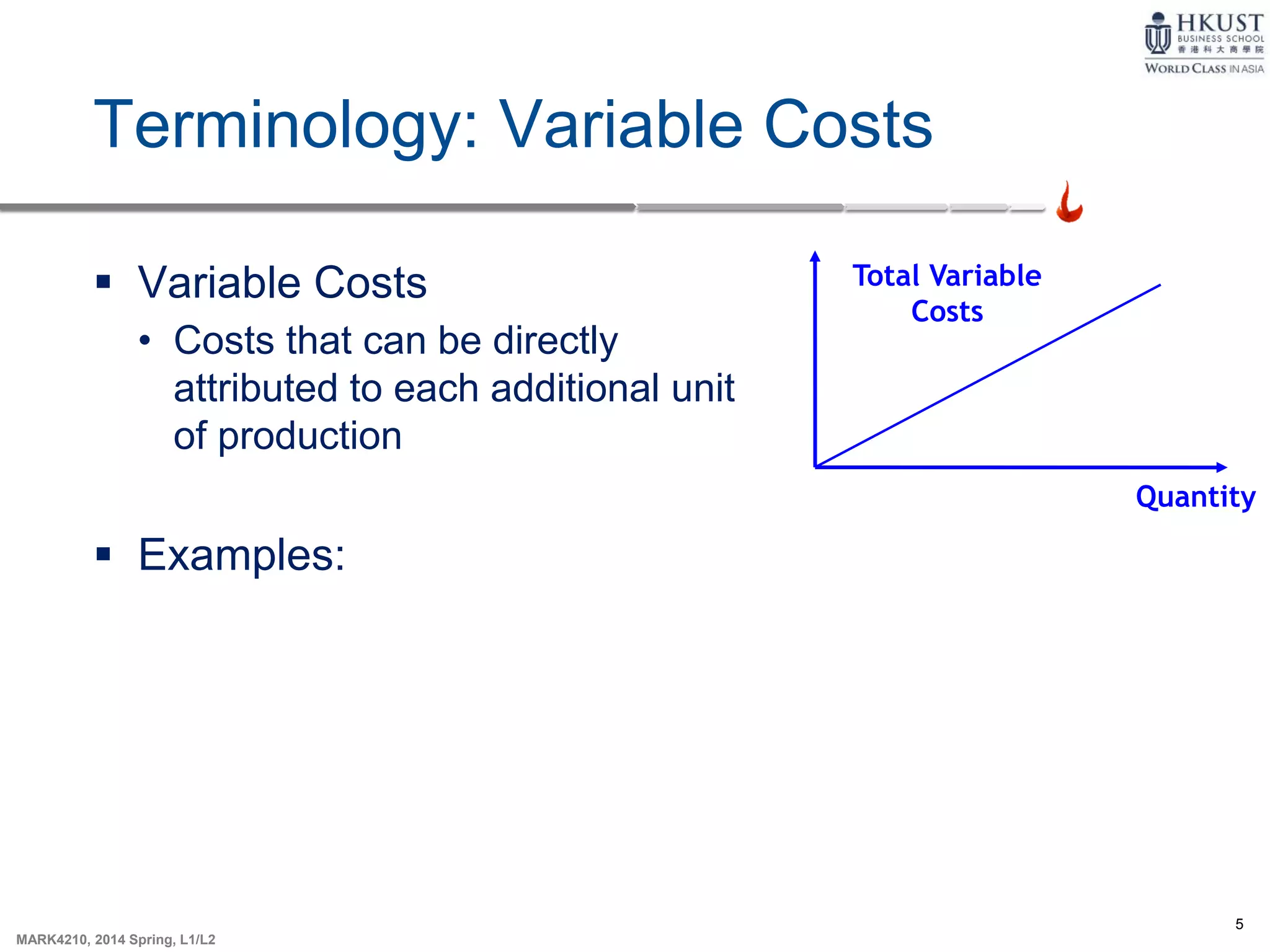

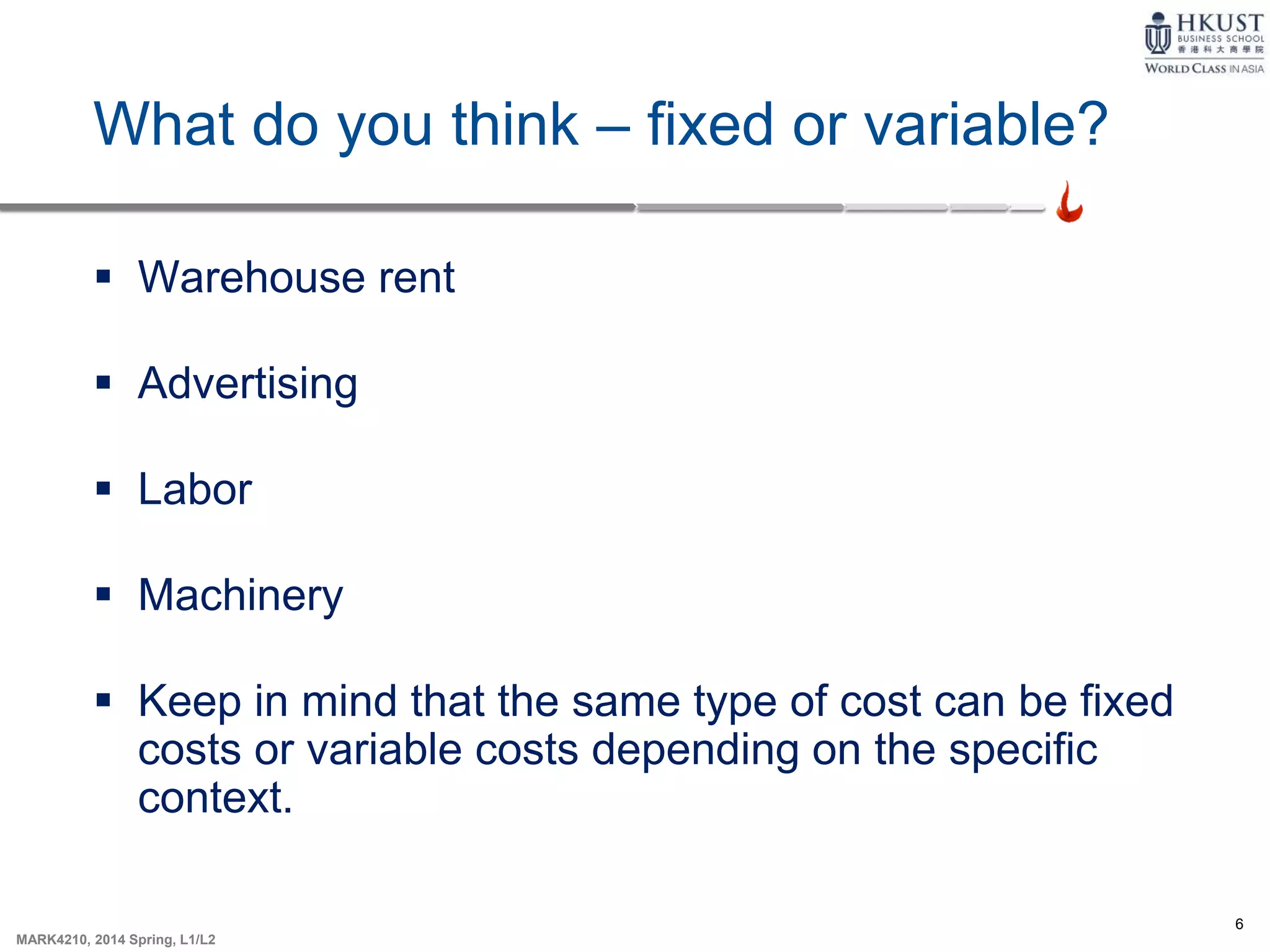

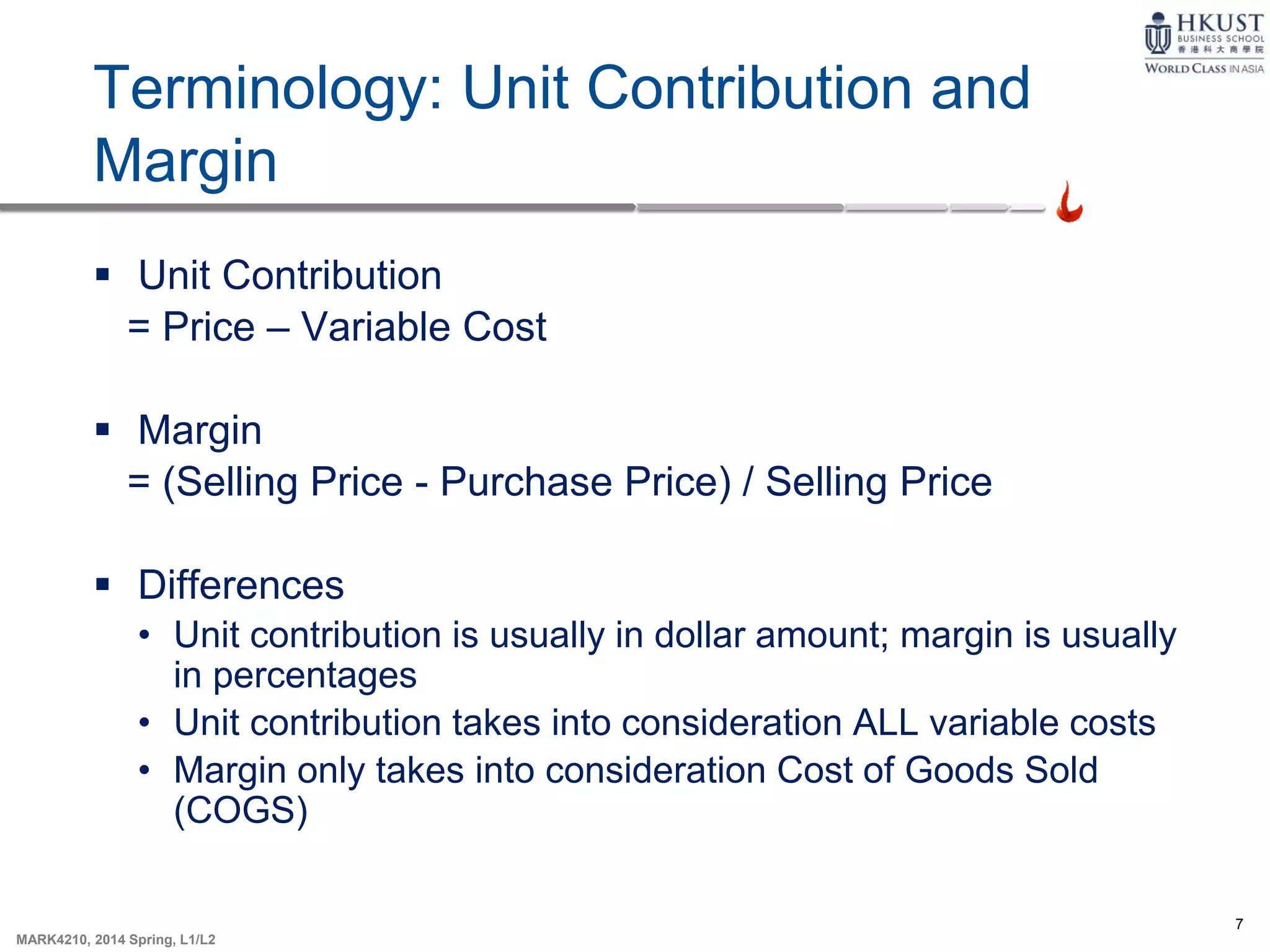

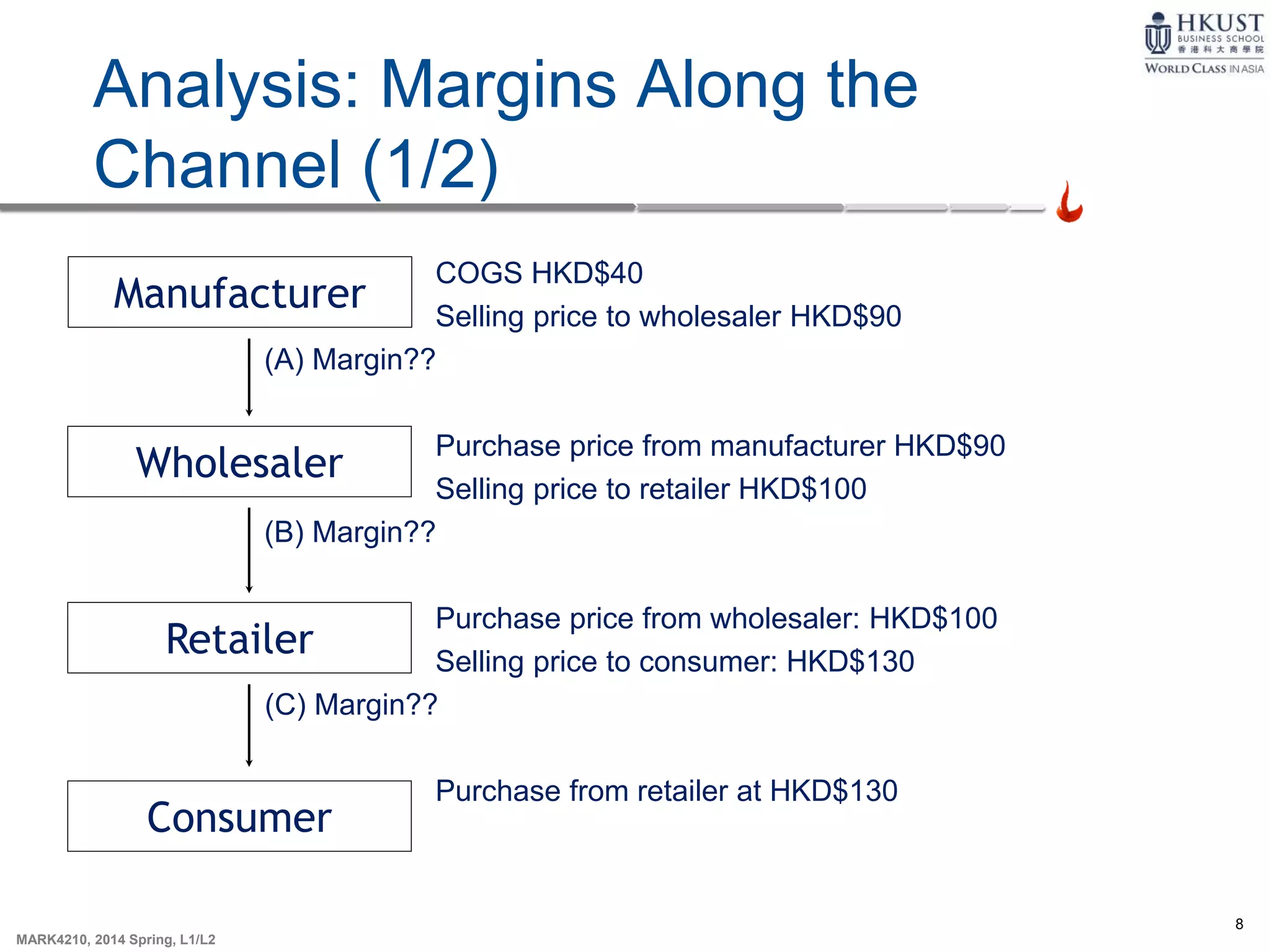

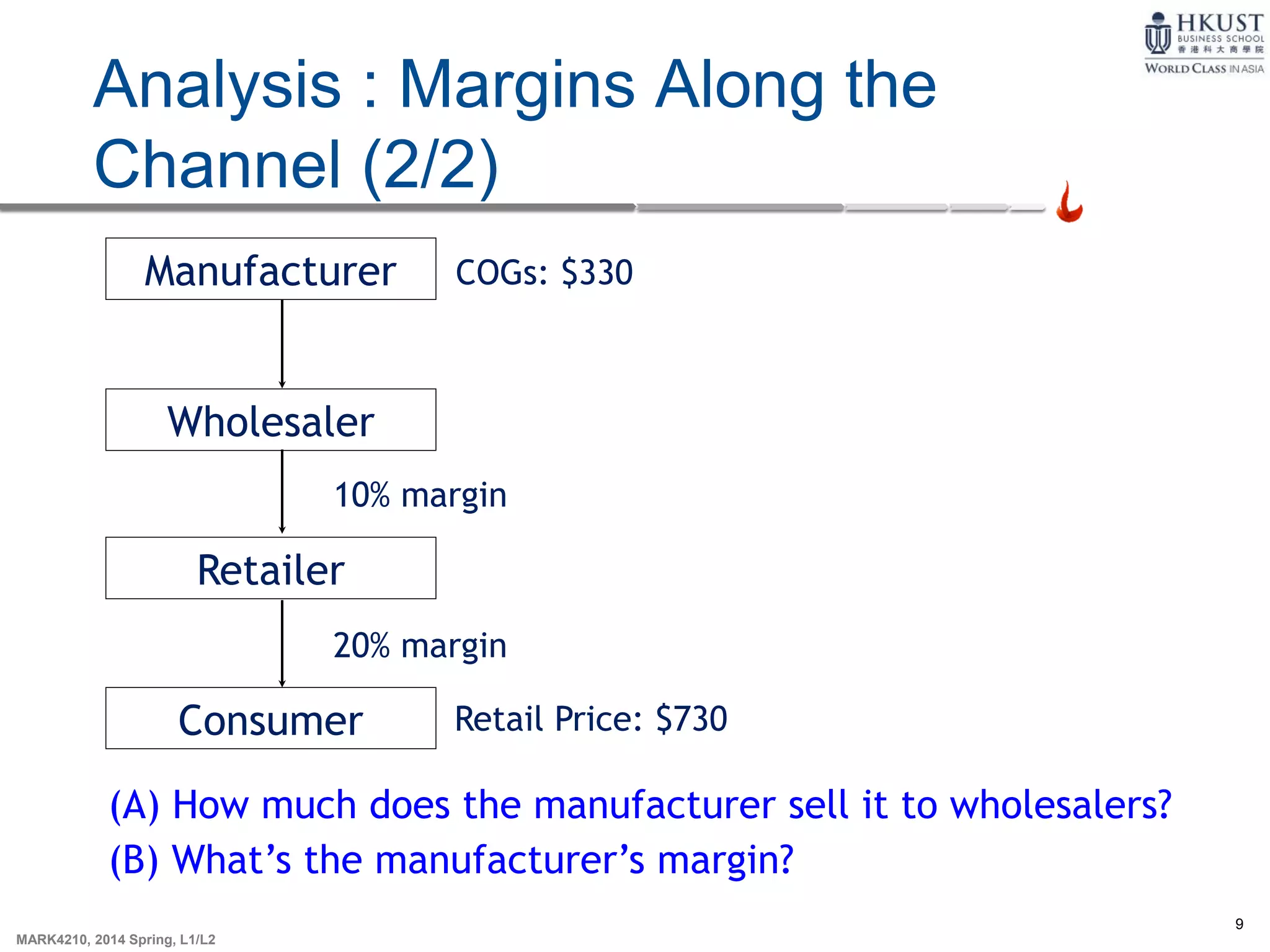

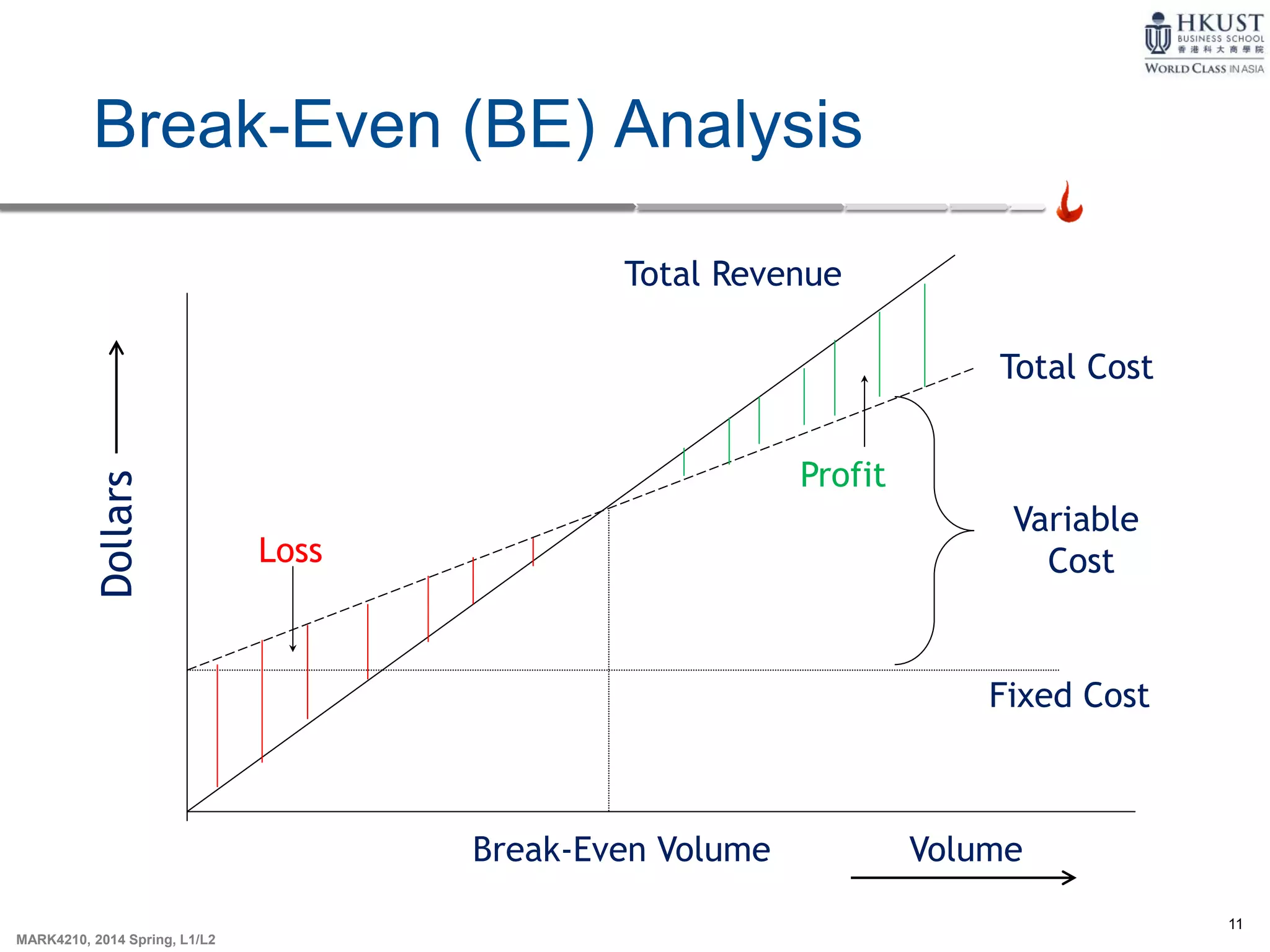

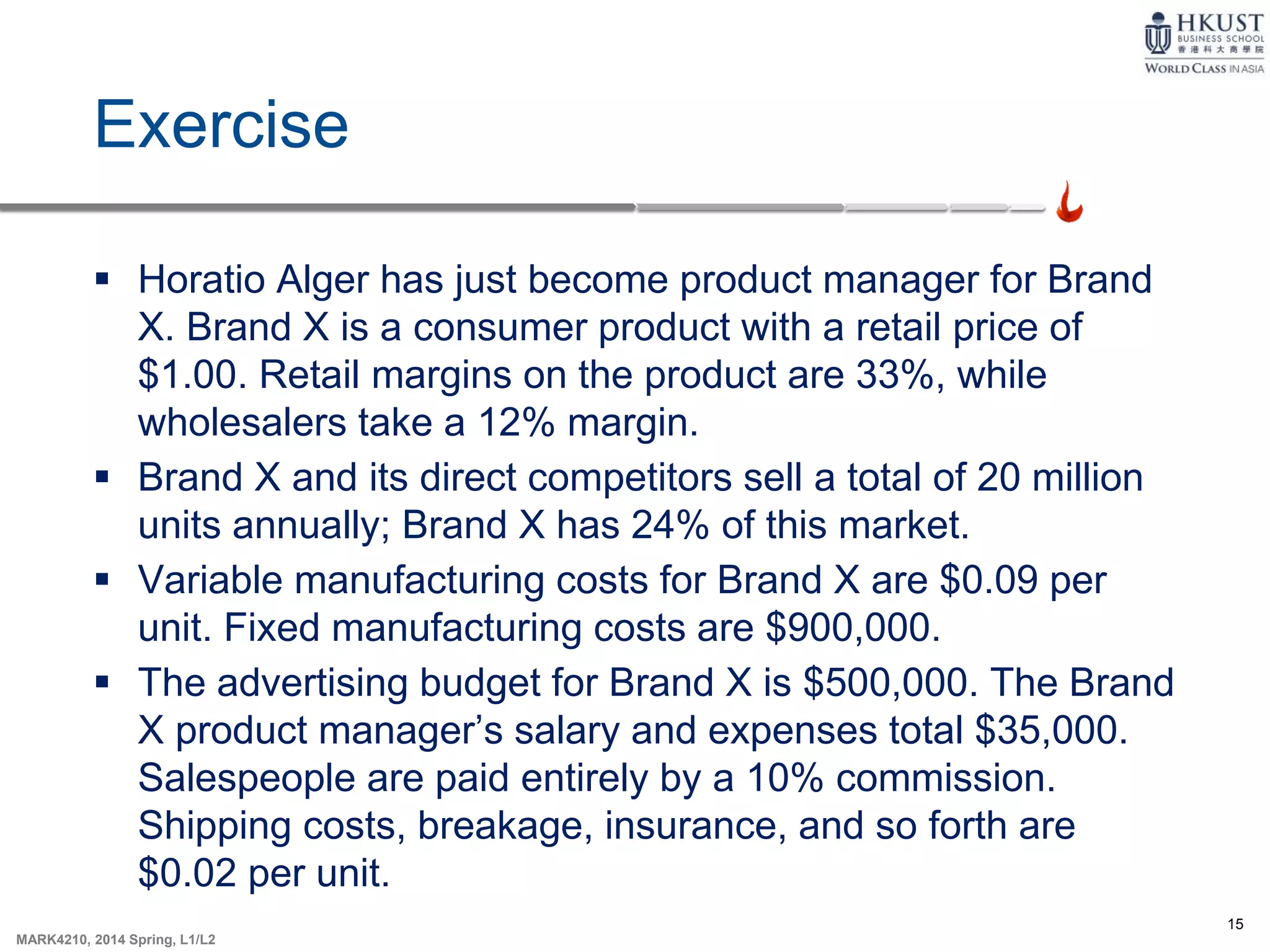

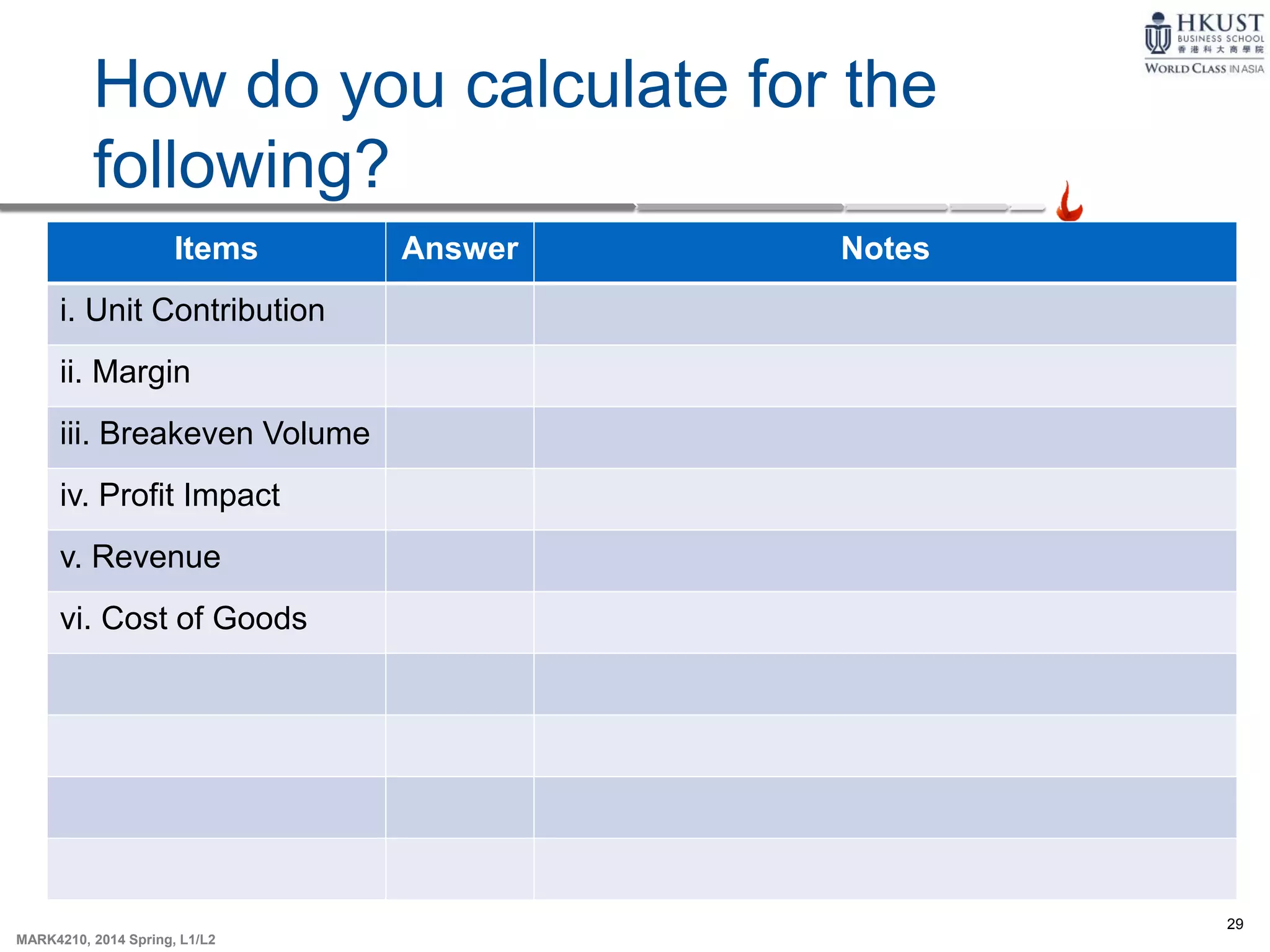

This document outlines quantitative analysis concepts and terminology for a marketing class. It discusses the importance of quantitative analysis in making marketing decisions and defines key terms like fixed costs, variable costs, unit contribution, margin, break-even analysis, and profit impact. The document also provides an example marketing case study and exercise for students to practice calculating various metrics like unit contribution, break-even point, market share needed to break even, and profit impact under different scenarios.

![MARK4210, 2014 Spring, L1/L2

[Class #3]

Quantitative Analysis in

Marketing

MARK4210: Strategic Marketing

2014 Spring, Section L1/L2](https://image.slidesharecdn.com/iclass3-quantitativeanalysisv20140411posting-140605023558-phpapp02/75/quantitative-analysis-4210-1-2048.jpg)